Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 1E

Payback Method

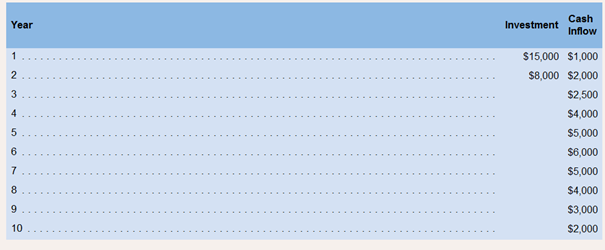

The management of Unter Corporation, an architectural design firm, is considering an investment with the following

Required:

1. Determine the payback period of the investment.

2. Would the payback period be affected if the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

don't give me incorrect solution

I mistakenly submitted blurr image please comment i will write values.

please dont Solve with incorrect values otherwise unhelpful.

Can you help me solve this general accounting problem using the correct accounting process?

Chapter 12 Solutions

Introduction To Managerial Accounting

Ch. 12.A - Basic Present Value Concepts Annual cash inflows...Ch. 12.A - Basic Present value Concepts Julie has just...Ch. 12.A - Prob. 3ECh. 12.A - Prob. 4ECh. 12.A - Basic Present Value Concepts The Atlantic Medical...Ch. 12.A - Prob. 6ECh. 12 - What is the difference between capital budgeting...Ch. 12 - Prob. 2QCh. 12 - Prob. 3QCh. 12 - Prob. 4Q

Ch. 12 - Why are discounted cash flow methods of making...Ch. 12 - Prob. 6QCh. 12 - Identify two simplifying assumptions associated...Ch. 12 - Prob. 8QCh. 12 - Prob. 9QCh. 12 - Prob. 10QCh. 12 - Prob. 11QCh. 12 - Prob. 12QCh. 12 - How is the project profitability index computed,...Ch. 12 - Prob. 14QCh. 12 - Prob. 15QCh. 12 - Prob. 1AECh. 12 - The Excel worksheet form that appears below is to...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Prob. 3F15Ch. 12 - Prob. 4F15Ch. 12 - Prob. 5F15Ch. 12 - Prob. 6F15Ch. 12 - Prob. 7F15Ch. 12 - Prob. 8F15Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Prob. 11F15Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Prob. 13F15Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Payback Method The management of Unter...Ch. 12 - Net Present Value Analysis The management of...Ch. 12 - Internal Rate of Return Wendell’s Donut Shoppe is...Ch. 12 - Uncertain Future Cash Flows Lukow Products is...Ch. 12 - Prob. 5ECh. 12 - Simple Rate of Return Method The management of...Ch. 12 - Prob. 7ECh. 12 - Payback Period and Simple Rate of Return Nicks...Ch. 12 - Prob. 9ECh. 12 - Prob. 10ECh. 12 - Preference Ranking of Investment Projects Oxford...Ch. 12 - Prob. 12ECh. 12 - Payback Period and Simple Rate of Return...Ch. 12 - Comparison of Projects Using Net Present Value...Ch. 12 - Internal Rate of Return and Net Present Value...Ch. 12 - Net Present Value Analysis Windhoek Mines, Ltd.,...Ch. 12 - Net Present Value Analysis; Internal Rate of...Ch. 12 - Net Present Value Analysis Oakmont Company has an...Ch. 12 - Simple Rate of Return; Payback Period Paul Swanson...Ch. 12 - Prob. 20PCh. 12 - Prob. 21PCh. 12 - Prob. 22PCh. 12 - Comprehensive Problem - Lou Barlow, a divisional...Ch. 12 - Prob. 24PCh. 12 - Prob. 25PCh. 12 - Prob. 26PCh. 12 - Net Present Value Analysis In five years, Kent...Ch. 12 - Prob. 28PCh. 12 - Prob. 29P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On March 1, 20X1, your company,which uses Units-of-Production (UOP) Depreciation, purchases a machine for $300,000.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardI am searching for the right answer to this financial accounting question using proper techniques.arrow_forward

- Please explain the solution to this general accounting problem with accurate principles.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardi will give unhelpful.blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License