FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

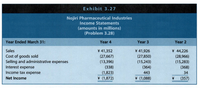

- Using the financial statements and additional information below, construct an indirect

cash flow statement in Excel for year 4. As long as you are following general cash flow formatting rules (e.g. operating section, investing section, financing section), you can format it as you see fit. Remember that these reports should be clean, easy to read and understand, and useful for decision-making purposes.

Expert Solution

arrow_forward

Step 1

SOLUTION

CASH FLOW STATEMENT IS A FINANCIAL STATEMENT THAT SHOWS HOW CHANGES IN BALANCE SHEET ACCOUNTS AND INCOME EFFECT CASH AND CASH EQUIVALENT AND ANALYSIS THE OPERATING , INVESTING AND FINANCING ACTIVITIES.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What is the formula for the dividens paid that results in the -787? I am struggling to find the correct numbers to use

Solution

by Bartleby Expert

Follow-up Question

What is dividen's paid called on the

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What is the formula for the dividens paid that results in the -787? I am struggling to find the correct numbers to use

Solution

by Bartleby Expert

Follow-up Question

What is dividen's paid called on the

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Discuss the importance of reporting the transactions of cash flows in the correct period for a cash based business.arrow_forwardBelow you can find the problem I need you to solve. As you will notice is similar to the one I sent you before. The only difference is the in this case the WACC must be used to calculate the present value for the previously calculated cash flows. Please use Excel to make all the calculations so I can check what you did and the process. If you could finish this by the 15 it would be great because I can correct this and send the approval to the Registrar before leaving on the 16th. Feel free to contact me if you have any questions or problems when solving it. PROBLEM Your company is contemplating replacing their current fleet of delivery vehicles with Nissan NV vans. You will be replacing 5 fully depreciated vans, which you think you can sell for $4,100 each and which you could probably use for another 2 years if you chose not to replace them. The NV vans will cost $40,000 each in the configuration you want them and can be depreciated using MACRS over a 5-year life, but you are unable to…arrow_forwardCreate a cash-flow statement. Make sure all three areas (operating, investment, and Financing activities) are includedarrow_forward

- Which of the following is the final step in preparing a spreadsheet (work sheet) for the statement of cash flows using the indirect method? Add the Debit and Credit Transactions columns and verify that the totals are equal. Analyze all noncash accounts and enter the net increase (decrease) in cash during the period. Add the Balance column totals, which should total to zero. After all noncash accounts have been analyzed, enter the net increase (decrease) in cash during the period.arrow_forwardMatch each of the following term with the corresponding description. Not all descriptions will be used._____ Operating activities_____ Indirect method_____ Cash equivalent_____ Investing activities_____ Direct method_____ Financing activitiesA. Measures the percent of net income that comes from high-margin products.B. Includes such events as the receipt of dividends and interest on investment assets.C. Includes assets that are very liquid and have original maturities of three months or less.D. The percent of total debt represented by a company's cash account.E. These activities include only purchases made with borrowed funds.F. Where cash flows from operating activities are calculated by converting each revenue and expense item from an accrual to a cash basis.G. This ratio multiplies net income by the average rate of interest the company receives on its investments.H. This ratio uses net income instead of operating cash flow to Analysis a company's ability to finance the cost of its…arrow_forwardCan you please write the calculations step by step including the formulas. How did you calculate the Cash flow in order to calculate the cumulative cash flow after that?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education