Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 14F15

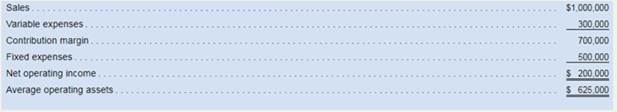

Westerville Company reported the following result from last year’s operations:

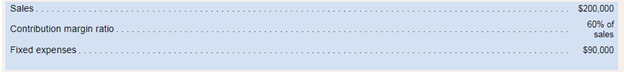

At the beginning of this year, the company has a $120,000 investment opportunity with following cost and revenue characteristics: The company’s minimum required

The company’s minimum required

Required:

14. If Westerville’s chief executive officer will earn a bonus only if her residual income from this year exceeds her residual income from last year, would she pursue the investment opportunity?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A company is planning to invest $75,000 (before taxes) in a personnel training program. The $75,000 outlay will be charged off as an expense by the firm this year (year 0). The returns estimated from the program in the form of greater productivity and a reduction in employee turnover are as follows (on an after-tax basis):

Years 1–5: $7,500 per year

Years 6–10: $22,500 per year

The company has estimated its cost of capital to be 15 percent. Assume that the entire $75,000 is paid at time zero (the beginning of the project). The marginal tax rate for the firm is 40 percent.

Complete the following table to compute the net present value (NPV) of the program. (Hint: When calculating cash flow for Year 0, consider the tax effects of charging off the initial outlay as an expense.)

Year

Cash Flow

PV Interest Factor at 15%

Present Value (PV)

($)

($)

0

1.00000

1

0.86957

2

0.75614

3

0.65752

4

0.57175

5…

Turtle is the manager of the Home Care Products Division of Care Corporation. As a

manager of an investment center, Turtle's performance is measured using the residual

income method.

For the coming year, Turtle wants to achieve a residual income target of P100,000

using an imputed interest charge of 20%. Other forecasted figures for the coming

year are as follows:

Working Capital

Plant and equipment

Costs and expenses

P90,000

860,000

1,210,000

How much should revenues be next year to achieve the residual income target?

1,482,000

1,464,000

1,300,000

1,500,000

A company is planning to invest $100,000

(before tax) in a personnel training program.

The $100,000 outlay will be charged off as an

expense by the firm this year (year 0). The

returns from the program in the form of

greater productivity and a reduction in

employee turnover are estimated as follows (on

an after-tax basis):

Years 1-10:

$10,000 per year

Years 11-20:

$22,000 per year

The company has estimated its cost of capital

to be 12 percent. Assume that the entire

$100,000 is paid at time 0 (the beginning of the

project). The marginal tax rate for the firm is 40

percent. Should the firm undertake the

training program? Why or why not?

Chapter 10 Solutions

Introduction To Managerial Accounting

Ch. 10 - What is meant by the term decentralization?Ch. 10 - What benefits result from decentralization?Ch. 10 - Distinguish between a cost center, a profit...Ch. 10 - What is meant by the terms margin and turnover in...Ch. 10 - Prob. 5QCh. 10 - In what way can the use of ROI as a performance...Ch. 10 - What is the difference between delivery cycle tame...Ch. 10 - What does a manufacturing cycle efficiency (MCE)...Ch. 10 - Prob. 9QCh. 10 - Prob. 10Q

