Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 2F15

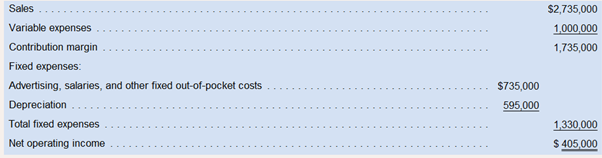

Cardinal Company is considering a five-year project that would require a $2,975,000 investment in equipment with a useful life of five years and no salvage value. The company’s discount rate is 14%. The project would provide net operating income in each of five wars as follows:

Required:

(Answer each question by referring to the original data unless instructed otherwise.)

2. What are the project’s annual net

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Wayne Company is considering a long-term investment project called ZIP. ZIP will require an investment of $137,956. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $79,900, and annual cash outflows would increase by $42,000. Compute the cash payback period. (Round answer to 2 decimal places, e.g. 10.52.)

Cash payback period

_________?

enter the Cash payback period in years rounded to 2 decimal places years.

Magsaysay Company is evaluating an investment that would have an eight-year life and would require a P300,000 purchase of equipment which has no salvage value. The project has the following additional information: Sales, P500,000; Cash Variable Expenses, P200,000; Fixed cash expenses, P150,000; Depreciation expense, P37,500. If the company's required rate of return is 10%, what is the payback period of the investment?

a. 3 years

b. 2 years

c. 2.5 years

d. 2.67 years

Sierra Company is considering a long-term investment project called ZIP. ZIP will require an investment of $140,040. It will have a

useful life of four years and no salvage value. Annual cash inflows would increase by $93,360, and annual cash outflows would increase

by $47,847. The company's required rate of return is 12%. Calculate the internal rate of return on this project. (Round answer to 1

decimal place, e.g. 12.4%.)

Internal rate of return

%

Identify whether the project should be accepted or rejected.

The project should be

Chapter 12 Solutions

Introduction To Managerial Accounting

Ch. 12.A - Basic Present Value Concepts Annual cash inflows...Ch. 12.A - Basic Present value Concepts Julie has just...Ch. 12.A - Prob. 3ECh. 12.A - Prob. 4ECh. 12.A - Basic Present Value Concepts The Atlantic Medical...Ch. 12.A - Prob. 6ECh. 12 - What is the difference between capital budgeting...Ch. 12 - Prob. 2QCh. 12 - Prob. 3QCh. 12 - Prob. 4Q

Ch. 12 - Why are discounted cash flow methods of making...Ch. 12 - Prob. 6QCh. 12 - Identify two simplifying assumptions associated...Ch. 12 - Prob. 8QCh. 12 - Prob. 9QCh. 12 - Prob. 10QCh. 12 - Prob. 11QCh. 12 - Prob. 12QCh. 12 - How is the project profitability index computed,...Ch. 12 - Prob. 14QCh. 12 - Prob. 15QCh. 12 - Prob. 1AECh. 12 - The Excel worksheet form that appears below is to...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Prob. 3F15Ch. 12 - Prob. 4F15Ch. 12 - Prob. 5F15Ch. 12 - Prob. 6F15Ch. 12 - Prob. 7F15Ch. 12 - Prob. 8F15Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Prob. 11F15Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Prob. 13F15Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Payback Method The management of Unter...Ch. 12 - Net Present Value Analysis The management of...Ch. 12 - Internal Rate of Return Wendell’s Donut Shoppe is...Ch. 12 - Uncertain Future Cash Flows Lukow Products is...Ch. 12 - Prob. 5ECh. 12 - Simple Rate of Return Method The management of...Ch. 12 - Prob. 7ECh. 12 - Payback Period and Simple Rate of Return Nicks...Ch. 12 - Prob. 9ECh. 12 - Prob. 10ECh. 12 - Preference Ranking of Investment Projects Oxford...Ch. 12 - Prob. 12ECh. 12 - Payback Period and Simple Rate of Return...Ch. 12 - Comparison of Projects Using Net Present Value...Ch. 12 - Internal Rate of Return and Net Present Value...Ch. 12 - Net Present Value Analysis Windhoek Mines, Ltd.,...Ch. 12 - Net Present Value Analysis; Internal Rate of...Ch. 12 - Net Present Value Analysis Oakmont Company has an...Ch. 12 - Simple Rate of Return; Payback Period Paul Swanson...Ch. 12 - Prob. 20PCh. 12 - Prob. 21PCh. 12 - Prob. 22PCh. 12 - Comprehensive Problem - Lou Barlow, a divisional...Ch. 12 - Prob. 24PCh. 12 - Prob. 25PCh. 12 - Prob. 26PCh. 12 - Net Present Value Analysis In five years, Kent...Ch. 12 - Prob. 28PCh. 12 - Prob. 29P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Staten Corporation is considering two mutually exclusive projects. Both require an initial outlay of 150,000 and will operate for five years. The cash flows associated with these projects are as follows: Statens required rate of return is 10%. Using the net present value method and the present value table provided in Appendix A, which of the following actions would you recommend to Staten? a. Accept Project X and reject Project Y. b. Accept Project Y and reject Project X. c. Accept Projects X and Y. d. Reject Projects X and Y.arrow_forwardGallant Sports s considering the purchase of a new rock-climbing facility. The company estimates that the construction will require an initial outlay of $350,000. Other cash flows are estimated as follows: Assuming the company limits its analysis to four years due to economic uncertainties, determine the net present value of the rock-climbing facility. Should the company develop the facility if the required rate of return is 6%?arrow_forwardWayne Company is considering a long-term investment project called ZIP. ZIP will require an investment of $ 130,975. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $ 80,300, and annual cash outflows would increase by $ 40,000. Compute the cash payback period. (Round answer to 2 decimal places, e.g. 10.52.) Cash payback period years.arrow_forward

