The Midwest Division of the Paibec Corporation manufactures subassemblies that are used in the corporation’s final products. Lynn Hardt of Midwest’s Profit Planning Department has been assigned the task of determining whether a component, MTR–2000, should continue to be manufactured by Midwest or purchased from Marley Company, an outside supplier. MTR–2000 is part of a subassembly manufactured by Midwest.

Marley has submitted a bid to manufacture and supply the 32,000 units of MTR–2000 that Paibec will need for 20x1 at a unit price of $17.30. Marley has assured Paibec that the units will be delivered according to Paibec’s production specifications and needs. While the contract price of $17.30 is only applicable in 20x1, Marley is interested in entering into a long-term arrangement beyond 20x1.

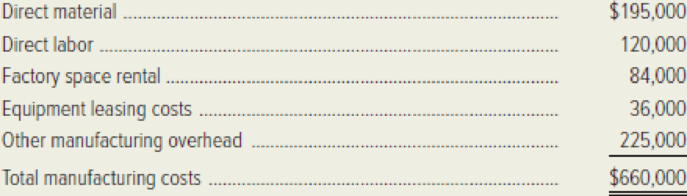

Hardt has gathered the following information regarding Midwest’s

Hardt has collected the following additional information related to manufacturing MTR–2000.

- Direct materials used in the production of MTR–2000 are expected to increase 8 percent in 20x1.

- Midwest’s direct-labor contract calls for a 5 percent increase in 20x1.

- The facilities used to manufacture MTR–2000 are rented under a month-to-month rental agreement. Thus, Midwest can withdraw from the rental agreement without any penalty. Midwest will have no need for this space if MTR–2000 is not manufactured.

- Equipment leasing costs represent special equipment that is used in the manufacture of MTR– 2000. This lease can be terminated by paying the equivalent of one month’s lease payment for each year left on the lease agreement. Midwest has two years left on the lease agreement, through the end of the year 20x2.

- Forty percent of the other manufacturing

overhead is considered variable. Variable overhead changes with the number of units produced, and this rate per unit is not expected to change in 20x1. The fixed manufacturing overhead costs are expected to be the same across a relevant range of zero to 50,000 units. Equipment other than the leased equipment can be used in Midwest’s other manufacturing operations.

John Porter, divisional manager of Midwest, stopped by Hardt’s office to voice his concern regarding the outsourcing of MTR–2000. Porter commented, “I am really concerned about outsourcing MTR– 2000. I have a son-in-law and a nephew, not to mention a member of our bowling team, who work on MTR–2000. They could lose their jobs if we buy that component from Marley. I really would appreciate anything you can do to make sure the cost analysis comes out right to show we should continue making MTR–2000. Corporate is not aware of the material increases and maybe you can leave out some of those fixed costs. I just think we should continue making MTR–2000!”

Required:

- a. Prepare an analysis of relevant costs that shows whether or not the Midwest Division of Paibec Corporation should make MTR–2000 or purchase it from Marley Company for 20x1.

- b. Based solely on the financial results, recommend whether the 32,000 units of MTR–2000 for 20x1 should be made by Midwest or purchased from Marley.

- 2. Identify and briefly discuss three qualitative factors that the Midwest Division and Paibec Corporation should consider before agreeing to purchase MTR–2000 from Marley Company.

- 3. By referring to the standards of ethical conduct for

managerial accountants given in Chapter 1, explain why Lynn Hardt would consider the request of John Porter to be unethical.

