FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

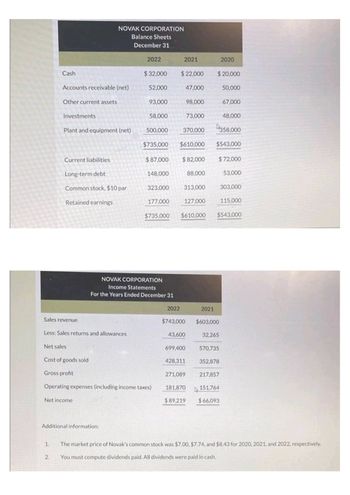

Transcribed Image Text:Cash

Accounts receivable (net)

Other current assets

1.

Investments

Plant and equipment (net)

Net sales

2.

NOVAK CORPORATION

Balance Sheets

December 31

Current liabilities

Long-term debt

Common stock, $10 par

Retained earnings

Sales revenue

Less: Sales returns and allowances

Net income

Additional information:

2022

$32,000

52,000

93,000

58,000

500,000

$735,000

148,000

Cost of goods sold

Gross profit

Operating expenses (including income taxes)

323,000

177,000

NOVAK CORPORATION

Income Statements

For the Years Ended December 31

2021

$ 22,000

47,000

$87,000 $82,000

2022

98,000

370,000

$610,000

73,000

313,000

127,000

88,000

699,400

428,311

271,089

2021

$20,000

2020

$743,000 $603,000

43,600

115,000

$735,000 $610.000 $543,000

50,000

32,265

570,735

352,878

217,857

181,870 ▷ 151,764

$89,219

$66,093

67,000

48,000

358,000

$543,000

$72,000

53,000

303,000

The market price of Novak's common stock was $7.00, $7.74, and $8.43 for 2020, 2021, and 2022, respectively.

You must compute dividends paid. All dividends were paid in cash.

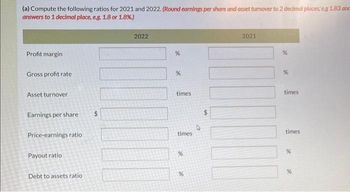

Transcribed Image Text:(a) Compute the following ratios for 2021 and 2022. (Round earnings per share and asset turnover to 2 decimal places; eg 1.83 and

answers to 1 decimal place, e.g. 1.8 or 1.8%)

Profit margin

Gross profit rate

Asset turnover

Earnings per share

Price-earnings ratio

Payout ratio

Debt to assets ratio

2022

%

%

times

times

%

%

4

$

2021

%

times

times

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the financial data for Key Wahl Industries Sales Net Profit After Tax Total Assets Total Liabilities O.50 02 O.75 $4,500,000 What is the debt ratio? O.075 $337,5000 $6,750,000 $ 3,375,000arrow_forwardA comparative statement of financial position for Blue Spruce Industries Inc. follows: BLUE SPRUCE INDUSTRIES INC. Statement of Financial Position December 31, 2023 Assets Cash Accounts receivable Inventory. Land Equipment Accumulated depreciation-equipment Total Liabilities and Shareholders' Equity Accounts payable Bonds payable Common shares Retained earnings Total Additional information: 1 2. 3. vi December 31 2023 $22,800 122,000 234,000 77,000 269,000 (70,300) $654,500 $52,400 163,800 233,000 205,300 $654,500 No equipment was sold during the year. 2022 $35,800 55,600 191.000 Net income for the fiscal year ended December 31, 2023, was $130,000. Cash dividends of $48,300 were declared and paid. Dividends paid are treated as financing activities. Bonds payable amounting to $50,000 were retired through the issuance of common shares. 4. Land was sold at a gain of $4,000 125.000 216.000 (43,500) $579,900 $59,500 213,800 183,000 123.600 $579,900arrow_forwardMadsen Company reported the following information for :2020 Sales revenue Cost of goods sold Operating expenses O dividends 220,000 Unrealized holding gain on available-for-sale debt securities 180,000 Cash O $420,000 $2,040,000 1,400,000 $128,000 For 2020, Madsen would report other comprehensive income of 8,000 .a .barrow_forward

