Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 10F15

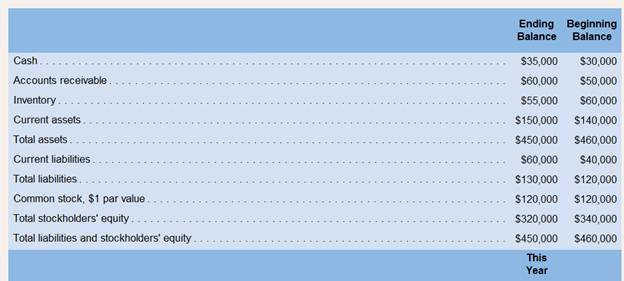

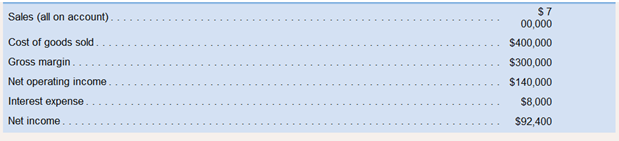

Markus Company’s common stock sold for $2.75 per share at the end of this. The company paid a common stock dividend of $0.55 per share this year. It also provided the following data excerpts from this rears financial statements:

Required:

10.What is the inventor, turnover and the average sale period?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Need help with this general accounting question

Determine the following measures for 20Y2, rounding to one decimal place including, percentage, except for per-share amounts.

5. Number of days sales in receivables

7. number of days sale in inventory

12. return on total asset

14. return on common stockholders equity

17. dividends per share of common stock

18. dividend yield

i need help on these questions i have provided please please please

Selected current year company information follows:

Net income

Net sales

Total liabilities, beginning-year

Total liabilities, end-of-year

$ 16,553

718,855

89,932

109,201

Total stockholders' equity, beginning-year 204,935

Total stockholders' equity, end-of-year

130,851

What is the return on total assets? (Do not round intermediate calculations.).

Chapter 14 Solutions

Introduction To Managerial Accounting

Ch. 14 - Prob. 1QCh. 14 - What is the basic purpose for examining trends in...Ch. 14 - Prob. 3QCh. 14 - Prob. 4QCh. 14 - What is meant by the dividend yield on a common...Ch. 14 - What is meant by the term financial leverage?Ch. 14 - Prob. 7QCh. 14 - Prob. 8QCh. 14 - Prob. 9QCh. 14 - Markus Company’s common stock sold for $2.75 per...

Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Prob. 11F15Ch. 14 - Prob. 12F15Ch. 14 - Prob. 13F15Ch. 14 - Prob. 14F15Ch. 14 - Prob. 15F15Ch. 14 - Common-Size Income Statement A comparative income...Ch. 14 - Prob. 2ECh. 14 - Prob. 3ECh. 14 - Financial Ratios for Debt Management Refer to the...Ch. 14 - Prob. 5ECh. 14 - Prob. 6ECh. 14 - Prob. 7ECh. 14 - Prob. 8ECh. 14 - Financial Ratios for Assessing Profitability and...Ch. 14 - Prob. 10ECh. 14 - Prob. 11ECh. 14 - Selected Financial Measures for Assessing...Ch. 14 - Effects of Transactions on Various Financial...Ch. 14 - Effects of Transactions on Various Ratios Denna...Ch. 14 - Prob. 15PCh. 14 - Common-Size Financial StatementsRefer to the...Ch. 14 - Interpretation of Financial Ratios Pecunious...Ch. 14 - Common-Size Statements and Financial Ratios for a...Ch. 14 - Financial Ratios for Assessing Profitability and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Required: 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardRatio Analysis MJO Inc. has the following stockholders equity section of the balance sheet: On the balance sheet date, MJOs stock was selling for S25 per share. Required: Assuming MJOs dividend yield is 1%, what are the dividends per common share? Assuming MJOs dividend yield is 1% and its dividend payout is 20%, what is MJOs net income?arrow_forward

