Cain Nelson is a divisional manager for Pigeon Company His anal pay raises me 1rgel determined by his divisions

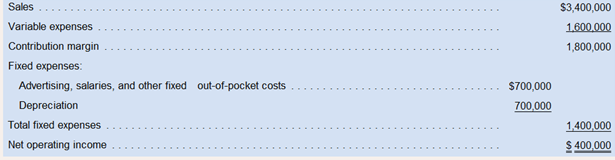

The project would provide net operating income each vet for five vets as follows:

Required:

1. What is the project’s net present value?

2. What is the project’s internal rate of return to the nearest whole percent?

3. What is the project’s simple rate of return?

4. Would the company wait Casey to pursue this investment opportunity? Would Casey be inclined to pursue this investment opportunity? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Introduction To Managerial Accounting

- Golden Goodness (GG) has an investment center that had the following data: Operating Income $28,000 Sales $350,000 Invested assets $175,000 PMB has set a minimum acceptable rate of return at 14%. Using the information, answer the following questions. You must include what type of number it is (%, $, etc.) Part A: What is the residual income? Part B: Show calcualtions on how you got answerarrow_forwardShalom Company provided the following data pertaining to its Peace Department: Margin on sales Minimum required rate of return Return on investment Turnover Average operating assets Sales 10% 18% 25% 2.50 40,000 100,000 Suppose you were presented Project Piss that has ROI of 22% and residual income of P1,900. Will Peace Department consider accepting the project? Yes or no? Use the underlined words as your choice. Input answers in capital letters.arrow_forwardCourse: Costs and Budgeting - Equilibrium Point ABC has generated an investment of $500,000 with its shareholders and wishes to achieve a pre-tax return of 30% for this period. Its variable costs are $30 per unit, selling price is $80 per unit and fixed costs are $50,000. How much does the company have to sell to reach the profit projected by the shareholders?arrow_forward

- 15. The manager of the Cement Division expects the following results in 2022: Sales Variable Costs (60%) Contribution Margin P 49.600,00O 29, 760,000 19,840.000 Fixed Costs Profit P 7.840,000 The Division's investments are as follows: Plant equipment Working Capital ROI P 19,510.000 P 14.880.00O 22.8% The division has a target ROI of 30 percent, and the rmanager has asked you to determine how much sales volume the division would need in order to realize that. He states that the sales mix is relatively constant so variable costs should be close to 60 percent of sales, fixed costs and plant and equipment should remain constant, and working capital should vary closely with sales in the percentage reflected above. 15. The peso sales that the division needs in order to realize the 30 percen ROI target is: O a. P 19,829,032 O b. P 57,590,322 O c. P 44,373,871 O d. P 59,510,000arrow_forwardThe following results pertain to an investment center. Sales $ 1,577,200 Variable costs 820,000 Traceable fixed costs 114,000 Average investment 960,000 Divisional cost of capital (discount rate) 10 % How much is the return on investment (ROI) for this investment center?arrow_forwardA company has three investment alternatives. The alternatives have similar economic lives. The following data is available for each alternative Investment A Investment B Investment $100,000 $100,000 Annual net income $31,000 $18,000 Residual value of investment $10,000 $20,000 Assuming the company can select only one investment, which investment would be selected under ROI analysis? ROI on Investment A ROI on Investment Barrow_forward

- Using the following data, estimate the new Return on Investment if there is a 10% increase in sales - with average operating assets as the base. Sales $2,000,000 Variable costs 1,100,000 Contribution margin 45% 900.000 Controllable fıxed costs 300.000 Controllable margin $600,000 Average operating assets $5,000,000 Round to two decimal places. Be sure to enter the answer as a percentage but do not include the % sign.arrow_forwardTop management is unhappy with the investment center's return on investment (ROD) It asks the manager of the South Division to submit plans to improve ROI in the next year. The manager believes it is feasible to consider the following independent courses of action 1 2 3 (a) Compute the return on investment (ROI) for the current year. (Round ROI to 2 decimal places, e.g. 1.57%) Increase sales by $300,000 with no change in the contribution margin percentage. Reduce variable costs by $160,000 Reduce average operating assets by 3% Return on Investment Action 1 (b) Using the ROI formula, compute the ROI under each of the proposed courses of action. (Round ROI to 2 decimal places, eg. 1.57%) Action 21 Action 31 Save for Later % Return on investment Attempts: 0 of 1 used Submit Answer Parrow_forwardPlease answer all questions. I would hate to use another question because of 1 extra part. Problem 12-17 (Algo) Net Present Value Analysis; Internal Rate of Return; Simple Rate of Return [LO12-2, LO12-3, LO12-6] Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division’s return on investment (ROI), which has been above 22% each of the last three years. Casey is considering a capital budgeting project that would require a $3,900,000 investment in equipment with a useful life of five years and no salvage value. Pigeon Company’s discount rate is 18%. The project would provide net operating income each year for five years as follows: Sales $ 3,800,000 Variable expenses 1,760,000 Contribution margin 2,040,000 Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs $ 740,000 Depreciation 780,000 Total fixed expenses 1,520,000 Net operating income $ 520,000 Click here to…arrow_forward

- Market size = $500,000 per month R&D Spend Rate =$30,000 Mktg Spend Rate =$30,000 Employee Ownership = 0 %3D What is the resulting operating income? Do not enter dollar sign or commas, just the numerical valuearrow_forwardQ4. As a manager you are presented with a $10,000 investment opportunity that will yield $1,600 in additional operating income. The manager’s division is currently operating at 17% ROI. If the company’s minimum acceptable return is 15%, what will happen to the company’s residual income if the investment is accepted by the manager? A. It will increase by $1,500 B. It will increase by $1,600 C. It will increase by $100 D. It will increase by $200 Answer: _________arrow_forwardSubject: Logistic management calculate EVA and suggest favorable or not ? Investment 1 mioSales 500,000All Expenses 400,000Market opportunity cost 15%arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT