Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 10E

Cost-Volume-Profit Analysis and

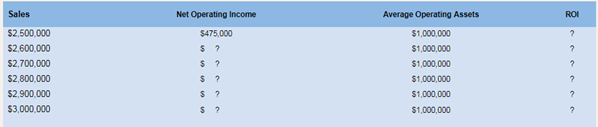

Posters.com is a small Internet retailer of high-quality posters. The company has $1,000,000 in operating assets and fixed expenses of $150,000 per year. With this level of operating assets and fixed expenses; the company can support sales of up to $3,000,000 per year. The company's contribution margin ratio is 25%, which means that an additional dollar of sales results in additional contribution margin and net operating income, of 25 cents.

Required:

1. Complete the following table shelving the relation between sales and return on investment (ROI).

2. What happens to the company's return on investment (ROI) as sales increase? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Posters.com is an Internet retailer of high-quality posters. The company has $710,000 in operating assets and fixed expenses of

$165,000 per year. With this level of operating assets and fixed expenses, the company can support sales of up to $4,800,000 per

year. The company's contribution margin ratio is 10%, which means an additional dollar of sales results in additional contribution

margin, and net operating income, of 10 cents.

Required:

1. Complete the following table showing the relation between sales and return on investment (ROI).

2. What happens to the company's return on investment (ROI) as sales increase?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Complete the following table showing the relation between sales and return on investment (ROI).

Note: Round your percentage answers to 2 decimal places.

Sales

Net Operating

Income

Average

Operating

Assets

ROI %

$ 4,300,000 $ 265,000 $

710,000

$ 4,400,000

$ 710,000

$ 4,500,000

$

710,000

$…

Posters.com is a small Internet retailer of high-quality posters. The company has $1,000,000 in operatingassets and fixed expenses of $150,000 per year. With this level of operating assets and fixed expenses, thecompany can support sales of up to $3,000,000 per year. The company’s contribution margin ratio is 25%,which means that an additional dollar of sales results in additional contribution margin, and net operatingincome, of 25 cents.Required:1. Complete the following table showing the relation between sales and return on investment (ROI).Net Operating AverageSales Income Operating Assets ROI$2,500,000 $475,000 $1,000,000 ?$2,600,000 $ ? $1,000,000 ?$2,700,000 $ ? $1,000,000 ?$2,800,000 $ ? $1,000,000 ?$2,900,000 $ ? $1,000,000 ?$3,000,000 $ ? $1,000,000 ?2. What happens to the company’s return on investment (ROI) as sales increase? Explain.

Cost-Volume-Profit Analysis and Return on Investment

Posters.com is a small Internet retailer of high-quality posters. The company has $1,000,000 in operating assets and fixed expenses of $150,000 per year. With this level of operating assets and fixed expenses, the company can support sales of up to $3,000,000 per year. The company’s contribution margin ratio is 25%, which means that an additional dollar of sales results in additional contribution margin, and net operating income, of 25 cents.

Required:

1. Complete the following table showing the relation between sales and return on investment (ROT).

2. What happens to the company’s return on investment (ROD as sales increase? Explain.

Chapter 10 Solutions

Introduction To Managerial Accounting

Ch. 10 - What is meant by the term decentralization?Ch. 10 - What benefits result from decentralization?Ch. 10 - Distinguish between a cost center, a profit...Ch. 10 - What is meant by the terms margin and turnover in...Ch. 10 - Prob. 5QCh. 10 - In what way can the use of ROI as a performance...Ch. 10 - What is the difference between delivery cycle tame...Ch. 10 - What does a manufacturing cycle efficiency (MCE)...Ch. 10 - Prob. 9QCh. 10 - Prob. 10Q

