Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

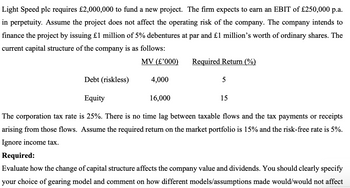

Transcribed Image Text:Light Speed plc requires £2,000,000 to fund a new project. The firm expects to earn an EBIT of £250,000 p.a.

in perpetuity. Assume the project does not affect the operating risk of the company. The company intends to

finance the project by issuing £1 million of 5% debentures at par and £1 million's worth of ordinary shares. The

current capital structure of the company is as follows:

MV (£'000)

Debt (riskless)

4,000

16,000

Required Return (%)

5

Equity

The corporation tax rate is 25%. There is no time lag between taxable flows and the tax payments or receipts

arising from those flows. Assume the required return on the market portfolio is 15% and the risk-free rate is 5%.

Ignore income tax.

15

Required:

Evaluate how the change of capital structure affects the company value and dividends. You should clearly specify

your choice of gearing model and comment on how different models/assumptions made would/would not affect

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

why is the formula for dividend paid different both times?

Solution

by Bartleby Expert

Follow-up Question

Why is the dividend calculation fomula different both times.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

why is the formula for dividend paid different both times?

Solution

by Bartleby Expert

Follow-up Question

Why is the dividend calculation fomula different both times.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Firms A and B are identical except for their capital structure. A carries no debt, whereas B carries £60m of debt on which it pays a 5% interest rate. Assume no transaction costs, no taxes and risk-free debt. The relevant numbers are provided in the following table (in £ m): A B Value of Firm 100 120 Debt 60 Equity 100 60 Projected earnings before interest 12 12 Interest payment Not Interest rate Applicable 5% Please answer the following questions a) "The situation described in the table is consistent with the absence of arbitrage opportunities". True or False (T/F)? b) Which one of the two firms is relatively overvalued (A/B)? c) "B's shares carry more risk than A's shares". True or False (T/F)? d) What is the return to an investor holding a 10% stake in B (in £ '000)? e) Consider an investor who wants to purchase a 20% stake in A. If he wished to replicate B's capital structure through homemade leverage, how much would he need to borrow to finance his position in £m? ) What is the…arrow_forward4arrow_forwardAssume that Firms U and L are in the same risk class and that both have EBIT=$500,000. Firm U uses no debt financing, and its cost of equity is rsU=14%. Firm L has $1 million of debt outstanding at a cost of rd=8%. There are no taxes. Assume that the MM assumptions hold. Graph (a) the relationships between capital costs and leverage as measured by D/V and (b) the relationship between V and D. Now assume that Firms L and U are both subject to a 40% corporate tax rate. Using the data given in Part b, repeat the analysis called for in b(1) and b(2) using assumptions from the MM model with taxes.arrow_forward

- Micolash Industries plans to reduce the use of debt financing and increase the use of equity financing (for example, move from a 70% Debt-to-Capital Ratio to 50%). Assume that the company, which does not pay any dividends, takes this action, and that total assets, operating income (EBIT), and its tax rate (say 40%) all remain constant. Which of the following would occur? Group of answer choices The company’s interest expense would remain constant. The company would have less common equity than before. The company’s taxable income (EBT) would fall. The company would have to pay more taxes. The company’s net income would decrease.arrow_forwardAssume the firm has a tax rate of 23 percent. c-1. Calculate return on equity (ROE) under each of the three economic scenarios before any debt is Issued. (Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-2. Calculate the percentage changes in ROE when the economy expands or enters a recession. (A negative answer should be indicated by a minus sign. Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-3. Calculate the return on equity (ROE) under each of the three economic scenarios assuming the firm goes through with the recapitalization. (Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-4. Given the recapitalization, calculate the percentage changes in ROE when the economy expands or enters a recession. (A negative answer should be indicated by a minus sign. Do not round…arrow_forwardB.F. Pierce & Company is considering changing its capital structure. The company currently has no debt and no preferred stock, but it would like to add some debt to take advantage of low interest rates and the tax shield. Its investment banker has indicated that the pre-tax cost of debt under various possible capital structures would be as follows: 8.66% 9.21% 8.83% Market Debt-to- Value Ratio 9.07% (WD) 0.00 0.20 0.40 0.60 0.80 Market Equity-to- Value Ratio (WE) 1.00 0.80 0.60 0.40 0.20 Market Debt-to- Equity Ratio (D/E) 0.00 0.25 0.67 1.50 4.00 Before-Tax Cost of Debt (rD) 5.00% The company uses the CAPM to estimate its cost of common equity. Currently the risk-free rate is 4%, the market risk premium is 6%, and the company's tax rate is 25%. The company estimates that its beta now (which is unlevered because it currently has no debt) is 0.8. Based on this information, what is the firm's weighted average cost of capital at its optimal capital structure? 6.00% 7.00% 8.00% 9.00%arrow_forward

- 14. AT Steel currently has no debt and an equity cost of capital of 14%. Suppose that the company decides to increase its leverage and maintain a market debt-to-value ratio of 1/2. Suppose its debt cost of capital is 8% and its corporate tax rate is 21%. Assuming that the pre-tax WACC remains constant, then with the addition of leverage its effective after-tax WACC will be closest to: A) 10.8%. B) 12.4%. C) 12.8%. D) 13.6%.arrow_forwardPls help correctly, I only need c part and correct with approach and explanation.arrow_forwardTrue or False: It is free for a company to raise money through retained earnings, because retained earnings represent money that is left over after dividends are paid out to shareholders. False True The cost of equity using the CAPM approach The current risk-free rate of return (TRF) is 3.86% while the market risk premium is 6.63%. The Monroe Company has a beta of 0.92. Using the capital asset pricing model (CAPM) approach, Monroe's cost of equity is The cost of equity using the bond yield plus risk premium approach The Lincoln Company is closely held and, therefore, cannot generate reliable inputs with which to use the CAPM method for estimating a company's cost of internal equity. Lincoln's bonds yield 11.52%, and the firm's analysts estimate that the firm's risk premium on its stock over its bonds is 4.95%. Based on the bond-yield-plus-risk-premium approach, Lincoln's cost of internal equity is: 19.76% 16.47% 15.65% O 18.12%arrow_forward

- Solve it using formulas, no tables correct answers are: i) i^2= 0.063977 > 0.0536 iii) Po= £91,630.9 iv) i'= 0.028985 = 2.9% paarrow_forward2. Assume that you went to your bank to buy ¥10 million. The bank quoted that you can buy ¥120 for $1. Based on this information, answer the following questions: (15 Points) a. Is this a direct quote or an indirect quote? b. If it is a direct quote, what is the indirect quote or if it is an indirect quote what is the direct quote? C. How much dollar you need to buy ¥10 million? U Direct 1/120 =.0083 # B1 = 1/120 C,33,333.33arrow_forwardTrue/False: Discounting the FCF(Free Cash Flow) of the 100% equity firm with the WACC (Weighted Average Cost Capital)takes the tax shield into account.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education