FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

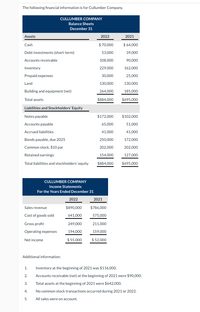

Transcribed Image Text:The following financial information is for Cullumber Company.

CULLUMBER COMPANY

Balance Sheets

December 31

Assets

2022

2021

Cash

$ 70,000

$64,000

Debt investments (short-term)

53,000

39,000

Accounts receivable

108,000

90,000

Inventory

229,000

162,000

Prepaid expenses

30,000

25,000

Land

130,000

130,000

Building and equipment (net)

264,000

185,000

Total assets

$884,000

$695,000

Liabilities and Stockholders' Equity

Notes payable

$172,000

$102,000

Accounts payable

65,000

51,000

Accrued liabilities

41,000

41,000

Bonds payable, due 2025

250,000

172,000

Common stock, $10 par

202,000

202,000

Retained earnings

154,000

127,000

Total liabilities and stockholders' equity

$884,000

$695,000

CULLUMBER COMPANY

Income Statements

For the Years Ended December 31

2022

2021

Sales revenue

$890,000

$786,000

Cost of goods sold

641,000

575,000

Gross profit

249,000

211,000

Operating expenses

194,000

159,000

$ 5000

$ 52,000

Net income

Additional information:

Inventory at the beginning of 2021 was $116,000.

1.

2.

Accounts receivable (net) at the beginning of 2021 were $90,000.

3.

Total assets at the beginning of 2021 were $642,000.

4.

No common stock transactions occurred during 2021 or 2022.

All sales were on account.

5.

Transcribed Image Text:(a1)

Compute the liquidity and profitability ratios of Cullumber Company for 2021 and 2022. (Round Curent ratio, Asset turnover and

Earnings per share to 2 decimal places, eg. 15.50 and round all other answers to 1 decimal place, eg. 15.5. Round % change to O decima!

places, for eg. 1% and if % change is a decrease show the numbers as negative, eg. -1% or (1%).)

2021

% Change

2022

LIQUIDITY

Current ratio

:1

:1

Accounts

receivables

times

times

turnover

Inventory

turnover

times

times

2021

2022

% Change

PROFITABILITY

Profit margin

Asset turnover

times

times

Return on assets

Earnings per share

2$

2$

(b)

Given below are three independent situations and a ratio that may be affected. For each situation, compute the affected ratio (1) as

of December 31, 2022, and (2) as of December 31, 2023, after giving effect to the situation. (Round Debt to assets ratio to 0 decima!

places, eg. 15 and round all other answers to 1 decimal place, e,g. 15.5. Round % change to 0 decimal places, for eg. 1% and if % change is a

decrease show the numbers as negative, e.g. -1% or (1%).)

Situation

Ratio

1.

18,000 shares of common stock were sold at par on July 1, 2023. Net income for 2023 was

$53,000.

Return on common

stockholders' equity

2.

All of the notes payable were paid in 2023. All other liabilities remained at their December 31,

2022 levels. Total assets on December 31, 2023, were $904,000.

Debt to assets ratio

The market price of common stock was $9 and $13 on December 31, 2022 and 2023,

respectively.

3.

Price-earnings ratio

2022

2023

% Change

Return on

common

stockholders'