- Measures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was 82.60 on December 31, 20Y2. Instructions Determine the following measures for 20Y2 (round to one decimal place, including percentages, except for per-share amounts): 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days sales in receivables 6. Inventory turnover 7. Number of days sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders equity 14. Return on common stockholders equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yieldarrow_forwardThe income statement, statement of retained earnings, and balance sheet for Somerville Company are as follows: Includes both state and federal taxes. Refer to the information for Somerville Company on the previous pages. Also, assume that the price per common share for Somerville is 8.10. Required: Compute the price-earnings ratio. (Note: Round the answer to two decimal places.)arrow_forwardMeasures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was 82.60 on December 31, 20Y2. Instructions Determine the following measures for 20Y2, rounding to one decimal place, including percentages, except for per-share amounts: 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days sales in receivables 6. Inventory turnover 7. Number of days sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders equity 14. Return on common stockholders equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yieldarrow_forward

- The comparative financial statements of Stargel Inc. are as follows. The market price of Stargel common stock was $119.70 on December 31, 20Y2. Please see the attachment for details: InstructionsDetermine the following measures for 20Y2, rounding to one decimal place including percentages, except for per-share amounts:1. Working capital2. Current ratio3. Quick ratio4. Accounts receivable turnover5. Number of days’ sales in receivables6. Inventory turnover7. Number of days’ sales in inventory8. Ratio of fixed assets to long-term liabilities9. Ratio of liabilities to stockholders’ equity10. Times interest earned11. Asset turnover12. Return on total assets13. Return on stockholders’ equity14. Return on common stockholders’ equity15. Earnings per share on common stock16. Price-earnings ratio17. Dividends per share of common stock18. Dividend yieldarrow_forwardDetermine the following measures for 20Y2 (round to one decimal place, including percentages, except for per-share amounts): Return on common stockholders' equity Earnings per share on common stock Price-earnings ratio Dividends per share of common stock Dividend yieldarrow_forwardFinancial Accountingarrow_forward

- At the beginning of the year, the net assets of Shannon Co. were $617,900. The only transactions affecting stockholders’ equity during the year were net income of $60,800 and dividends of $16,600.Required:Calculate Shannon Co.’s return on equity (ROE) % for the year.arrow_forwardMarkus Company's common stock sold for $5.25 per share at the end of this year. The company paid a common stock dividend of $0.63 per share this year. It also provided the following data excerpts from this year's financial statements: Cash Accounts receivable Inventory Current assets Total assets Current liabilities Total liabilities Common stock, $1 par value Total stockholders' equity Total liabilities and stockholders' equity Sales (all on account) Cost of goods sold Gross margin Net operating income Interest expense Net income This Year $ 1,095,000 $ 635,100 $ 459,900 $ 313,875 $ 15,500 $ 208,862 Accounts receivable turnover Average collection period Answer is complete but not entirely correct. 13.62 26.76 days Ending Balance $ 49,000 $ 92,000 $ 76,300 $ 217,300 $ 801,000 $ 85,500 $ 206,000 $ 165,000 $ 595,000 $ 801,000 Beginning Balance $ 44,200 $ 68,700 $ 92,000 $ 204,900 $ 875,400 Foundational 14-9 (Algo) 9. What is the accounts receivable turnover and the average collection…arrow_forwardFROM THE FOLLOWING, CALCULATE PROFITABILITY RATIOS.TRADING AND PROFIT AND LOSS ACCOUNT OF MMR & CO.FOR THE YEAR ENDING 31.12. 2019(HORIZONTAL FORMAT)PARTICULARS $ PARTICULARS $Opening stock 199,000 Sales 1,700,000Purchases 1,119,000 Closing stock 298,000Gross profit 680,0001,998,000 1,998,000Administrationexpenses300,000 Gross profit 680, 000Selling expenses 60,000 Interest 18,000Financeexpenses30,000Loss on sale ofplant8,000Net profit 300,000698,000 698,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License