Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 2CMA

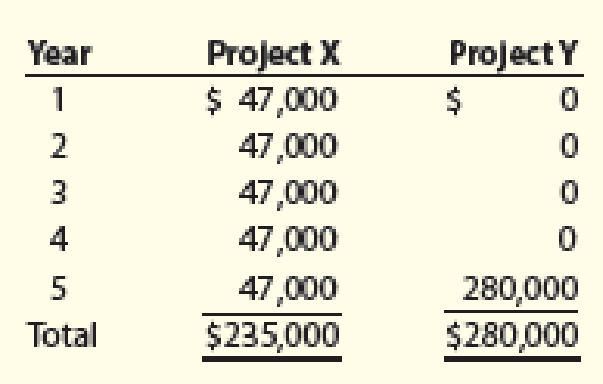

Staten Corporation is considering two mutually exclusive projects. Both require an initial outlay of $150,000 and will operate for five years. The

Staten’s required

- a. Accept Project X and reject Project Y.

- b. Accept Project Y and reject Project X.

- c. Accept Projects X and Y.

- d. Reject Projects X and Y.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The Bartram-Pulley Company (BPC) must decide between two mutually exclusive investment projects. Each project costs $7,750 and has an expected life of 3 years. Annual net cash flows from each project begin 1 year after the initial investment is made and have the following probability distributions:

Project B

Project A

Cash Flows

Project A:

$

Yes

$

σ

$

Project A

Project B

$

b. What is the risk-adjusted NPV of each project? Do not round intermediate calculations. Round your answers to the nearest cent.

x

X

*

$

CV

BPC has decided to evaluate the riskier project at an 11% rate and the less risky project at a 10% rate.

a. What is the expected value of the annual cash flows from each project? Do not round intermediate calculations. Round your answers to the nearest dollar.

Project A

Project B

X

Net cash flow $

What is the coefficient of variation (CV)? (Hint: OB-$4,757.63 and CVB=$0.67.) Do not round intermediate calculations. Round a values to the nearest cent and CV values to two decimal…

Yokam Company is considering two alternative projects. Project 1 requires an initial investment of $400,000 and has a present value of

cash flows of $1,100,000. Project 2 requires an initial investment of $4,000,000 and has a present value of cash flows of $6,000,000.

1. Compute the profitability index for each project.

2. Based on the profitability index, which project should the company prefer?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Compute the profitability index for each project.

Project 1

Project 2

Choose Numerator:

Profitability Index

T

7

Choose Denominator:

4 of 5

180

#

Next >

G O

Shell Camping Gear, Inc., is considering two mutually exclusive projects. Each requires an initial investment of $180,000. John Shell, president of the company, has set a maximum payback period of 4 years.The cash inflows associated with each project are shown in the following table attached;

.

a. Determine the payback period of each project.

b. Which project is acceptable based on payback period?

Chapter 12 Solutions

Managerial Accounting

Ch. 12 - What are the principal objections to the use of...Ch. 12 - Discuss the principal limitations of the cash...Ch. 12 - Prob. 3DQCh. 12 - Your boss has suggested that a one-year payback...Ch. 12 - Prob. 5DQCh. 12 - Prob. 6DQCh. 12 - A net present value analysis used to evaluate a...Ch. 12 - Two projects have an identical net present value...Ch. 12 - Prob. 9DQCh. 12 - What are the major disadvantages of the use of the...