Ch. 10 - Prob. 1AECh. 10 - Prob. 2AECh. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Prob. 6F15Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Prob. 9F15Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Compute the Return or Investment (ROI) Alyeska...Ch. 10 - Residual Income Jumper Design Lid of Manchester....Ch. 10 - Measures of Internal Business Process Performance...Ch. 10 - Building a Balanced Scorecard Lost Peak ski resort...Ch. 10 - Return on Investment (ROI) Provide the missing...Ch. 10 - Prob. 6ECh. 10 - Creating a Balanced Scorecard Ariel Tax Services...Ch. 10 - Computing and Interpreting Return on Investment...Ch. 10 - Return on Investment (ROI) and Residual Income...Ch. 10 - Cost-Volume-Profit Analysis and Return on...Ch. 10 - Effects of Charges in Profits arid Assets on...Ch. 10 - Prob. 12ECh. 10 - Effects of Changes in Sales, Expenses, and Assets...Ch. 10 - Measures of Internal Business Process Performance...Ch. 10 - Prob. 15PCh. 10 - Creating a Balanced Scorecard Mason Paper Company...Ch. 10 - Comparison of Performance Using Return on...Ch. 10 - Return on Investment (ROI) and Residual Income "I...Ch. 10 - Internal Business Process Performance Measures...Ch. 10 - Return on Investment (ROI) Analysis The...Ch. 10 - Creating Balanced Scorecards that Support...Ch. 10 - Prob. 22P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company is considering the following three compensation plans for the salespeople listed in the table below. Which of these will be the most expensive? Which will be the least expensive? Is the monetary cost the only consideration for a company? Plan A: Give each salesperson a commission of 10% on the first $250,000 of sales made each year and 12% on the next $250,000. Plan B: Give each salesperson a salary of $10,000 a year and 5% commission on all sales made each year. Plan C: Give each salesperson a salary of $25,000 a year and a bonus of 4% commission on all sales made over $250,000 in a year. Salesperson Estimated Sales for Next Year Herndon $300,000 MacLeon $270,000 Menon $190,000 Baker $290,000 Hand $225,000 Zank $325,000 Smith $310,000 2. Based on the chapter content on motivation, what factors cause you to increase or decrease the amount of effort – your motivation to work – you put into earning your desired grade in a class? Your grade is your performance level. What…arrow_forwardYou are asked to evaluate ergonomic interventions for your company based on the following projections: Decreased annual Workers' Compensation costs: $13, 060 Increased annual production: $17,501 Initial purchase costs: $4, 561 If you have an expectation of 3.75% interest over a 6-year period, what would you calculate the multiplier for the Worker's Comp equivalence calculation to be if you're asked to evaluate the future worth over the life of the project?arrow_forwardToselli Animation plans to offer its employees a salary enhancement package that has revenue sharing as its main component. Specifically, the company will set aside 1% of total sales revenue for year-end bonuses. The sales are expected to be $5 million the first year, $5.5 million the second year, and amounts increasing by 10% each year for the next 5 years. At an interest rate of 14% per year, what is the equivalent annual worth in years 1 through 5 of the bonus package? The equivalent annual worth of the bonus package is $arrow_forward

- You are asked to evaluate the following project for a corporation with profitable ongoing operations. The required investment on January 1 of this year is $31.000. The firm will depreciate the investment at a CCA rate of 20 percent. The firm is in the 40 percent tax bracket. The price of the product on January 1 will be $106 per unit. That price will stay constant in real terms. Labour costs will be $15.20 per hour on January 1. They will increase at 1 percent per year in real terms. Energy costs will be $7.30 per physical unit on January 1; they will increase at 2.5 percent per year in real terms. The inflation rate is 3.2 percent. Revenue is recelved and costs are paid at year-end: Year 1 Year 2 Year 3 Year 4 Physical production, in units Labour input, in hours Energy input, physical units 390 1,120 170 340 170 1,120 180 1,120 180 1,120 180 180 The risk-free nominal discount rate is 77 percent. The real discount rate for costs and revenues is 4.7 percent. Calculate the NPV of this…arrow_forwardYou are asked to evaluate the following project for a corporation profitable ongoing operations. The required investment on January 1 of this year is $29,000. The firm will depreciate the investment at a CCA rate of 20 percent. The firm is in the 40 percent tax bracket. The price of the product on January 1 year 1 is $104 per unit. That price will stay constant in real terms. Labour costs is $14.00 per hour on January 1 year 1. Labour costs will increase by 1 percent per year in real terms after year 1. Energy costs will be $7.20 per physical unit on January 1 year 1; energy cost will increase at 2.5 percent per year in real terms after year 1. The inflation rate is 4.1 percent. The company sells all of its production in the year produced; revenue is received and costs are paid at year-end: Physical production, in units Labour input, in hours Energy input, physical units Year 1 150 1,080 180 Year 2 300 1,080 180 Year 3 350 1,080 180 Year 4 150 1,080 180 The risk-free nominal discount…arrow_forwardAn organization's objective is to increase its production by 20 percent next year. How do you consider the Accounting Department of the company? Line or staff? Justify your answer.arrow_forward

