Concept explainers

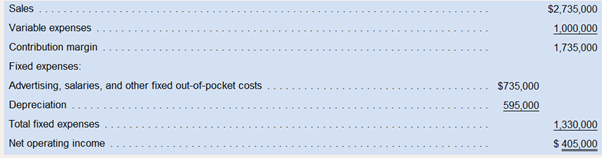

Cardinal Company is considering a five-year project that would require a $2,975,000 investment in equipment with a useful life of five years and no salvage value. The company’s discount rate is 14%. The project would provide net operating income in each of five wars as follows:

Required:

(Answer each question by referring to the original data unless instructed otherwise.)

10. If the equipment had a salvage i1ue of $300000 at the end of five yes, would von expect the project’s pa1ack period to be higher than, lower than, or the same as vow answer to requirement 7? No computations are necessary.

If the equipment had a salvage i1ue of $300000 at the end of five yes, would von expect the project’s pa1ack period to be higher than, lower than, or the same as vow answer to requirement 7? No computations are necessary.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Introduction To Managerial Accounting

- Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?arrow_forwardRoberts Company is considering an investment in equipment that is capable of producing more efficiently than the current technology. The outlay required is 2,293,200. The equipment is expected to last five years and will have no salvage value. The expected cash flows associated with the project are as follows: Required: 1. Compute the projects payback period. 2. Compute the projects accounting rate of return. 3. Compute the projects net present value, assuming a required rate of return of 10 percent. 4. Compute the projects internal rate of return.arrow_forwardA firm is considering three mutually exclusive alternatives as part of an upgrade to an existing transportation network. If the MARR is 10% per year, which alternative (if any) should be chosen using the IRR analysis procedure? Use trial & error and show your calculations. A B Initial Cost Annual Revenue Annual Cost Salvage Value Useful Life 40,000 10,400 4,000 3,000 30,000 8,560 3,000 2,500 20,000 7,750 2,500 2,000 20 20 10arrow_forward

- Tempura, Inc., is considering two projects. Project A requires an investment of $48,000. Estimated annual receipts for 20 years are $19.000; estimated annual costs are $12,500. An alternative project, B, requires an investment of $77,000, has annual receipts for 20 years of $23,000, and has annual costs of $18,000. Assume both projects have a zero salvage value and that MARR is 11.0 %/year. Click here to access the TVM Factor Table Calculator Part a What is the present worth of each project? Project A. $ Project B: $arrow_forwardPlease show all your workarrow_forwardCardinal Company is considering a five-year project that would require a $2,915,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 16%. The project would provide net operating income in each of five years as follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses $ 2,863, 000 1,014,000 1,849,000 $ 781,000 583, 000 1,364, 000 $ 485,000 Net operating incone Click here to view Exhibit 148-1 ond Exhibit 148-2, to determine the appropriate discount factor(s) using table. 15. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 45%. What was the project's actual simple rate of return? (Round your answer to 2 decimal places.) Simple rate of returnarrow_forward

- Please show all your workarrow_forwardCardinal Company is considering a five-year project that would require a $2,890,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 12%. The project would provide net operating income in each of five years as follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses $2,739,000 1, 100,000 1,639,000 $641, 000 578,000 1, 219,000 Net operating income 420,000 Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. 5. What is the project profitability index for this project? (Round your answer to 2 decimal places.) Project profitability index %24arrow_forwardCardinal Company is considering a five-year project that would require a $2,890,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 12%. The project would provide net operating income in each of five years as follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses $2,739,000 1, 100,000 1,639,000 $641,000 578,000 1, 219,000 Net operating income $ 420,000 Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. 8. What is the project's simple rate of return for each of the five years? (Round your answer to 2 decimal places.) Simple rate of return %arrow_forward

- Cardinal Company is considering a five-year project that would require a $2,890,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 12%. The project would provide net operating income in each of five years as follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses $2,739,000 1, 100, 000 1,639,000 $641,000 578,000 1, 219, 000 $ 420,000 Net operating income Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. 4. What is the project's net present value? (Round discount factor(s) to 3 decimal places and final answer to the nearest whole dollar amount.) Net present valuearrow_forwardGive me correct answer and explanation.harrow_forwardPlease answer ASAP if you can please. Thank youarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning