FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

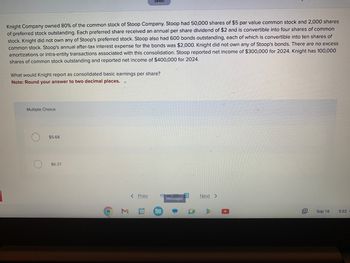

Transcribed Image Text:Knight Company owned 80% of the common stock of Stoop Company. Stoop had 50,000 shares of $5 par value common stock and 2,000 shares

of preferred stock outstanding. Each preferred share received an annual per share dividend of $2 and is convertible into four shares of common

stock. Knight did not own any of Stoop's preferred stock. Stoop also had 600 bonds outstanding, each of which is convertible into ten shares of

common stock. Stoop's annual after-tax interest expense for the bonds was $2,000. Knight did not own any of Stoop's bonds. There are no excess

amortizations or intra-entity transactions associated with this consolidation. Stoop reported net income of $300,000 for 2024. Knight has 100,000

shares of common stock outstanding and reported net income of $400,000 for 2024.

What would Knight report as consolidated basic earnings per share?

Note: Round your answer to two decimal places.

Multiple Choice

O $5.68

$6.37

O

M

Saved

< Prev

31

19 of 20

Messages

14

Next >

12+

Sep 16

5:02

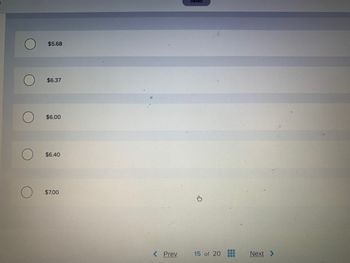

Transcribed Image Text:O

$5.68

$6.37

$6.00

$6.40

$7.00

< Prev

Saved

15 of 20

www

Next >

Expert Solution

arrow_forward

Step 1: Introduction:-

Basic earning per share :- Basic earnings per share is the amount of a company's profit that can be attributable to each share of common stock.

Basic earnings per

= (Net income - preferred dividends) ÷ weighted average of common shares outstanding

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Why is the dividend calculation fomula different both times.arrow_forwardHello, could you explain to me what is a decimal place when calculating financial ratios. thank you.arrow_forwardAssume the following data for Cable Corporation and Multi-Media Incorporated. Net income Sales Total assets Total debt Stockholders' equity Cable Corporation $ 34,400 364,000 448,000 237,000 211,000 Cable Corporation Multi-Media, Incorporated a. 1. Compute return on stockholders' equity for both firms. Note: Input your answers as a percent rounded to 2 decimal places. Return on Stockholders' Equity Multi-Media Incorporated $ 128,000 2,700,000 % % 970,000 468,000 502,000arrow_forward

- How are dividends per share for common stock used in the calculation of the following? O A. O B. O c. OD. Dividends per share payout ratio Numerator Numerator Denominator Denominator Earnings per share Numerator Not used Not used Denominatorarrow_forwardDetermine Fisher’s return on stockholders’ equity if its Year 1 earnings after tax are $9,000(000). Round your answer to two decimal places. %arrow_forwardVishuarrow_forward

- Required Indicate the effect of each of the following transactions on (1) the current ratio, (2) working capital, (3) stockholders' equity, (4) book value per share of common stock, and (5) retained earnings. Assume that the current ratio is greater than 1:1 (Indicate the effect of each transaction by selecting "+" for increase, "-"for decrease, and leave the cell blank if there is no effect.). a. Collected account receivable. b. Wrote off account receivable. c. Converted a short-term note payable to a long-term note payable. d. Purchased inventory on account. e. Declared cash dividend f. Sold merchandise on account at a profit. g. Issued stock dividend h. Paid account payable. i. Sold building at a loss. Retained Value Earnings Current Working Stockholders Book Ratio Capital Equityarrow_forwardNeed assistance with (a) (4) through (7)arrow_forwardPlease do not give image formatarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education