Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 8F15

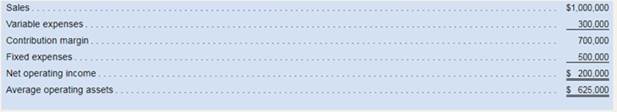

Westerville Company reported the following result from last year’s operations:

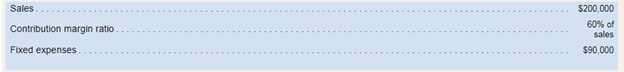

At the beginning of this year, the company has a $120,000 investment opportunity with following cost and revenue characteristics: The company’s minimum required

The company’s minimum required

Required:

8. If the company pursues the investment opportunity and otherwise performs the same as last year, what turnover will it earn this year?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Consider the following scenario:

Cute Camel Woodcraft Company’s income statement reports data for its first year of operation. The firm’s CEO would like sales to increase by 25% next year.

1.

Cute Camel is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before interest and taxes (EBIT).

2.

The company’s operating costs (excluding depreciation and amortization) remain at 65% of net sales, and its depreciation and amortization expenses remain constant from year to year.

3.

The company’s tax rate remains constant at 25% of its pre-tax income or earnings before taxes (EBT).

4.

In Year 2, Cute Camel expects to pay $100,000 and $1,773,844 of preferred and common stock dividends, respectively.

Complete the Year 2 income statement data for Cute Camel, then answer the questions that follow. Be sure to round each dollar value to the nearest whole dollar.

Need help with Year 2 values and questions at bottom

Consider the following scenario:

Fuzzy Button Clothing Company’s income statement reports data for its first year of operation. The firm’s CEO would like sales to increase by 25% next year.

1.

Fuzzy Button is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before interest and taxes (EBIT).

2.

The company’s operating costs (excluding depreciation and amortization) remain at 70.00% of net sales, and its depreciation and amortization expenses remain constant from year to year.

3.

The company’s tax rate remains constant at 40% of its pre-tax income or earnings before taxes (EBT).

4.

In Year 2, Fuzzy Button expects to pay $100,000 and $896,963 of preferred and common stock dividends, respectively.

Complete the Year 2 income statement data for Fuzzy Button, then answer the questions that follow. Round each dollar value to the nearest whole dollar.

Solano Company has sales of $700,000, cost of goods sold of $470,000, other operating expenses of $50,000, average invested

assets of $2,100,000, and a hurdle rate of 9 percent.

Required:

1. Determine Solano's return on investment (ROI), investment turnover, profit margin, and residual income.

2. Several possible changes that Solano could face in the upcoming year follow. Determine each scenario's impact on Solano's ROI

and residual income. (Note: Treat each scenario independently.)

a. Company sales and cost of goods sold increase by 30 percent.

b. Operating expenses decrease by $8,000.

c. Operating expenses increase by 10 percent.

d. Average invested assets increase by $400,000.

e. Solano changes its hurdle rate to 15 percent.

Complete this question by entering your answers in the tabs below.

Req 1

Req 2A

Req 2B

Req 2C

Req 2D

Req 2E

Determine Solano's return on investment (ROI), investment turnover, profit margin, and residual income.

Note: Loss amounts should be indicated with a…

Chapter 10 Solutions

Introduction To Managerial Accounting

Ch. 10 - What is meant by the term decentralization?Ch. 10 - What benefits result from decentralization?Ch. 10 - Distinguish between a cost center, a profit...Ch. 10 - What is meant by the terms margin and turnover in...Ch. 10 - Prob. 5QCh. 10 - In what way can the use of ROI as a performance...Ch. 10 - What is the difference between delivery cycle tame...Ch. 10 - What does a manufacturing cycle efficiency (MCE)...Ch. 10 - Prob. 9QCh. 10 - Prob. 10Q