equity

Debt to assets

ratio

Price earnings

ratio

times

times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selected information from the comparative financial statements of AppleVerse Company for the year ended December 31 appears below: 2018 2017 Php Php Accounts receivable (net) 175,000 200,000 Inventory 130,000 150,000 Total assets 1,100,000 800,000 Current liabilities 140,000 110,000 Long-term debt 410,000 300,000 Net credit sales 800,000 700,000 Cost of goods sold 600,000 530.000 Interest expense 40.000 25,000 Income tax expense 60.000 29,000 Net income 150.000 85,000 Net cash provided by operating 220,000 135,000 activities Compute for the Receivables Turnover for 2018. O 2.13 O 4.27 O 5.95 O 3.23arrow_forwardCondensed balance sheet and income statement data for Bridgeport Corporation are presented here. Bridgeport CorporationBalance SheetsDecember 31 2020 2019 2018 Cash $ 32,000 $ 22,000 $ 20,000 Accounts receivable (net) 52,000 47,000 50,000 Other current assets 93,000 98,000 67,000 Investments 58,000 73,000 48,000 Plant and equipment (net) 500,000 370,000 358,000 $735,000 $610,000 $543,000 Current liabilities $ 87,000 $ 82,000 $ 72,000 Long-term debt 148,000 88,000 53,000 Common stock, $10 par 323,000 313,000 303,000 Retained earnings 177,000 127,000 115,000 $735,000 $610,000 $543,000 Bridgeport CorporationIncome StatementsFor the Years Ended December 31 2020 2019 Sales revenue $743,000 $603,000 Less: Sales returns and allowances 42,000 32,000 Net sales 701,000…arrow_forwardVockery Market Co. Balance Sheet 2018 2017 Cash 20,000 24,000 ST Investments 18,000 26,000 Net Accounts Receivable 50,000 78,000 Inventory 70,000 66,000 Prepaid Expenses 12,000 10,000 Total Current Assets 170,000 204,000 PP&E 105,000 85,000 Total Assets 275,000 289,000 Total Current Liabilities 130,000 120,000 Income Statement: Net Sales 478,000 Cost of Goods Sold 318,000 Compute the following ratios: Current ratio Acid-test ratio Inventory turnover Days' sales in inventory Days' sales in receivables Gross profit percentagearrow_forward

- Here is financial information for Windsor, Inc. December 31, 2022 December 31, 2021 Current assets $104,753 $ 89,000 Plant assets (net) 367,169 319,000 Current liabilities 108,936 72,000 Long-term liabilities 109,986 83,000 Common stock, $1 par 120,946 106,000 Retained earnings 132,054 147,000 Prepare a schedule showing a horizontal analysis for 2022, using 2021 as the base year. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 1 decimal place, e.g. 12.1%.) WINDSOR, INC. Assets Current Assets Condensed Balance Sheet December 31 2022 2021 $104,753 $89,000 Plant assets (net) 367,169 319,000 Total assets Liabilities Current Liabilities $471,922 $408,000 $108,936 $72,000 Long-term liabilities 109,986 83,000 +A +A Increase or (Decrease) Amount Percentage % de % % do % % de Total liabilities $218,922 $155,000 do % Stockholders' Equity Common stock, $1 par 120,946 106,000 % Retained earnings 132,054 147,000 %…arrow_forwardThe financial statements of Carrier Office Furniture Company include the following items: 2025 $44,000 14,000 98,000 149,000 553,000 290,000 60,000 Cash Short-term Investments Net Accounts Receivable Merchandise Inventory Total Assets Total Current Liabilities Long-term Note Payable What is working capital for 2026? O A. $37,500 OB. $98,500 O C. $191,000 O D. $66,500 2026 $48,500 29,000 95,000 165,000 526,000 271,000 64,000arrow_forwardFlint Corp. Statement of Financial Position For the Year Ended December 31, 2023 Current assets Cash (net of bank overdraft of $40,000 ) $450,000 Accounts receivable (net) Inventory at the lower of cost and net realizable value FV-NI investments (at cost-fair value $320,000 ) Property, plant, and equipment Buildings (net) 590,000 Equipment (net) 190,000 Land held for future use ,265,000 Intangible assets Goodwill Investment in bonds to collect cash flows, at amortized cost 100,000 Prepaid expenses Current liabilities Accounts payable 365,000 Notes payable (due next year) Pension obligation Rent payable 505,000 511,000 340,000 265,000 Long-term liabilities Bonds payable 681,000 Shareholders' equity Common shares, unlimited authorized, 380,000 issued 380,000 Contributed surplus 210,000 Retained earningsarrow_forward