- Joruarrow_forwardA project with a life of 6 years is expected to provide annual sales of $260,000 and costs of $173,000. The project will require an investment in equipment of $490,000, which will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +/-15 percent. The tax rate is 21 percent. What is the annual operating cash flow for the best-case scenario?arrow_forwardOredo is installing new equipment at a cost of 240000 OMR. Expected cash flows from this project over the next three years will be 145000 OMR , 175000 OMR and 165000 OMR. The company's discount rate for such projects is 12 percent. What is the project's discounted payback period? Select one: a. 2.82 years b. 1.79 years c. 1.53 years d. None of these e. 1.74 yearsarrow_forward

- Petal Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost $915,000. Projected net cash inflows are as follows: Year 1 $263,000 Year 2 252,000 Year 3 222,000 Year 4 214,000 Year 5 201,000 Year 6 178,000 1. Compute this project's NPV using Petal's 14% hurdle rate. Should Petal invest in the equipment? 2. Petal could refurbish the equipment at the end of six years for $100,000. The refurbished equipment could be used one more year, providing $77,000 of net cash inflows in year 7. Additionally, the refurbished equipment would have a $52,000 residual value at the end of year 7. Should Petal invest in the equipment and refurbish it after six years? (Hint: In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present value.)arrow_forwardA project that will provde annual cash flows of $2,550 for nine years costs $10,500 today. a. At a required return of 11 percent, what is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. At a required return of 27 percent, what is the NPV of the project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. At what discount rate would you be indifferent between accepting the project and rejecting it? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. NPV b. NPV c. Discount ratearrow_forwardNielsen NV has a project with initial investment requiring $-130,000 and the following cash flows will be generated because of the project: $32,500; $54,000; $61,000; and $42,000 respectively at the end of each year for the next four years. If the required rate of return is 0.17, find the Net Present Value (NPV) of the project. none of the answers is correct -$1,804 -$1,660 -$2,275 -$902arrow_forward

- Management of Ivanhoe, Inc., is considering switching to a new production technology. The cost the required equipment will be $4,000,000. The discount rate is 13 percent. The cash flows that management expects the new technology to generate as follows: Years: CF: 1-2 0 3-5 $720,000 6-9 $1,670,000 A) Compute the payback and discounted payback periods for the project B) What is the NPV for the project? Should the firm go ahead with the project? C) What is the IRR, and what would be the decision based on the IRR?arrow_forwardA project that provides annual cash flows of $2,620 for eight years costs $9,430 today. a.At a required return of 8 percent, what is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)b.At a required return of 24 percent, what is the NPV of the project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)c.At what discount rate would you be indifferent between accepting the project and rejecting it? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardEve Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost $930,000. Projected net cash inflows are as follows: (Click the icon to view the projected net cash inflows.) (Click the icon to view Present Value of $1 table.) Read the requirements. Requirement 1. Compute this project's NPV using Eve's 14% hurdle rate. Should Eve invest in the equipment? Use the following table to calculate the net present value of the project. (Enter any factor amounts to three decimal places, X.XXX. PV Factor (i = 14%) Years Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Present value of each year's inflow: (n = 1) Present value of each year's inflow: (n = 2) Present value of each year's inflow: (n = 3) Present value of each year's inflow: (n=4) Present value of each year's inflow: (n = 5) Present value of each year's inflow: (n = 6) Total PV of cash inflows Year 0 Initial investment Net present value of the project example…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License