Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 13P

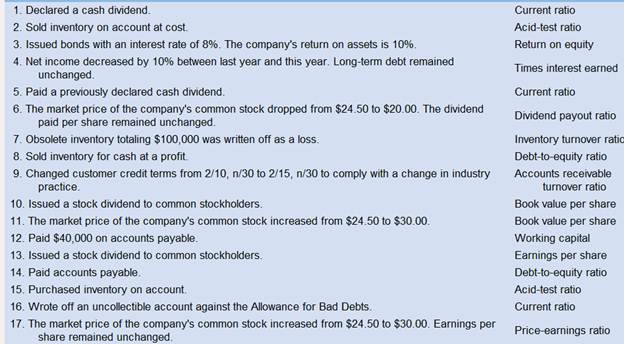

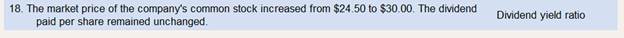

Effects of Transactions on Various Financial Ratios

In the right-hand column below, certain financial ratios are listed. To the left of each ratio is a business transaction or event relating to the operating activities of Delta Company (each transaction should be considered independently).

Required:

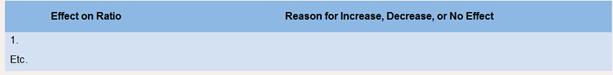

Indicate the effect that each business transaction or event would have on the ratio listed opposite to it. State the effect in terms of increase. decrease, or no effect on the ratio involved, and give the reason for your answer. In all cases, assume that the current assets exceed the current liabilities both before and after the event or transaction. Use the following format for your answers:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Identify how each of the following transactions affects the company's financial statements. For the balance sheet, Identify how each

transaction affects total assets, total llabilities, and equity. For the Income statement, Identify how each transaction affects profit. If

there is an Increase, select a *+" In the column or columns. If there is a decrease, select a "-" In the column or columns. If there is both

an Increase and a decrease, select a *+/-" In the column or columns. The Iline for the first transaction Is completed as an example.

Income

Statement

Balance Sheet

Total

Total

Transaction

Equity

Profit

Assets

Liabilities

1 Owner invests cash

2 Seli services for cash

3 Acquire services on credit

4 Pay wages with cash

5 Owner withdraws cash

6 Borrow cash with note payable

7 Sell services on credit

8 Buy office equipment for cash

9 Collect receivable from (7)

10 Buy asset with note payable

Effect of transactions on various financial ratios Indicate the effect that eachtransaction/event listed here will have on the financial ratio listed opposite it, and provide an explanation for your answer. Use 1 for increase, − for decrease, and (NE) for no effect. Assume that current assets exceed current liabilities in all cases, bothbefore and after the transaction/event.Transaction/Event Financial Ratioa. Split the common stock 2 for 1.b. Collected accounts receivable.c. Issued common stock for cash.d. Sold treasury stock.e. Accrued interest on a note receivable.f. Sold inventory on account.g. Wrote off an uncollectible account.h. Declared a cash dividend.i. Incurred operating expenses.j. Sold equipment at a loss.Book value per share of common stockNumber of days’ sales in accounts receivableTotal asset turnoverReturn on equityCurrent ratioAcid-test ratioAccounts receivable turnoverDividend yieldMarginEarnings per share

Effect of transactions on various financial ratios Indicate the effect that each

transaction/event listed here will have on the financial ratio listed opposite it, and

provide an explanation for your answer. Use + for increase, - for decrease, and (NE)

for no effect. Assume that current assets exceed current liabilities in all cases, both

before and after the transaction/event.

Transaction/Event

Financial Ratio

a. Purchased inventory on account.

b. Sold inventory for cash, at a profit.

C. Issued a 10% stock dividend.

Number of days' sales in inventory

Inventory turnover

Earnings per share

Debt ratio

d. Issued common stock for cash.

Return on investment

e. Sold land at a gain.

f. Purchased treasury stock for cash.

g. Accrued interest on a note payable.

h. Accrued wages that have been earned

by employees.

i. Purchased equipment for cash.

J. Issued bonds at an interest rate that is

less than the company's ROI.

Debt/equity ratio

Times interest earned

Current ratio

Plant and equipment…

Chapter 14 Solutions

Introduction To Managerial Accounting

Ch. 14 - Prob. 1QCh. 14 - What is the basic purpose for examining trends in...Ch. 14 - Prob. 3QCh. 14 - Prob. 4QCh. 14 - What is meant by the dividend yield on a common...Ch. 14 - What is meant by the term financial leverage?Ch. 14 - Prob. 7QCh. 14 - Prob. 8QCh. 14 - Prob. 9QCh. 14 - Markus Company’s common stock sold for $2.75 per...

Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Prob. 11F15Ch. 14 - Prob. 12F15Ch. 14 - Prob. 13F15Ch. 14 - Prob. 14F15Ch. 14 - Prob. 15F15Ch. 14 - Common-Size Income Statement A comparative income...Ch. 14 - Prob. 2ECh. 14 - Prob. 3ECh. 14 - Financial Ratios for Debt Management Refer to the...Ch. 14 - Prob. 5ECh. 14 - Prob. 6ECh. 14 - Prob. 7ECh. 14 - Prob. 8ECh. 14 - Financial Ratios for Assessing Profitability and...Ch. 14 - Prob. 10ECh. 14 - Prob. 11ECh. 14 - Selected Financial Measures for Assessing...Ch. 14 - Effects of Transactions on Various Financial...Ch. 14 - Effects of Transactions on Various Ratios Denna...Ch. 14 - Prob. 15PCh. 14 - Common-Size Financial StatementsRefer to the...Ch. 14 - Interpretation of Financial Ratios Pecunious...Ch. 14 - Common-Size Statements and Financial Ratios for a...Ch. 14 - Financial Ratios for Assessing Profitability and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Effect of transactions on current position analysis Data pertaining to the current position of Lucroy Industries Inc. follow: Instructions 1. Compute (a) the working capital, (b) the current ratio, and (c) the quick ratio. Round ratios in parts b through j to one decimal place. 2. List the following captions on a sheet of paper: Compute the working capital, the current ratio, and the quick ratio after each of the following transactions and record the results in the appropriate columns. Consider each transaction separately and assume that only that transaction affects the data given. Round to one decimal place. a. Sold marketable securities at no gain or loss, 500,000. b. Paid accounts payable, 287,500. c. Purchased goods on account, 400,000. d. Paid notes payable, 125,000. e. Declared a cash dividend, 325,000. f. Declared a common stock dividend on common stock, 150,000. g. Borrowed cash from bank on a long-term note, 1,000,000. h. Received cash on account, 75,000. i. Issued additional shares of stock for cash, 2,000,000. j. Paid cash for prepaid expenses, 200,000.arrow_forwardEffects of Transactions on Various Financial Ratios In the right-hand column below, certain financial ratios are listed. To the left of each ratio is a business transaction or event relating to the operating activities of Delta Company (each transaction should be considered independently). Required: Indicate the effect that each business transaction or event would have on the ratio listed opposite to it. State the effect in terms of increase, decrease, or no effect on the ratio involved, and give the reason for your answer. In all cases, assume that the current assets exceed the current liabilities both before and after the event or transaction. Use the following format for your answers:arrow_forwardRatios provide a _________ measure of a company’s performance and condition. a. Gross b. Relative c. Qualitative d. Definitive An accountant recognizes revenues and expenses on: a. a revenue basis b. a cash basis c. an accrual basis d. an expense basisarrow_forward

- Identify how each of the following separate transactions through 10 affects financial statements. For increases, place a "+" and the dollar amount in the column or columns. For decreases, place a "-" and the dollar amount in the column or columns. Some cells may contain both an increase (+) and a decrease (-) along with dollar amounts. The first transaction is completed as an example. Required: a. For the balance sheet, identify how each transaction affects total assets, total liabilities, and total equity. For the income statement, identify how each transaction affects net income. b. For the statement of cash flows, identify how each transaction affects cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities. Transaction 1. Owner invests $750 cash in business in exchange for stock 2. Receives $550 cash for services provided 3. Pays $350 cash for employee wages 4. Buys $480 of equipment on credit 5. Purchases $580 of supplies…arrow_forwardRatio analysis "up and down" is applied from which of the following directions? a) vertical relationships b) external and internal relationships c) horizontal relationships O d) Show relationships between financial statement accounts Jayarrow_forwardHow is a financial ratio analysis performed? Comparing two items in financial statements. Evaluating the balance sheet Assessing the income statementarrow_forward

- Identify how each of the following separate transactions through 10 affects financial statements. For increases, place a "+" and the dollar amount in the column or columns. For decreases, place a "-" and the dollar amount in the column or columns. Some cells may contain both an increase (+) and a decrease (-) along with dollar amounts. The first transaction is completed as an example. Required a. For the balance sheet, identify how each transaction affects total assets, total liabilities, and total cq- A1 P1 uity. For the income statement, identify how each transaction affects net income. b. For the statement of cash flows, identify how each transaction affects cash flows from operating ac- tivities, cash flows from investing activities, and cash flows from financing activities. 2 3 4 5 6 7 8 9 10 Transaction Owner invests $800 cash in business in exchange for stock Purchases $100 of supplies on credit Buys equipment for $400 cash Provides services for $900 cash Pays $400 cash for rent…arrow_forwardEffect of transactions on various financial ratios Indicate the effect that eachtransaction/event listed here will have on the financial ratio listed opposite it, andprovide an explanation for your answer. Use 1 for increase, − for decrease, and (NE)for no effect. Assume that current assets exceed current liabilities in all cases, bothbefore and after the transaction/event.Transaction/Event Financial Ratioa. Purchased inventory on account.b. Sold inventory for cash, at a profi t.c. Issued a 10% stock dividend.d. Issued common stock for cash.e. Sold land at a gain.f. Purchased treasury stock for cash.g. Accrued interest on a note payable.h. Accrued wages that have been earnedby employees.i. Purchased equipment for cash.j. Issued bonds at an interest rate that isless than the company’s ROI.Number of days’ sales in inventoryInventory turnoverEarnings per shareDebt ratioReturn on investmentDebt/equity ratioTimes interest earnedCurrent ratioPlant and equipment turnoverReturn on equityarrow_forwardThe following transactions occurred during a recent year: a. Paid wages of $1,450 for the current period (example). b. Borrowed $7,250 cash from local bank using a short-term note. c. Purchased $2,900 of equipment on credit. d. Earned $580 of sales revenue; collected cash. e. Received $1,160 of utilities services, on credit. f. Earned $2,450 of service revenue, on credit. g. Paid $435 cash on account to a supplier. h. Incurred $100 of travel expenses; paid cash. i. Earned $580 of service revenue; collected half in cash, with balance on credit. j. Collected $160 cash from customers on account. k. Incurred $420 of advertising costs; paid half in cash, with balance on credit. Required: 1. For each of the transactions, complete the following table, indicating the account, amount, and direction of the effect (+ for increase and - for decrease) of each transaction under the accrual basis. Include revenues and expenses as subcategories of stockholders' equity, as shown for the first…arrow_forward

- Please briefly describe an income statement, statement of cash flows, and balance sheet. Please describe a hypothetical pro forma income statement. Please describe the five types of financial ratio analyses. Please provide and briefly discuss 1 ratio from each of the five types of analysis. Apply these same ratios to the financial statements of a firm of your choice, except those that we formerly addressed in any way in the course.arrow_forwardConsider the following company’s balance sheet and income statement Return on assets. Return on equity.arrow_forwardIn performing vertical analysis, we express each item in a financial statement as a percentage of a base amount. What base amount is commonly used for income statement accounts? For balance sheet accounts?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License