Ch. 12 - Prob. 11DQCh. 12 - Prob. 12DQCh. 12 - Average rate of return Determine the average rate...Ch. 12 - Prob. 2BECh. 12 - Prob. 3BECh. 12 - Internal rate of return A project is estimated to...Ch. 12 - Prob. 5BECh. 12 - Average rate of return The following data are...Ch. 12 - Average rate of returncost savings Maui...Ch. 12 - Average rate of returnnew product Hana Inc. is...Ch. 12 - Determine cash flows Natural Foods Inc. is...Ch. 12 - Cash payback period for a service company Janes...Ch. 12 - Cash payback method Lily Products Company is...Ch. 12 - Prob. 7ECh. 12 - Net present value method for a service company...Ch. 12 - Net present value methodannuity for a service...Ch. 12 - Net present value methodannuity Jones Excavation...Ch. 12 - Prob. 11ECh. 12 - Prob. 12ECh. 12 - Prob. 13ECh. 12 - Prob. 14ECh. 12 - Prob. 15ECh. 12 - Prob. 16ECh. 12 - Prob. 17ECh. 12 - Prob. 18ECh. 12 - Prob. 19ECh. 12 - Prob. 20ECh. 12 - Net present value-unequal lives Bunker Hill Mining...Ch. 12 - Prob. 22ECh. 12 - Average rate of return method, net present value...Ch. 12 - Prob. 2PACh. 12 - Net present value method, present value index, and...Ch. 12 - Net present value method, internal rate of return...Ch. 12 - Prob. 5PACh. 12 - Prob. 6PACh. 12 - Prob. 1PBCh. 12 - Prob. 2PBCh. 12 - Net present value method, present value index, and...Ch. 12 - Prob. 4PBCh. 12 - Prob. 5PBCh. 12 - Prob. 6PBCh. 12 - San Lucas Corporation is considering investment in...Ch. 12 - Prob. 2MADCh. 12 - Prob. 3MADCh. 12 - Prob. 4MADCh. 12 - Prob. 5MADCh. 12 - Assume Home Garden Inc. in MAD 26-5 assigns the...Ch. 12 - Ethics in Action Danielle Hastings was recently...Ch. 12 - Prob. 4TIFCh. 12 - CEO, Worthington Industries (WOR) (a...Ch. 12 - Prob. 6TIFCh. 12 - Prob. 1CMACh. 12 - Staten Corporation is considering two mutually...Ch. 12 - Prob. 3CMACh. 12 - Foster Manufacturing is analyzing a capital...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ABC Service can purchase a new assembler for $15,052 that will provide an annual net cash flow of $6,000 per year for five years. Calculate the NP of the assembler if the required rate of return is 12%. Show calculation. Would you accept/reject a project based on NPV decision criteria? Why? Based on NPV calculated in part A, determine Profitability Index (PI). Show calculation. Would you accept/reject a project based on PI decision criteria? Why?arrow_forwardYokam Company is considering two alternative projects. Project 1 requires an initial investment of $400,000 and has a present value of cash flows of $1,100,000. Project 2 requires an initial investment of $4 million and has a present value of cash flows of $6 million. Compute the profitability index for each project. Based on the profitability index, which project should the company prefer? Explain.arrow_forwardThe Michner Corporation is trying to choose between the following two mutually exclusive design projects: Year Cash Flow (1) Cash Flow (II) 0 123 -$ 73,000 33,000 33,000 3 33,000 -$ 17,100 9,250 9,250 9,250 a-1.If the required return is 11 percent, what is the profitability index for both projects? (Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161.) Project I Project II - If the company applies the profitability index decision rule, which project should the 2. firm accept? O Project I O Project II b- What is the NPV for both projects? (A negative answer should be indicated by a 1. minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Project I Project IIarrow_forward

- The Michner Corporation is trying to choose between the following two mutually exclusive design projects: Year Cash Flow (I) Cash Flow (II) 0 -$ 82,000 -$ 21,700 1 37,600 11,200 2 11,200 11,200 37,600 37,600 a-1. If the required return is 10 percent, what is the profitability index for each project? Note: Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161. a-2. If the required return is 10 percent and the company applies the profitability index decision rule, which project should the firm accept? b-1. If the required return is 10 percent, what is the NPV for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b-2. If the company applies the NPV decision rule, which project should it take? a-1. Project I Project II a-2. Project acceptance b-1. Project I Project II b-2. Project acceptancearrow_forwardYokam Company is considering two alternative projects. Project 1 requires an initial investment of $420,000 and has a present value of all its cash flows of $1,350,000. Project 2 requires an initial investment of $5 million and has a present value of all its cash flows of $6 million. (a) Compute the profitability index for each project.(b) Based on the profitability index, which project should the company select?arrow_forwardYokam Company is considering two alternative projects. Project 1 requires an initial investment of $470,000 and has a present value of all its cash flows of $2,350,000. Project 2 requires an initial investment of $5,000,000 and has a present value of all its cash flows of $6,000,000. (a) Compute the profitability index for each project. (b) Based on the profitability index, which project should the company select? Complete this question by entering your answers in the tabs below. Required A Required B Compute the profitability index for each project. Profitability Index Numerator: Denominator: Profitability Index = Profitability index Project 1 Project 2arrow_forward

- The Webex Corporation is trying to choose between the following two mutually exclusive designprojects: Year Net Cash Flow Project - I($) Net Cash Flow Project - II($) 0 (53,000) (16,000) 1 27000 9100 2 27000 9100 3 27000 9100 (a) If the required return is 10% and the company applies the Profitability Index decision rule,which project should the firm accept?(b) If the company applies the Net Present Value decision rule, which project should it take?(c) Explain why your answers in (a) and (b) are different(d) Calculate the Internal Rate of Return of both projects.arrow_forwardShaylee Corporation has $2.00 million to invest in new projects. The company's managers have presented a number of possible options that the board must prioritize. Information about the projects follows: Initial investment Present value of future cash flows Required: 1. Is Shaylee able to invest in all of these projects simultaneously? 2-a. Calculate the profitability index for each project. 2-b. What is Shaylee's order of preference based on the profitability index? Complete this question by entering your answers in the tabs below. Req 1 Project A $ 435,000 785,000 Req 2A and 2B Is Shaylee able to invest in all of these projects simultaneously? Is Shaylee able to invest in all of these projects simultaneously? Project C $ 740,000 1,220,000 Project D $ 965,000 1,580,000arrow_forwardA company is considering three alternative investment projects with different net cash flows. The present value of net cash flows is calculated using Excel and the results follow. Potential Projects Present value of net cash flows (excluding initial investment) Initial investment Project A $ 11,226 (10,000) Project B $ 10,568 (10,000) a. Compute the net present value of each project. b. If the company accepts all positive net present value projects, which of these will it accept? c. If the company can choose only one project, which will it choose on the basis of net present value? Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the net present value of each project. Potential Projects Project A Project B Project C Present value of net cash flows Initial investment Net present value $ $ $arrow_forward

- The Michner Corporation is trying to choose between the following two mutually exclusive design projects: Year Cash Flow (I) Cash Flow (II) 0 -$ 76,000 -$ 34,000 1 29,000 11,000 23,500 17,500 2 3 36,000 42,000 a-1. If the required return is 12 percent, what is the profitability index for each project? Note: Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161. a-2. If the company applies the profitability index decision rule, which project should it take? b-1. If the required return is 12 percent, what is the NPV for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b-2. If the company applies the net present value decision rule, which project should it take? a-1. Project I a-2. Project II b-1. Project I b-2. Project IIarrow_forwardBloombish Corp. Inc. is considering a project that has cash flows of -$152,000, $60,800, $61,300, and $75,000 for Years 0 to 3 respectively. The required rate of return is 14 percent. Based on the internal rate of return ________ percent, you should ___________ the project. Select one: A. 12.95 percent; accept B. 14.67 percent; accept C. 13.67 percent; reject D. 14.67 percent; rejectarrow_forwardThe Whenworth Corporation is trying to choose between the following two mutually exclusive design projects: Year Cash Flow (I) Cash Flow (II) -$84,000 33,900 44,000 50,000 -$42,000 12,600 31,500 25,500 1 a-1. If the required return is 17 percent, what is the profitability index for each project? (Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161.) a-2. If the company applies the profitability index decision rule, which project should it take? b-1. If the required return is 17 percent, what is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b-2. If the company applies the net present value decision rule, which project should it take? a-1. Project I Project II а-2. b-1. Project I Project IIarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License