FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

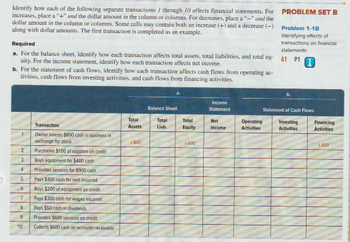

Transcribed Image Text:Identify how each of the following separate transactions through 10 affects financial statements. For

increases, place a "+" and the dollar amount in the column or columns. For decreases, place a "-" and the

dollar amount in the column or columns. Some cells may contain both an increase (+) and a decrease (-)

along with dollar amounts. The first transaction is completed as an example.

Required

a. For the balance sheet, identify how each transaction affects total assets, total liabilities, and total cq- A1 P1

uity. For the income statement, identify how each transaction affects net income.

b. For the statement of cash flows, identify how each transaction affects cash flows from operating ac-

tivities, cash flows from investing activities, and cash flows from financing activities.

2

3

4

5

6

7

8

9

10

Transaction

Owner invests $800 cash in business in

exchange for stock

Purchases $100 of supplies on credit

Buys equipment for $400 cash

Provides services for $900 cash

Pays $400 cash for rent incurred

Buys $200 of equipment on credit

Pays $300 cash for wages incurred

Pays $50 cash in dividends

Provides $600 services on credit

Collects $600 cash on accounts receivable

Total

Assets

+800

Balance Sheet

Total

Liab.

Total

Equity

+-800

Income

Statement

Net

Income

PROBLEM SET B

Problem 1-18

Identifying effects of

transactions on financial

statements

Operating

Activities

Statement of Cash Flows

Investing

Activities

Financing

Activities

+-800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Identifying Financial Statement Line Items and Accounts Several line items and account titles are listed below. For each, indicate in which of the following financial statement(s) we would likely find the item or account: income statement (IS), balance sheet (BS), statement of stockholders' equity (SE), or statement of cash flows (SCF). (Select all that apply.) Account (a) Cash asset (b) Expenses (c) Noncash assets (d) Contributed capital (e) Cash outflow for capital expenditures (f) Retained earnings (g) Cash inflow for stock issued (h) Cash outflow for dividends (i) Revenue Financial Statement(s) ◆ + + ♦ ♦ + ◆arrow_forwarda. List the four types of financial statements b.Describe the interrelationshipbetween balance sheet and the income statementarrow_forward1. How often should income statements be prepared? 2. Which is more important a. Statement of financial position (balance sheet) or b. Statement of results of operation (income statement)? 3. Explain the following: a. Balance sheet for a specific date (for example, December 31, 20X1) b. Income statement is for a period of time (for example: For the Year Ended December 31, 20X1) 4. What are the advantages of multistep income statement over a single-step income statement? 5. Relate accounts in the income statement with those in the balance sheet. Discuss how the income statement accounts affect balance sheet accounts.arrow_forward

- Identify how each of the following transactions affects the company's financial statements. For the balance sheet, Identify how each transaction affects total assets, total llabilities, and equity. For the Income statement, Identify how each transaction affects profit. If there is an Increase, select a *+" In the column or columns. If there is a decrease, select a "-" In the column or columns. If there is both an Increase and a decrease, select a *+/-" In the column or columns. The Iline for the first transaction Is completed as an example. Income Statement Balance Sheet Total Total Transaction Equity Profit Assets Liabilities 1 Owner invests cash 2 Seli services for cash 3 Acquire services on credit 4 Pay wages with cash 5 Owner withdraws cash 6 Borrow cash with note payable 7 Sell services on credit 8 Buy office equipment for cash 9 Collect receivable from (7) 10 Buy asset with note payablearrow_forwardThe following lettered items represent a classification scheme for a balance sheet, and the numbered items represent data found on balance sheets. In the blank next to each account, write the letter indicating to which category it belongs. А. Current assets В. Investments C. Property, plant, and equipment D. Intangible assets Е. Current liabilities F. Long-term liabilities G. Stockholders' equity Н. Not on the balance sheetarrow_forwardFor each account, identify whether the normal balance is a debit or credit a.Notes Payable b.Dividends c.Service Revenue How do i figure this out?arrow_forward

- Identify how each of the following separate transactions through 10 affects financial statements. For increases, place a "i" and the dollar amount in the column or columns. For decreases, place a"- and the dollar amount in the column or columns. Some cells may contain both an increase (+) and a decrease (-) along with dollar amounts. The first transaction is completed as an example. Required: a. For the balance sheet, identify how each transaction affects total essets, total abilities, and total equity For the income statement, identify how each transaction affects net income. b. For the statement of cash flows, identify how each transaction affects cash flows from operating activities, cash flows from investing activities, and cash flows from Snancing activities. Transaction 1. Owner invest $300 cash in business in exchange for vock 2 Rives $700 cash for services provided 3 Pays $500 cash for employee wages & Buys $100 of equipment on cred 5 Purchases $200 af supplies on credit &…arrow_forwardWhen performing vertical analysis of a balance sheet, the base amount is ________. A gross profit B total cash and cash equivalents C net income D total assetsarrow_forwardHarrigan Service Company, Inc., was incorporated by lan Harrigan and five other managers. The following activities occurred during the year: 1. Received $71,400 cash from the managers; each was issued 1,190 shares. 2. Purchased equipment for use in the business at a cost of $50,000; one-fourth was paid in cash and the company signed a note for the balance (due in six months). 3. Signed an agreement with a cleaning service to pay it $690 per week for cleaning the corporate offices, beginning next week. 4. Ian Harrigan borrowed $19,500 for personal use from a local bank, signing a one-year note.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education