Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 8F15

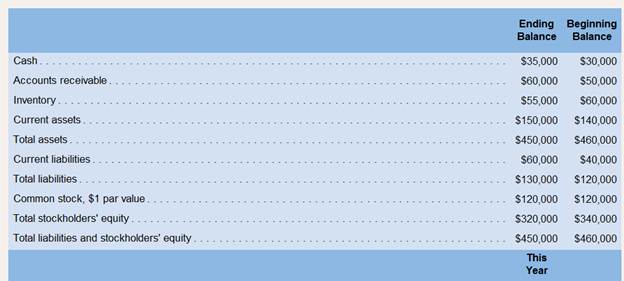

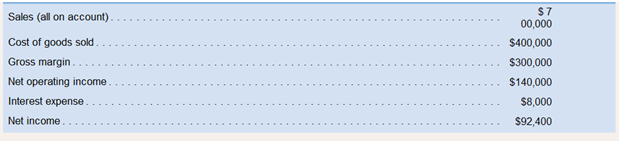

Markus Company’s common stock sold for $2.75 per share at the end of this. The company paid a common stock dividend of $0.55 per share this year. It also provided the following data excerpts from this rears financial statements:

Required:

8. What is the acid-test ratio at the end of this year?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following information is available for Jase Company:

Market price per share of common stock

$25.00

Earnings per share on common stock

1.25

Which of the following statements is correct?

a. The price-earnings ratio is 10 and a share of common stock was selling for 125 times the amount of earnings per share at the end of the year.

b. The market price per share and the earnings per share are not statistically related to each other.

c. The price-earnings ratio is 20 and a share of common stock was selling for 20 times the amount of earnings per share at the end of the year.

d. The price-earnings ratio is 5% and a share of common stock was selling for 5% more than the amount of earnings per share at the end of the year.

Markus Company's common stock sold for $5.25 per share at the end of this year. The company paid a common stock

dividend of $0.63 per share this year. It also provided the following data excerpts from this year's financial statements:

Cash

Accounts receivable

Inventory

Current assets

Total assets

Current liabilities

Total liabilities

Common stock, $1 par value

Total stockholders' equity

Total liabilities and stockholders' equity

Sales (all on account)

Cost of goods sold

Gross margin

Net operating income

Interest expense

Net income

This Year

$ 1,095,000

$ 635,100

$ 459,900

$ 313,875

$ 15,500

$ 208,862

Accounts receivable turnover

Average collection period

Answer is complete but not entirely correct.

13.62

26.76 days

Ending Balance

$ 49,000

$ 92,000

$ 76,300

$ 217,300

$ 801,000

$ 85,500

$ 206,000

$ 165,000

$ 595,000

$ 801,000

Beginning Balance

$ 44,200

$ 68,700

$ 92,000

$ 204,900

$ 875,400

Foundational 14-9 (Algo)

9. What is the accounts receivable turnover and the average collection…

Markus Company’s common stock sold for $2.75 per share at the end of this year. The company paid a common stock dividend of $0.55 per share this year. It also provided the following from this year’s financial statements:data excerpts

Required:

1. What is the earnings per share?

2. What is the price-earnings ratio?

3. What is the dividend payout ratio and the dividend yield ratio?

4. What is the return on total assets (assuming a 30% tax rate)?

5. What is the return on equity?

6. What is the book value per share at the end of this year?

7. What is the amount of working capital and the current ratio at the end of this year?

8. What is the acid-test ratio at the end of this year?

9. What is the accounts receivable turnover and the average collection period?

10. What is the inventory turnover and the average sale period?

11. What is the company’s operating cycle?

12. What is the total asset turnover?

13. What is the times interest earned ratio?

14. What is the debt-to-equity ratio at the…

Chapter 14 Solutions

Introduction To Managerial Accounting

Ch. 14 - Prob. 1QCh. 14 - What is the basic purpose for examining trends in...Ch. 14 - Prob. 3QCh. 14 - Prob. 4QCh. 14 - What is meant by the dividend yield on a common...Ch. 14 - What is meant by the term financial leverage?Ch. 14 - Prob. 7QCh. 14 - Prob. 8QCh. 14 - Prob. 9QCh. 14 - Markus Company’s common stock sold for $2.75 per...

Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Markus Company’s common stock sold for $2.75 per...Ch. 14 - Prob. 11F15Ch. 14 - Prob. 12F15Ch. 14 - Prob. 13F15Ch. 14 - Prob. 14F15Ch. 14 - Prob. 15F15Ch. 14 - Common-Size Income Statement A comparative income...Ch. 14 - Prob. 2ECh. 14 - Prob. 3ECh. 14 - Financial Ratios for Debt Management Refer to the...Ch. 14 - Prob. 5ECh. 14 - Prob. 6ECh. 14 - Prob. 7ECh. 14 - Prob. 8ECh. 14 - Financial Ratios for Assessing Profitability and...Ch. 14 - Prob. 10ECh. 14 - Prob. 11ECh. 14 - Selected Financial Measures for Assessing...Ch. 14 - Effects of Transactions on Various Financial...Ch. 14 - Effects of Transactions on Various Ratios Denna...Ch. 14 - Prob. 15PCh. 14 - Common-Size Financial StatementsRefer to the...Ch. 14 - Interpretation of Financial Ratios Pecunious...Ch. 14 - Common-Size Statements and Financial Ratios for a...Ch. 14 - Financial Ratios for Assessing Profitability and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Required: 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardAt the beginning of the year, the net assets of Shannon Co. were $617,900. The only transactions affecting stockholders’ equity during the year were net income of $60,800 and dividends of $16,600.Required:Calculate Shannon Co.’s return on equity (ROE) % for the year.arrow_forward

- Cases Unlimited reported operating income of $780,000, interest expense of $120,000, and net income of $575,000. The weighted-average number of shares of common stock outstanding during the year was 100,000 shares. What is the times-interest-earned ratio? (Round your final answer to two decimal places.) Select one: a. 7.50 b. 5.79 c. 6.50 d. 4.79arrow_forwardCrane Jewelers management announced that the company had net earnings of $4,356,000 for this year. The company has 1,613,000 shares outstanding, and the year-end stock price is $68.91. What are Crane’s earnings per share and P/E ratio? (Round answers to 2 decimal places, e.g. 12.25)arrow_forwardFor 20Y2, Macklin Inc. reported a significant increase in net income. At the end of the year, John Mayer, the president, is presented with the following condensed comparative income statement: Please see the attachment for details: Instructions1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 20Y1 as the base year. Round percentages to one decimal place.2. To the extent the data permit, comment on the significant relationships revealed by the horizontal analysis prepared in (1).arrow_forward

- On October 25, Illinois Company had a market price per share of common stock of $33. For the previous year, it paid an annual dividend of $2.31. What is the dividend yield for Illinois Company? a. 14% b. 7% C. 2% d. None of these choices are correct.arrow_forwardSmith Inc. has announced net earnings of $877,500 for this year. The company has 325,660 shares outstanding, and the year-end stock price is $50.48. What are the company’s earnings per share and P/E ratio? a. EPS: $2.69; P/E: 18.77 times b. EPS: $0.37; P/E: 18.77 times c. EPS: $0.37; P/E: 10.55 times d. EPS: $2.69; P/E: 10.55 timesarrow_forwardSong Corp's stock price at the end of last year was $27.75 and its earnings per share for the year were $1.30. What was its P/E ratio?arrow_forward

- The market price for Microsoft Corporation closed at $55.48 and $46.45 on December 31, current year, and previous year, respectively. The dividends per share were $1.24 for current year and $1.12 for previous year.a. Determine the dividend yield for Microsoft on December 31, current year, and previous year. Round percentages to two decimal places.b. Interpret these measures.arrow_forwardThe Gizmo, Inc. has just announced year-end results as follows: a. Calculate the book value per share. b. Calculate earnings per share. c. Calculate Gizmo, Inc.'s dividend yield. d. Calculate the market-to-book ratio. a. The book value per share is $ Value of company assets Value of company liabilities Net income Common stock dividends Preferred stock dividends (Round to the nearest cent.) Number of shares of common stock outstanding Closing price of Gizmo, Inc.'s stock $11,440,000 $5,597,242 $1,661,997 $180,572 $427,107 831,680 $43.77 per sharearrow_forwardJustice Corporation reported the following financial statements: LOADING... (Click the icon to view the financial statements.) The company has 2,900 shares of common stock outstanding and the market price is $25 per share. What is Justice's price/earnings ratio? (Round any intermeidary calculations and your final answer to two decimal places, X.XX.) A. 0.09 B. 8.80 C. 8.80 times D. $0.09 Click to select your answer. Financial Statements Justice Corporation Comparative Balance Sheet December 31, 2025 and 2024 2025 2024 Assets Current Assets: Cash and Cash Equivalents $2,150 $1,724 Accounts Receivable 1,966 1,772 Merchandise Inventory 1,348 1,104 Prepaid Expenses 1,638 2,055 Total Current Assets 7,102 6,655 Other Assets 17,335 16,268 Total Assets $24,437 $22,923 Liabilities Current Liabilities $7,383…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License