- Kinder Company Balance Sheet December 31 2020 2019 Cash $ 40,208 $ 11,424 Accounts receivable (net) 42,896 22,736 Inventory 39,200 47,040 Long-term investments 0 16,800 Property, plant & equipment 264,880 168,000 Accumulated depreciation (42,224) (28,000) $344,960 $238,000 Accounts payable $ 19,040 $ 29,680 Accrued liabilities 23,520 19,040 Long-term notes payable 78,400 56,000 Common stock 145,600 100,800 Retained earnings 78,400 32,480 $344,960 $238,000 Kinder Company Income statement December 31, 2020 Sales Revenue $ 520,285 Cost of Goods Sold (304,045) Gross Profit 216,240 Operating Expenses (137,056) Depreciation Expense (14,224) Gain on Sale of Investment 14,560 Net Income $79,520 Additional data: 1. Paid dividends of $33,600…arrow_forwardAs of December 31, 2021, Halaga Corporation reported the following items in its balance sheet: Cash- P520,000 Receivables- P240,000 Inventory- P350,000 Equipment- P850,000 Accounts payable- P325,650 Short-term notes payable- P524,500 Long-term debt- P1,049,850 Weighted average of outstanding shares in 2021- P250,000 Halaga Corporation contracted a third-party appraiser which has determined that the replacement value of its assets. This resulted to P14.22 calculation as its replacement value per share of the company.Based on the report of the appraiser, the property and plant have replacement cost of 125% of its reported value. On the other hand, the equipment only commands replacement cost of 70% of its value. According to the appraiser, the equipment was designed using an old technology, thus, the lower replacement cost. Other assets and liabilities are valued fairly.How much is the book value per share of Halaga Corporation as of December 31, 2021? a. Php 0.24 b. Php 14.22 c.…arrow_forwardthe balance sheets for Plasma Screens Corporation and additional information are provided below. PLASMA SCREENS CORPORATIONBalance SheetsDecember 31, 2021 and 2020 2021 2020 Assets Current assets: Cash $ 242,000 $ 130,000 Accounts receivable 98,000 102,000 Inventory 105,000 90,000 Investments 5,000 3,000 Long-term assets: Land 580,000 580,000 Equipment 890,000 770,000 Less: Accumulated depreciation (528,000 ) (368,000 ) Total assets $ 1,392,000 $ 1,307,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $ 109,000 $ 95,000 Interest payable 7,000 13,000 Income tax payable 9,000 6,000 Long-term liabilities: Notes payable 110,000 220,000 Stockholders' equity: Common stock…arrow_forward

- Presented below are data taken from the records of Sheffield Company. December 31,2020 December 31,2019 Cash $15,100 $7,900 Current assets other than cash 85,800 59,800 Long-term investments 10,100 53,000 Plant assets 335,200 214,500 $446,200 $335,200 Accumulated depreciation $20,200 $40,200 Current liabilities 39,600 22,000 Bonds payable 75,800 –0– Common stock 252,800 252,800 Retained earnings 57,800 20,200 $446,200 $335,200 Additional information: 1. Held-to-maturity debt securities carried at a cost of $42,900 on December 31, 2019, were sold in 2020 for $33,600. The loss (not unusual) was incorrectly charged directly to Retained Earnings. 2. Plant assets that cost $49,600 and were 80% depreciated were sold during 2020 for $7,900. The loss was incorrectly charged directly to Retained Earnings. 3. Net income as reported on the…arrow_forwardvv. Subject Financearrow_forwardThis Year Last Year Assets Current assets: Cash $360,000 $310,000 Marketable securities 220,000 80,000 Accounts receivable, net 775,000 700,000 Inventory 925,000 750,000 Other current assets 355,000 195,000 Total current assets 2,635,000 2,035,000 Plant and eqipment, net 1,975,000 1,800,000 Other assets 75,000 100,000 Total assets $4,685,000 $3,935,000 Liabilities and Stockholders' Equity Current Liabilities: Accounts payable $250,000 $225,000 Short-term bank loans 750,000 600,000 Accrued payables 550,000 395,000 Other current liabilities 275,000 223,400 Total current liabilities 1,825,000 1,443,400 Bonds payable, 10% 575,000 400,000 Total liabilities 2,400,000 1,843,400 Stockholders' equity: Common stock 1,150,000 1,150,000 Retained earnings 1,135,000 941,600 Total stockholders' equity 2,285,000 2,091,600 Total liabilities and stockholders' equity $4,685,000 $3,935,000…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education