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Clonal Inc., a biotechnology company, developed and patented a diagnostic product called Trouver. Clonal purchased some research equipment to be used exclusively for Trouver and other research equipment to be used on Trouver and subsequent research projects. Clonal defeated a legal challenge to its Trouver patent and began production and marketing operations for the product. Clonal allocated its corporate headquarters’ costs to its research division as a percentage of the division’s salaries. Required: What is the definition of research and of development as defined by GAAP? Briefly indicate the justification for the existing GAAP relating to R&D costs. Explain how Clonal should report the equipment purchased for Trouver on its income statements and balance sheets. Explain how Clonal should report the legal costs incurred in defending Trouver’s patent on its statement of cash flows. Explain how Clonal should classify its corporate headquarters’ costs allocated to the…arrow_forwardFusion Metals Company is considering the elimination of its Packaging Department. Management has received an offer from an outside firm to supply all Fusion’s packaging needs. To help her in making the decision, Fusion’s president has asked the controller for an analysis of the cost of running Fusion’s Packaging Department. Included in that analysis is $9,100 of rent, which represents the Packaging Department’s allocation of the rent on Fusion’s factory building. If the Packaging Department is eliminated,the space it used will be converted to storage space. Currently Fusion rents storage space in a nearby warehouse for $11,000 per year. The warehouse rental would no longer be necessary if the Packaging Department were eliminated. Required:1. Discuss each of the figures given in the exercise with regard to its relevance in the departmentclosing decision.2. What type of cost is the $11,000 warehouse rental, from the viewpoint of the costs of the Packaging Department?arrow_forwardThe Blair Company’s three assembly plants are located in California, Georgia, and New Jersey. Previously, the company purchased a major subassembly, which becomes part of the final product, from an outside firm. Blair has decided to manufacture the subassemblies within the company and must now consider whether to rent one centrally located facility (e.g., in Missouri, where all the subassemblies would be manufactured) or to rent three separate facilities, each located near one of the assembly plants, where each facility would manufacture only the subassemblies needed for the nearby assembly plant. A single, centrally located facility, with a production capacity of 18,000 units per year, would have fixed costs of $900,000 per year and a variable cost of $250 per unit. Three separate decentralized facilities, with production capacities of 8,000, 6,000, and 4,000 units per year, would have fixed costs of $475,000, $425,000, and $400,000, respectively, and variable costs per unit of only…arrow_forward

- Maroon Ltd is a company that produces chemicals for the cleaning industry. One of its processes manufactures join products Y and Z, and by-product X. The company uses the net realizable value of its joint products to allocate joint production costs. The by-product is valued for inventory purposes at its market value less its disposal cost, and this value is used to reduce the joint production cost of P2,015,000. Information regarding the company’s August 2020 operations are presented below: In liters Y Z X Finished Goods inventory, August 1 30,000 100,000 40,000 August Sales 1,340,000 760,000 240,000 August Production 1,600,000 800,000 200,000 In Peso Further Processing cost 1,400,000 1,520,000 Final Sales value per Liter 10 14 Sales value per liter at split off 2.40 Disposal Cost per liter 0.40 Required: Calculate the by-product income Calculate the adjusted joint…arrow_forwardClonal Inc., a biotechnology company, developed and patented a diagnostic product called Trouver. Clonal purchased some research equipment to be used exclusively for Trouver and other research equipment to be used on Trouver and subsequent research projects. Clonal defeated a legal challenge to its Trouver patent and began production and marketing operations for the product. Clonal allocated its corporate headquarters’ costs to its research division as a percentage of the division’s salaries. Required: 1. Explain how Clonal should report the equipment purchased for Trouver on its income statements and balance sheets. 2. Describe the accounting treatment of R&D costs. What is the justification for the accounting treatment of R&D costs? 3. Explain how Clonal should classify its corporate headquarters’ costs allocated to the research division on its income statement. 4. Explain how Clonal should report the legal costs incurred in defending Trouver’s patent on its statement of cash…arrow_forwardChilton Peripherals manufactures printers, scanners, and other computer peripheral equipment. In the past, thecompany purchased equipment used in manufacturing from an outside vendor. In March 2018, Chilton decidedto design and build equipment to replace some obsolete equipment. A section of the manufacturing plant was setaside to develop and produce the equipment. Additional personnel were hired for the project. The equipment wascompleted and ready for use in September.Required:1. In general, what costs should be capitalized for a self-constructed asset?2. Discuss two alternatives for the inclusion of overhead costs in the cost of the equipment constructed by Chilton. Which alternative is generally accepted for financial reporting purposes?3. Under what circumstance(s) would interest be included in the cost of the equipment?arrow_forward

- Blossom Company manufactures products ranging from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $200,000 to $1,500,000 and are quoted inclusive of installation. The installation process does not involve changes to the features of the equipment and does not require proprietary information about the equipment in order for the installed equipment to perform to specifications. Blossom has the following arrangement with Sheridan Inc. Sheridan purchases equipment from Blossom for a price of $926,400 and contracts with Blossom to install the equipment. Blossom charges the same price for the equipment irrespective of whether it does the installation or not. Using market data, Blossom determines installation service is estimated to have a standalone selling price of $38,600. The cost of the equipment is $640,000. Sheridan is obligated to pay Blossom the $926,400 upon the delivery of the equipment. Blossom delivers the equipment on…arrow_forwardWildhorse Company manufactures products ranging from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $200,000 to $1,500,000 and are quoted inclusive of installation. The installation process does not involve changes to the features of the equipment and does not require proprietary information about the equipment in order for the installed equipment to perform to specifications. Wildhorse has the following arrangement with Sheffield Inc. Sheffield purchases equipment from Wildhorse for a price of $930,600 and contracts with Wildhorse to install the equipment. Wildhorse charges the same price for the equipment irrespective of whether it does the installation or not. Using market data, Wildhorse determines installation service is estimated to have a standalone selling price of $59,400. The cost of the equipment is $600,000. Sheffield is obligated to pay Wildhorse the $930,600 upon the delivery of the equipment. Wildhorse…arrow_forwardMonroe Manufacturing owns a warehouse that has been used for storing finished goods for electro-pump products. As the company is phasing out the electro-pump product line, the company is considering modifying the existing structure to use for manufacturing a new product line. Monroe's production engineer feels that the warehouse could be modified to handle one of two new product lines. The cost and revenue data for the two product alternatives arc as follows: Product A Product BInitial cash expenditure:• Warehouse modification $115,000 $189,000• Equipment $250,000 $315,000Annual revenues $215,000 $289,000Annual O&M costs $126,000 $168,000Product life 8 years 8 yearsSalvage value…arrow_forward

- Gemma Company is a midsize manufacturing company with 120 employees and approximately $45 million in sales. Management has established a set of processes to purchase fixed assets, described in the following paragraphs: When a user department decides to purchase a new fixed asset, the departmental manager prepares an asset request form. When completing the form, the manager must describe the fixed asset, the advantages or efficiencies offered by the asset, and estimates of costs and benefits. The asset request form is forwarded to the director of finance. Personnel in the finance department review estimates of costs and benefits and revise these if necessary. A discounted cash flow analysis is prepared and forwarded to the vice president of operations, who reviews the asset request forms and the discounted cash flow analysis, and then interviews user department managers if he or she feels it is warranted. After this review, she selects assets to purchase until she has exhausted the…arrow_forwardMSI is considering outsourcing the production of the handheld control module used with some of its products. The company has received a bid from Monte Legend Company (MLC) to produce 10,000 units of the module per year for $16 each. The following information pertains to MSI’s production of the control modules: Direct materials $ 9 Direct labor 4 Variable manufacturing overhead 2 Fixed manufacturing overhead 3 Total cost per unit $ 18 MSI has determined it could eliminate all variable costs if the control modules were produced externally, but none of the fixed overhead is avoidable. At this time, MSI has no specific use in mind for the space that is currently dedicated to the control module production. Required: 1. Compute the difference in cost between making and buying the control module. 2. Should MSI buy the modules from MLC or continue to make them? 3-a. Suppose the MSI space currently used for the modules could be utilized by a new product line that would generate…arrow_forwardRiverbed Company manufactures equipment. Riverbed's products range from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $ 200,000 to $ 1,500,000 and are quoted inclusive of installation. The installation process does not involve changes to the features of the equipment and does not require proprietary information about the equipment in order for the installed equipment to perform to specifications. Riverbed has the following arrangement with Winkerbean Inc. Winkerbean purchases equipment from Riverbed fora price of $ 1,100,000 and contracts with Riverbed to install the equipment. Riverbed charges the same price for the equipment irrespective of whether it does the installation or not. Using market data, Riverbed determines installation service is estimated to have a standalone selling price of $ 46,000. The cost of the equipment is $ 580,000. Winkerbean is obligated to pay Riverbed the $ 1,100,000 upon the delivery and…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education