- 1.Prepare the balance sheet 2. and the income statement for Belmond Incarrow_forwardCABOT CORPORATIONBalance SheetDecember 31 Assets Liabilities and Equity Cash $ 10,000 Accounts payable $ 19,500 Short-term investments 8,000 Accrued wages payable 3,400 Accounts receivable, net 33,600 Income taxes payable 2,900 Merchandise inventory 42,150 Long-term note payable, secured by mortgage on plant assets 66,400 Prepaid expenses 2,800 Common stock 83,000 Plant assets, net 147,300 Retained earnings 68,650 Total assets $ 243,850 Total liabilities and equity $ 243,850 Required:Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders' equity. (Do not round intermediate calculations.)arrow_forwardWhat is the debit to asset ratio?arrow_forward

- Accounts Payable Notes Payable Long Term Debt Common Stock Retained Earnings Total Liabilities & Equity $ 275,000 $ 315,000 $ 495,000 $ 925,000 $2,450,000 $4,460,000 Pre-Tax Cost of Debt: Intermediate Debt: 4.5% Long Term Debt: 6.5% Tax Rate: 21% Return on Equity: 11% Dividends per share: $0.20 Earnings per share: $0.90 C/S market price: $55 C/S outstanding: 80000 shares This company uses intermediate debt, long-term debt and common equity to finance its operations. With the information presented above: a. Calculate the firm's debt ratio (book value and market value based) b. Calculate the firm's WACC c. Calculate the new firm's WACC if the firm issued 150,000 new common stock at a flotation cost of $1.20 per share. The new issuance generates $4.5 million.arrow_forwardThe following information is available in respect of Vegas plc for the last 2 years ended 31 December. Non-current Assets (at Net Book Value) Current Assets: Inventory Trade receivables Cash at bank Equity and Liabilities: Equity Share capital £1 Share premium Revenue reserve Vegas plc: Statement of Financial Position 31.12.2021 Non-current Liabilities: Loan Current Liabilities: Trade payables Taxation (accrual) Operating profit Taxation £000 390 462 80 88 142 £000 2,100 932 3.032 900 50 852 1,802 1,000 230 3.032 274 (156) 118 (87) 31 31.12.2020 Vegas plc: Income Statement (Extract) for the year ended 31.12.2021 £000 Dividends Retained profit for the year The following information is also available: • There were no non-current asset disposals during the year. • Depreciation for the year was £240,000. £000 210 346 50 73 137 £000 1,975 606 2.581 700 821 1,521 850 210 2.581 Prepare, in a suitable format, the Statement of Cash Flow for Vegas plc for the year ended 31.12.2021, presenting…arrow_forwardPlease answer all requirementsarrow_forward

- CABOT CORPORATIONBalance SheetDecember 31 Assets Liabilities and Equity Cash $ 10,000 Accounts payable $ 19,500 Short-term investments 8,000 Accrued wages payable 3,400 Accounts receivable, net 33,600 Income taxes payable 2,900 Merchandise inventory 42,150 Long-term note payable, secured by mortgage on plant assets 66,400 Prepaid expenses 2,800 Common stock 83,000 Plant assets, net 147,300 Retained earnings 68,650 Total assets $ 243,850 Total liabilities and equity $ 243,850 Required:Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders' equity. (Do not round intermediate calculations.)arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forwardAssets Line Item Description Amount Cash and short-term investments $42,572 Accounts receivable (net) 33,774 Inventory 37,691 Property, plant, and equipment 215,705 Total assets $329,742 Liabilities and Stockholders’ Equity Line Item Description Amount Current liabilities $68,960 Long-term liabilities 98,919 Common stock, $10 par 64,740 Retained earnings 97,123 Total liabilities and stockholders’ equity $329,742 Income Statement Line Item Description Amount Sales $91,805 Cost of goods sold (41,312) Gross profit $50,493 Operating expenses (28,002) Net income $22,491 Number of shares of common stock 6,474 Market price of common stock $28 What is the current ratio?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education