Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

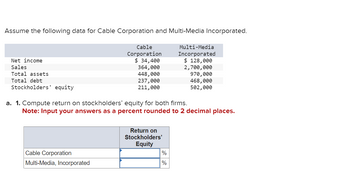

Transcribed Image Text:Assume the following data for Cable Corporation and Multi-Media Incorporated.

Net income

Sales

Total assets

Total debt

Stockholders' equity

Cable

Corporation

$ 34,400

364,000

448,000

237,000

211,000

Cable Corporation

Multi-Media, Incorporated

a. 1. Compute return on stockholders' equity for both firms.

Note: Input your answers as a percent rounded to 2 decimal places.

Return on

Stockholders'

Equity

Multi-Media

Incorporated

$ 128,000

2,700,000

%

%

970,000

468,000

502,000

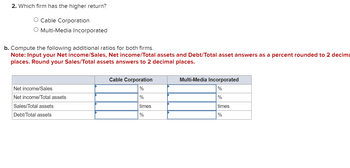

Transcribed Image Text:2. Which firm has the higher return?

O Cable Corporation

O Multi-Media Incorporated

b. Compute the following additional ratios for both firms.

Note: Input your Net income/Sales, Net income/Total assets and Debt/Total asset answers as a percent rounded to 2 decima

places. Round your Sales/Total assets answers to 2 decimal places.

Net income/Sales

Net income/Total assets

Sales/Total assets

Debt/Total assets

Cable Corporation

%

%

times

%

Multi-Media Incorporated

%

%

times

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Suppose a stock had an initial price of $84 per share, paid a dividend of $1.50 per share during the year, and had an ending share price of $71.50. a. Compute the percentage total return. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What was the dividend yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What was the capital gains yield? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardOnly need last 2 parts of the problem.arrow_forwardDarrow_forward

- D (Solving a comprehensive problem) Use the end-of-year stock price data in the popup window, E, to answer the following questions for the Harris and Pinwheel companies. a. Compute the annual rates of return for each time period and for both firms. b. Calculate both the arithmetic and the geometric mean rates of return for the entire three-year period using your annual rates of return from part a. (Note: you may assume that neither firm pays any dividends.) c. Compute a three-year rate of return spanning the entire period (i.e., using the ending price for period 1 and ending price for period 4). d. Since the rate of return calculated in part c is a three-year rate of return, convert it to an annual rate of return by using the following equation: W S J-(₁. 1+ e. How is the annual rate of return calculated in part d related to the geometric rate of return? When you are evaluating the performance of an investment that has been held for several years, what Time 1 X 2 3 4 Time 1 3 2 3 4 #…arrow_forwardThere are 2 parts to this question please read and answer carefully using the table provided.arrow_forwardThe account which increases equity is known as? A. Debit Account B. Credit Account C. Revenue D. Treasury Stockarrow_forward

- 14) Consider the following 2 tables in Database: Investor and Positions with respective columns. Investor InvestorID InvestorName Country *Assume there is a primary key on InvestorID Positions StockSymbol InvestorID ReportingDate Qty *Assume there is a primary key on StockSymbol, InvestorID, Reportingdate Positions means Stock holdings. Write a queries to a) Find all investors that have positions in more than one stocks on any reporting date. b) Output investors with their positions (they have ever had) and respective dates when they acquired those positions c) Investors that never had a positionarrow_forwardUsing the data in the following table,, estimate the: a. Average return and volatility for each stock. b. Covariance between the stocks. c. Correlation between these two stocks. a. Estimate the average return and volatility for each stock. The average return of stock A is %. (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year Stock A 2010 2011 2012 2013 2014 2015 - 1% 6% 2% -5% 4% 6% Stock B 20% 9% 8% -3% - 5% 21% Print Done ☑ Cleararrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education