Ch. 10 - Prob. 1AECh. 10 - Prob. 2AECh. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Prob. 6F15Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Prob. 9F15Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Compute the Return or Investment (ROI) Alyeska...Ch. 10 - Residual Income Jumper Design Lid of Manchester....Ch. 10 - Measures of Internal Business Process Performance...Ch. 10 - Building a Balanced Scorecard Lost Peak ski resort...Ch. 10 - Return on Investment (ROI) Provide the missing...Ch. 10 - Prob. 6ECh. 10 - Creating a Balanced Scorecard Ariel Tax Services...Ch. 10 - Computing and Interpreting Return on Investment...Ch. 10 - Return on Investment (ROI) and Residual Income...Ch. 10 - Cost-Volume-Profit Analysis and Return on...Ch. 10 - Effects of Charges in Profits arid Assets on...Ch. 10 - Prob. 12ECh. 10 - Effects of Changes in Sales, Expenses, and Assets...Ch. 10 - Measures of Internal Business Process Performance...Ch. 10 - Prob. 15PCh. 10 - Creating a Balanced Scorecard Mason Paper Company...Ch. 10 - Comparison of Performance Using Return on...Ch. 10 - Return on Investment (ROI) and Residual Income "I...Ch. 10 - Internal Business Process Performance Measures...Ch. 10 - Return on Investment (ROI) Analysis The...Ch. 10 - Creating Balanced Scorecards that Support...Ch. 10 - Prob. 22P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Faldo Company produces a single product. The projected income statement for the coming year, based on sales of 200,000 units, is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. Suppose that 30,000 units are sold above the break-even point. What is the profit? 2. Compute the contribution margin ratio and the break-even point in dollars. Suppose that revenues are 200,000 greater than expected. What would the total profit be? 3. Compute the margin of safety in sales revenue. 4. Compute the operating leverage. Compute the new profit level if sales are 20 percent higher than expected. 5. How many units must be sold to earn a profit equal to 10 percent of sales? 6. Assume the income tax rate is 40 percent. How many units must be sold to earn an after-tax profit of 180,000?arrow_forwardSales Needed to Earn Target Income Chillmax Company plans to sell 3,500 pairs of shoes at 60 each in the coming year. Variable cost is 35% of the sales price; contribution margin is 65% of the sales price. Total fixed cost equals 78,000 (includes fixed factory overhead and fixed selling and administrative expense). Required: 1. Calculate the sales revenue that Chillmax must make to earn operating income of 81,900 by using the point in sales equation. 2. Check your answer by preparing a contribution margin income statement based on the sales dollars calculated in Requirement 1.arrow_forwardSchylar Pharmaceuticals, Inc., plans to sell 130,000 units of antibiotic at an average price of 22 each in the coming year. Total variable costs equal 1,086,800. Total fixed costs equal 8,000,000. (Round all ratios to four significant digits, and round all dollar amounts to the nearest dollar.) Required: 1. What is the contribution margin per unit? What is the contribution margin ratio? 2. Calculate the sales revenue needed to break even. 3. Calculate the sales revenue needed to achieve a target profit of 245,000. 4. What if the average price per unit increased to 23.50? Recalculate: a. Contribution margin per unit b. Contribution margin ratio (rounded to four decimal places) c. Sales revenue needed to break even d. Sales revenue needed to achieve a target profit of 245,000arrow_forward

- Cost-Volume-Profit, Margin of Safety Victoria Company produces a single product. Last years income statement is as follows: Required: 1. Compute the break-even point in units and sales dollars calculated using the break-even units. 2. What was the margin of safety for Victoria last year in sales dollars? 3. Suppose that Victoria is considering an investment in new technology that will increase fixed cost by 250,000 per year but will lower variable costs to 45% of sales. Units sold will remain unchanged. Prepare a budgeted income statement assuming that Victoria makes this investment. What is the new break-even point in sales dollars, assuming that the investment is made?arrow_forwardKeleher Industries manufactures pet doors and sells them directly to the consumer via their web site. The marketing manager believes that if the company invests in new software, they will increase their sales by 10%. The new software will increase fixed costs by $400 per month. Prepare a forecasted contribution margin income statement for Keleher Industries reflecting the new software cost and associated increase in sales. The previous annual statement is as follows:arrow_forwardPosters.com is a small Internet retailer of high-quality posters. The company has $740,000 in operating assets and fixed expenses of $162,000 per year. With this level of operating assets and fixed expenses, the company can support sales of up to $4,800,000 per year. The company's contribution margin ratio is 10%, which means that an additional dollar of sales results in additional contribution margin, and net operating income, of 10 cents. Required: 1. Complete the following table showing the relation between sales and return on investment (ROI). 2. What happens to the company's return on investment (ROI) as sales increase? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the following table showing the relation between sales and return on investment (ROI). (Round your percentage answers to 2 decimal places.) Sales $ 4,300,000 $4,400,000 $ 4,500,000 $ 4,600,000 $4,700,000 $ 4,800,000 Net Operating Income $ 268,000 Average Operating…arrow_forward

- Posters.com is a small Internet retailer of high-quality posters. The company has $770,000 in operating assets and fixed expenses of $157,000 per year. With this level of operating assets and fixed expenses, the company can support sales of up to $4,900,000 per year. The company's contribution margin ratio is 11%, which means that an additional dollar of sales results in additional contribution margin, and net operating income, of 11 cents. Required: 1. Complete the following table showing the relation between sales and return on investment (ROI). 2. What happens to the company's return on investment (ROI) as sales increase? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the following table showing the relation between sales and return on investment (ROI). (Round your percentage answers to 2 decimal places.) Sales Net Operating Income Average Operating Assets $ 4,400,000 $ 327,000 $ $ 4,500,000 $ $ 4,600,000 $ 770,000 $ 4,700,000 $…arrow_forwardOperating leverage - Superior Door Company sells pre-hung doors to home builders. The doors are sold for $60 each. Variable costs are $42 per door and fixed costs total $450,000 per year. The company is currently selling 30,000 doors per year. Prepare a contribution format income statement for the company at the present level of sales and compute the degree of operating leverage. Management is confident that the company can sell 37,500 doors next year (an increase of 7,500 doors, or 25% over current sales). Compute the expected net operating income for next year. (Do not prepare an income statement; use the degree of operating leverage to compute your answer.)arrow_forwardPosters.com is a small Internet retailer of high-quality posters. The company has $800,000 in operating assets and fixed expenses of $168,000 per year. With this level of operating assets and fixed expenses, the company can support sales of up to $4,700,000 per year. The company's contribution margin ratio is 9%, which means that an additional dollar of sales results in additional contribution margin, and net operating income, of 9 cents. Required: 1. Complete the following table showing the relation between sales and return on investment (ROI). 2. What happens to the company's return on investment (ROI) as sales increase? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the following table showing the relation between sales and return on investment (ROI). (Round your percentage answers to 2 decimal places.) Net Operating Sales Income Average Operating Assets ROI % $ 4,200,000 $ 210,000 $ 800,000 $ 4,300,000 $ 800,000 $ 4,400,000 $…arrow_forward

- Posters.com is a small Internet retailer of high-quality posters. The company has $810,000 in operating assets and fixed expenses of $162,000 per year. With this level of operating assets and fixed expenses, the company can support sales of up to $4,600,000 per year. The company’s contribution margin ratio is 10%, which means that an additional dollar of sales results in additional contribution margin, and net operating income, of 10 cents. Required: Complete the following table showing the relation between sales and return on investment (ROI). What happens to the company’s return on investment (ROI) as sales increase? req 1 Complete the following table showing the relation between sales and return on investment (ROI). (Round your percentage answers to 2 decimal places.) Sales Net Operating Income Average Operating Assets ROI $4,100,000 $248,000 $810,000 % $4,200,000 $810,000 % $4,300,000 $810,000 % $4,400,000…arrow_forwardRequired information [The following information applies to the questions displayed below.] Data for Hermann Corporation are shown below: Selling price Variable expenses Contribution margin Fixed expenses are $82,000 per month and the company is selling 3,500 units per month. Percent Per Unit of Sales $ 110 100% 77 70 $ 33 30% 2-a. Refer to the data above. How much will net operating income increase (decrease) per month if the company uses higher-quality components that increase the variable expense by $5 per unit and increase unit sales by 20%. (See below for a hint if you are having trouble getting to the right answer.) 2-b. Should the higher-quality components be used? Complete this question by entering your answers in the tabs below. Req 2A Req 2B Refer to the original data. How much will net operating income increase (decrease) per month if the company uses higher- quality components that increase the variable expense by $5 per unit and increase unit sales by 20%. Net operating…arrow_forwardPosters.com is a small Internet retailer of high-quality posters. The company has $890,000 in operating assets and fixed expenses of $150,000 per year. With this level of operating assets and fixed expenses, the company can support sales of up to $5,300,000 per year. The company’s contribution margin ratio is 10%, which means that an additional dollar of sales results in additional contribution margin, and net operating income, of 10 cents. Required: 1. Complete the following table showing the relation between sales and return on investment (ROI). 2. What happens to the company’s return on investment (ROI) as sales increase? Complete this question by entrying your answers in the tab attachedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY