Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

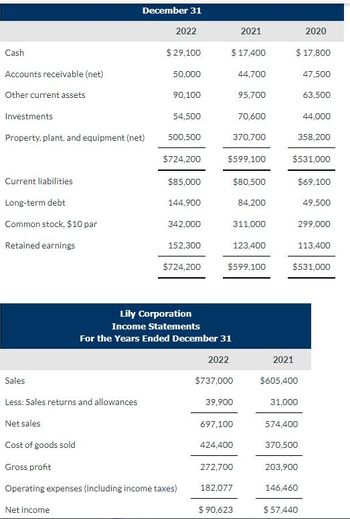

Transcribed Image Text:Cash

Accounts receivable (net)

Other current assets

December 31

Investments

Property, plant, and equipment (net)

Current liabilities

Long-term debt

Common stock, $10 par

Retained earnings

2022

$ 29,100

50,000

90,100

54,500

500,500

$724,200

$85,000

144,900

342,000

152,300

$724,200

2021

$ 17,400

Sales

Less: Sales returns and allowances

Net sales

Cost of goods sold

Gross profit

Operating expenses (including income taxes)

Net income

Lily Corporation

Income Statements

For the Years Ended December 31

2022

$737,000

$599,100

39,900

697,100

424,400

44,700

95,700

272,700

182,077

70,600

370,700

$599,100

$80,500

84,200

311,000

$ 90,623

123,400

$ 17,800

47,500

2021

2020

358,200

$531,000

63,500

44,000

$69,100

$605,400

31,000

299,000

574,400

370,500

113,400

$531,000

203,900

146,460

$ 57,440

49,500

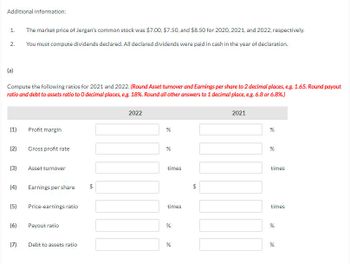

Transcribed Image Text:Additional information:

1.

2.

(a)

Compute the following ratios for 2021 and 2022. (Round Asset turnover and Earnings per share to 2 decimal places, e.g. 1.65. Round payout

ratio and debt to assets ratio to O decimal places, e.g. 18%. Round all other answers to 1 decimal place, e.g. 6.8 or 6.8%.)

(1)

(2)

(3)

(4)

(5)

(6)

The market price of Jergan's common stock was $7.00, $7.50, and $8.50 for 2020, 2021, and 2022, respectively.

You must compute dividends declared. All declared dividends were paid in cash in the year of declaration.

(7)

Profit margin

Gross profit rate

Asset turnover

Earnings per share $

Price-earnings ratio

Payout ratio

Debt to assets ratio

2022

%

de

%

times

times

%

%

+A

$

2021

%

%

times

times

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…arrow_forwardBalance Sheet for Bearcat Hathaway, 2022 2021 2022 Cash Accounts Receivable Inventory Current Assets Accum.Depreciation Net Fixed Assets Gross Fixed Assets $16,251,665 $20,567,330 Less $7,460,897 $10,117,819 Total Assets O 11.58% O 44.90% O 8.37% $5,268,485 $10,268,485 O 4.35% $2,574,230 $2,314,672 O 6.02% $529,062 $696,685 $8,371,777 $13,279,842 Total Liabilities and Equity What is the common size value for 2022 Notes Payable? $8,790,768 $10,449,511 $17,162,545 $23,729,353 Current Liabilities 2021 Accounts Payable Notes Payable $1,033,110 $1,987,233 2022 $1,673,992 $2,438,271 $2,707,102 $4,425,504 Long Term Debt $9,242,830 $11,468,302 Total Liabilities $11,949,932 $15,893,806 Common Stock ($0.50 par) $1,300,000 $1,600,000 Capital Surplus $1,148,120 $1,800,969 Retained $2,764,493 $4,434,578 Earnings $17,162,545 $23,729,353arrow_forwardCash Accounts Receivable Inventory Property Plant & Equipment Other Assets Total Assets Valley Technology Balance Sheet As of March 11, 2020 (amounts in thousands) 9,700 Accounts Payable 4,500 Debt 3,800 Other Liabilities 16,400 Total Liabilities 1,700 Paid-In Capital Retained Earnings Total Equity 36,100 Total Liabilities & Equity 1,500 2,900 800 5,200 7,300 23,600 30,900 36,100 Use T-accounts to record the transactions below, which occur on March 12, 2020, close the T-accounts, and construct a balance sheet to answer the question. 1. Buy $15,000 worth of manufacturing supplies on credit 2. Issue $85,000 in stock 3. Borrow $63,000 from a bank 4. Pay $5,000 owed to a supplier 5. Receive payment of $12,000 owed by a customer What is the final amount in Total Liabilities? Please specify your answer in the same units as the balance sheet.arrow_forward

- BnB Construction Inc.Balance Sheet (Millions of Dollars) Assets 2021 Est 2020 2019 Liabilities 2021 Est 2020 2019 Cash and Cash Equivalents 15 10 15 Accounts payable 115 60 30 Short-Term Investments 10 0 65 Overdrafts 115 110 60 Accounts Receivable 420 375 315 Accruals 260 140 130 Inventories 700 615 415 Total Current Liabilities 490 310 220 Total Current Assets 1145 1000 810 Long -Term Bonds and New Loan 1300 754 580 Net Plant and Equipment 1884 1190 870 Total Debt 1790 1064 800 Preferred Stock 40 40 40 Common Stock 130 130 130 Retained Earnings 1069 956 710 Total Common Equity 1199 1086 840 Total Assets 3029 2190 1680 Total Liabilities and Equity 3,029 2,190 1,680 Included is the Income Statement. Requirements: 1. Calculate the EPS, DPS, and BVPS, and Cash…arrow_forwardBarakah Company Balance Sheet as at 31st December 2019 Financed by: Fixed Assets (net after depreciation) 2$ $ Paid-up: Share Capital Retained Earnings Reserves 350,500 200,500 150,000 50,000 Land & Buildings 600,000 155,500 75,000 830,500 Equipment Vehicles Fixtures & Fittings Long Term Liabilities 25,000 751,000 Current Assets 125,000 Accounts Receivable 215,000 10,000 110,000 20,000 1,231,000 Inventory Current Other payables Trade creditors Liabilities 100,000 245,500 Prepayments Cash at Bank Cash in Hand Accrued expense 30.000 375,500 1,231.000 Additional Information: i) Work-in-Progress is one sixth of the total Inventory. Prepayments is related to rental of buildings. ii) ii) Bad Debts is 5% for the year. iv) Non Muslim ownership is at 20%. Required: Determine the zakat base and due for the company using: (a) Net Current Assets method; and (b) Net Invested Fund Method.arrow_forwardKIBAN INCORPORATED Comparative Balance Sheets At June 30 2021 2020 Assets Cash $ 81,500 $ 54,000 Accounts receivable, net 80,000 61,000 Inventory 73,800 101,500 Prepaid expenses 5,400 7,400 Total current assets 240,700 223,900 Equipment 134,000 125,000 Accumulated depreciation—Equipment (32,000) (14,000) Total assets $ 342,700 $ 334,900 Liabilities and Equity Accounts payable $ 35,000 $ 45,000 Wages payable 7,000 17,000 Income taxes payable 4,400 5,800 Total current liabilities 46,400 67,800 Notes payable (long term) 32,000 70,000 Total liabilities 78,400 137,800 Equity Common stock, $5 par value 240,000 170,000 Retained earnings 24,300 27,100 Total liabilities and equity $ 342,700 $ 334,900 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2021 Sales $ 728,000 Cost of goods sold 421,000 Gross profit 307,000 Operating expenses (excluding depreciation) 77,000 Depreciation expense 68,600 161,400…arrow_forward

- Find earnings per share 2019arrow_forwardSME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…arrow_forwardSME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…arrow_forward

- STATEMENT OF CASH FLOW EXAMPLE Kerby Company has prepared the following Balance Sheets for 2023 and 2022. Cash 12/31/23 $ 56 12/31/22 $ 40 Accounts receivable 41 42 Fixed assets 579 465 Accumulated depreciation (170) (140) $506 $407 Accounts payable Mortgage payable Preferred stock $ 74 $ 60 20 181 Additional Paid-In Capital - preferred 70 Common stock Retained earnings 100 61 ២៩៩៩88 100 100 $506 $407 1. On 8/1/23, Kerby sold a fixed asset with a cost of $91 and book value of $66 for $67. 2. Retained Earnings was adjusted by dividends and net income only. 3. Net Income in 2023 was $80. a. Net Cash Provided by Operations is $ b. Net Cash Used by Investments is $ c. Net Cash Provided by Financing is $arrow_forwardBalance Sheet for Bearcat Hathaway, 2022 2021 2022 Cash Accounts. Receivable $5,268,485 $10,268,485 Inventory $529,062 $696,685 Current Assets $8,371,777 $13,279,842 Less $2,574,230 $2,314,672 Gross Fixed Assets $16,251,665 $20,567,330 Accum.Depreciation Total Assets $7,460,897 $10,117,819 Accounts Payable Notes. Payable Current Liabilities Calculate the net working capital in 2022. Long Termi Debt Total Liabilities, None of these options are correct $10,572,740 $5,664,675 $8,854,338 $3,946,273 Total $17,162,545 $23,729,353 Liabilities and Equity Capital Surplus Retained. Earnings 2021 2022 $1,673,992 $2,438,271 Common Net Fixed Assets $8,790,768 $10,449,511 Stock ($0.50 $1,300,000 $1,600,000 par) $1,033,110 $1,987,233 $2,707,102 $4,425,504 $9,242,830 $11,468,302 $11,949,932 $15,893,806 $1,148,120 $1,800,969 $2,764,493 $4,434,578 $17,162,545 $23,729,353arrow_forwardThe following data are provided: December 31 2021 2020 Cash $ 1300000 $ 1005000 Accounts receivable (net) 1500000 1150000 Inventories 2600000 2100000 Plant assets (net) 6000000 6600000 Accounts payable 1150000 820000 Income taxes payable 220000 90000 Bonds payable 1400000 1400000 10% Preferred stock, $50 par 1800000 1800000 Common stock, $10 par 2300000 1700000 Paid-in capital in excess of par 1650000 1400000 Retained earnings 4100000 3400000 Net credit sales 12800000 Cost of goods sold 8500000 Operating expenses 2900000 Net income 1600000 Additional information:Depreciation included in cost of goods sold and operating expenses is $1200000. On May 1, 2021, 60000 shares of common stock were issued. The preferred stock is cumulative. The preferred dividends were not declared during 2021.At December 31, 2021,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education