Ch. 10 - Prob. 1AECh. 10 - Prob. 2AECh. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Prob. 6F15Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Prob. 9F15Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Compute the Return or Investment (ROI) Alyeska...Ch. 10 - Residual Income Jumper Design Lid of Manchester....Ch. 10 - Measures of Internal Business Process Performance...Ch. 10 - Building a Balanced Scorecard Lost Peak ski resort...Ch. 10 - Return on Investment (ROI) Provide the missing...Ch. 10 - Prob. 6ECh. 10 - Creating a Balanced Scorecard Ariel Tax Services...Ch. 10 - Computing and Interpreting Return on Investment...Ch. 10 - Return on Investment (ROI) and Residual Income...Ch. 10 - Cost-Volume-Profit Analysis and Return on...Ch. 10 - Effects of Charges in Profits arid Assets on...Ch. 10 - Prob. 12ECh. 10 - Effects of Changes in Sales, Expenses, and Assets...Ch. 10 - Measures of Internal Business Process Performance...Ch. 10 - Prob. 15PCh. 10 - Creating a Balanced Scorecard Mason Paper Company...Ch. 10 - Comparison of Performance Using Return on...Ch. 10 - Return on Investment (ROI) and Residual Income "I...Ch. 10 - Internal Business Process Performance Measures...Ch. 10 - Return on Investment (ROI) Analysis The...Ch. 10 - Creating Balanced Scorecards that Support...Ch. 10 - Prob. 22P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Foreman Publishing Company’s income for the most recent quarter was $500,000, and the averagenet book value (NBV) of assets during the quarter was $1.5 million. If the company has a requiredrate of return of 15% on investment, what was the residual income (RI) for the quarter?arrow_forwardConsider the following scenario: Green Caterpillar Garden Supplies Inc.’s income statement reports data for its first year of operation. The firm’s CEO would like sales to increase by 25% next year. 1. Green Caterpillar is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before interest and taxes (EBIT). 2. The company’s operating costs (excluding depreciation and amortization) remain at 60% of net sales, and its depreciation and amortization expenses remain constant from year to year. 3. The company’s tax rate remains constant at 25% of its pre-tax income or earnings before taxes (EBT). 4. In Year 2, Green Caterpillar expects to pay $100,000 and $1,759,500 of preferred and common stock dividends, respectively. A. Complete the Year 2 income statement data for Green Caterpillar, then answer the questions that follow. Be sure to round each dollar value to the nearest whole dollar. Green Caterpillar…arrow_forwardSolano Company has sales of $620,000, cost of goods sold of $430,000, other operating expenses of $51,000, average invested assets of $1,900,000, and a hurdle rate of 10 percent.Required:1. Determine Solano’s return on investment (ROI), investment turnover, profit margin, and residual income.2. Several possible changes that Solano could face in the upcoming year follow. Determine each scenario’s impact on Solano’s ROI and residual income. (Note: Treat each scenario independently.)a. Company sales and cost of goods sold increase by 30 percent.b. Operating expenses decrease by $15,500.c. Operating expenses increase by 10 percent.arrow_forward

- Solano Company has sales of $740,000, cost of goods sold of $490,000, other operating expenses of $46,000, average invested assets of $2.200,000, and a hurdle rate of 10 percent. Required: 1. Determine Solano's return on investment (ROI), Investment turnover, profit margin, and residual income. 2. Several possible changes that Solano could face in the upcoming year follow. Determine each scenario's impact on Solano's ROI and residual income. (Note: Treat each scenario independently) a. Company sales and cost of goods sold increase by 30 percent. b. Operating expenses decrease by $10,000. c. Operating expenses increase by 10 percent. d. Average invested assets increase by $420,000. e. Solano changes its hurdle rate to 16 percent. Complete this question by entering your answers in the tabs below. Reg Reg 2A Reg 2n Reg 20 Reg 20 Reg 2 Determine Solano's return on investment (ROI), investment turnover, profit margin, and residual income. (Loss amounts should be indicated with a minus sign.…arrow_forwardConsider the following scenario: Green Caterpillar Garden Supplies Inc.'s Income statement reports data for its first year of operation. The firm's CEO would like sales to increase by 25% next year. 1. Green Caterpillar is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before Interest and taxes (EBIT). 2. The company's operating costs (excluding depreciation and amortization) remain at 60% of net sales, and its depreciation and amortization expenses remain constant from year to year. 3. The company's tax rate remains constant at 25% of its pre-tax income or earnings before taxes (EBT). 4. In Year 2, Green Caterpillar expects to pay $100,000 and $1,759,500 of preferred and common stock dividends, respectively. Complete the Year 2 Income statement data for Green Caterpillar, then answer the questions that follow. Be sure to round each dollar value to the nearest whole dollar. Net sales Less: Operating costs, except depreciation…arrow_forwardLast year, Flynn Company reported a profit of $70,000 when sales totaled $520,000 and the contribution margin ratio was 40%. If fixed expenses increase by $10,000 next year, what amount of sales will be necessary in order for the company to earn a profit of $80,000?arrow_forward