- Toselli Animation plans to offer its employees a salary enhancement package that has revenue sharing as its main component. Specifically, the company will set aside 1% of total sales revenue for year-end bonuses. The sales are expected to be $5 million the first year, $5.5 million the second year, and amounts increasing by 10% each year for the next 5 years. At an interest rate of 8% per year, what is the equivalent annual worth in years 1 through 5 of the bonus package?arrow_forwardA certain company pays a bonus to each engineer at the end of each year based on the company’s profit for that year. If the company invested $ 2 million to start up, what rate of return has it made if each engineer’s bonus has been $3000 per year for the past 10 years? Assume the company has six engineers and that the bonus money paid represents 5% of the company’s profit.arrow_forwardYou are an employee of University Consultants, Limited, and have been given the following assignment. You are to present an investment analysis of a small retail income-producing property for sale to a potential investor. The asking price for the property is $1,360,000; rents are estimated at $174,080 during the first year and are expected to grow at 2.5 percent per year thereafter. Vacancies and collection losses are expected to be 10 percent of rents. Operating expenses will be 35 percent of effective gross income. A fully amortizing 70 percent loan can be obtained at 6 percent interest for 30 years (total annual payments will be monthly payments × 12). The property is expected to appreciate in value at 3 percent per year and is expected to be owned for five years and then sold. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor’s expected before-tax internal rate of return on equity invested (BTIRR)? d.…arrow_forward

- You are an employee of University Consultants, Limited, and have been given the following assignment. You are to present an investment analysis of a small retail income-producing property for sale to a potential investor. The asking price for the property is $1,280,000; rents are estimated at $163,840 during the first year and are expected to grow at 2.5 percent per year thereafter. Vacancies and collection losses are expected to be 10 percent of rents. Operating expenses will be 35 percent of effective gross income. A fully amortizing 70 percent loan can be obtained at 8 percent interest for 30 years (total annual payments will be monthly payments 12). The property is expected to appreciate in value at 3 percent per year and is expected to be owned for five years and then sold. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor's expected before-tax internal rate of return on equity invested (BTIRR)? d. What is…arrow_forwardThe Best Manufacturing Company is considering a new investment. Financial projections for the investment are tabulated here. The corporate tax rate is 22 percent. Assume all sales revenue is received in cash, all operating costs and income taxes are paid in cash, and all cash flows occur at the end of the year. All net working capital is recovered at the end of the project. Year 0 Year 1 Year 2 Year 3 Year 4 Investment $ 26,500 Sales revenue $ 13,600 $ 15,200 $ 16,600 $ 13,100 Operating costs 3,000 3,150 4,400 3,000 Depreciation 6,625 6,625 6,625 6,625 Net working capital spending 310 210 245 160 ? a. Compute the incremental net income of the investment for each year. (Do not round intermediate calculations.) b. Compute the incremental cash flows of the investment for each year. (Do not round intermediate calculations. A negative…arrow_forwardYou are an employee of University Consultants, Limited, and have been given the following assignment. You are to present an investment analysis of a small retail income-producing property for sale to a potential investor. The asking price for the property is $1,290,000; rents are estimated at $165,120 during the first year and are expected to grow at 2.5 percent per year thereafter. Vacancies and collection losses are expected to be 10 percent of rents. Operating expenses will be 35 percent of effective gross income. A fully amortizing 70 percent loan can be obtained at 7 percent interest for 30 years (total annual payments will be monthly payments × 12). The property is expected to appreciate in value at 3 percent per year and is expected to be owned for five years and then sold. Required: a. What is the first-year debt coverage ratio? Answer: 1.33 b. What is the terminal capitalization rate? c. What is the investor’s expected before-tax internal rate of return on equity invested…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

How to build an investment portfolio; Author: The Finance Storyteller;https://www.youtube.com/watch?v=K4mWd2zBYVk;License: Standard Youtube License