- Kaler Company has sales of $1,470,000, cost of goods sold of $800,000, other operating expenses of $213,000, average invested assets of $4,700,000, and a hurdle rate of 12 percent. Required: 1. Determine Kaler's return on investment (ROI), investment turnover, profit margin, and residual income. 2. Several possible changes Kaler could face in the upcoming year follow. Determine each scenario's impact on Kaler's ROI and residual income. (Note: Treat each scenario independently.) a. Company sales and cost of goods sold increase by 5 percent. b. Operating expenses increase by $86,000. c. Operating expenses decrease by 20 percent. d. Average invested assets decrease by $415,000. e. Kaler changes its hurdle rate to 9 percent. Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Req 2C Req 2D Req 2E Determine Kaler's return on investment (ROI), investment turnover, profit margin, and residual income. Note: Do not round your intermediate calculations. Enter…arrow_forwardSolano Company has sales of $740,000, cost of goods sold of $490,000, other operating expenses of $46,000, average invested assets of $2,200,000, and a hurdle rate of 10 percent. Required: Determine Solano’s return on investment (ROI), investment turnover, profit margin, and residual income. Several possible changes that Solano could face in the upcoming year follow. Determine each scenario’s impact on Solano’s ROI and residual income. (Note: Treat each scenario independently.) Company sales and cost of goods sold increase by 30 percent. Operating expenses decrease by $10,000. Operating expenses increase by 10 percent. Average invested assets increase by $420,000. Solano changes its hurdle rate to 16 percent.arrow_forwardMBI Incorporated had sales of $35 million for fiscal 2022. The company's gross profit ratio for that year was 26%. Required: a. Calculate the gross profit and cost of goods sold for MBI for fiscal 2022. b. Assume that a new product is developed and that it will cost $469 to manufacture. Calculate the selling price that must be set for this new product if its gross profit ratio is to be the same as the average achieved for all products for fiscal 2022. c. From a management viewpoint, it could use the estimated selling price as a "target" in conducting marketing research studies to assess its ultimate prospects for success at this price. Complete this question by entering your answers in the tabs below. Required A Required B Required C From a management viewpoint, it could use the estimated selling price as a "target" in conducting marketing research studies to assess its ultimate prospects for success at this price.arrow_forward

- On the average, a company has a work-in-process lead time of 10 weeks and annualcost of goods sold of $30 million. Assuming that the company works 50 weeks a year:a. What is the dollar value of the work-in-process?b. If the work-in-process could be reduced to 5 weeks and the annual cost of carryinginventory was 20% of the WIP inventory value, what would be the annual savings?arrow_forwardA company's invested capital is $13,000,000 and management has determined that the target rate of return on investment is 10%. Last year, the company produced 121,313 units and this year expects to units sales to be 10% above last year. The cost of the product is estimated to be $13 per unit. What is the target operating income per unit? (Round any intermediary calculations to the nearest unit and your final answer to the nearest cent.) a. $9.74 b. $9.00 c. $8.31 d. $8.99arrow_forwardLast year Minden Company introduced a new product and sold 25,500 units of it at a price of $90 per unit. The product's variable expenses are $60 per unit and its fixed expenses are $831,300 per year. Required: 1. What was this product's net operating income (loss) last year? 2. What is the product's break-even point in unit sales and dollar sales? 3. Assume the company has conducted a marketing study that estimates it can increase annual sales of this product by 5,000 units for each $2 reduction in its selling price. If the company will only consider price reductions in increments of $2 (e.g., $68, $66, etc.), what is the maximum annual profit that it can earn on this product? What sales volume and selling price per unit generate the maximum profit? 4. What would be the break - even point in unit sales and in dollar sales using the selling price that you determined in requirement 3?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License