FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I need answer financial accounting

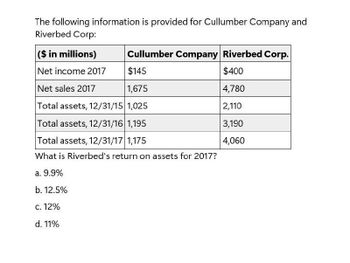

Transcribed Image Text:The following information is provided for Cullumber Company and

Riverbed Corp:

Cullumber Company Riverbed Corp.

($ in millions)

Net income 2017

$145

$400

Net sales 2017

1,675

4,780

Total assets, 12/31/15 1,025

2,110

Total assets, 12/31/16 1,195

3,190

Total assets, 12/31/17 1,175

4,060

What is Riverbed's return on assets for 2017?

a. 9.9%

b. 12.5%

c. 12%

d. 11%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information is provided for Cullumber Company and Bramble Corporation. (in $ millions) Cullumber Company Bramble Corporation Net income 2022 $145 $415 Net sales 2022 1755 4610 Total assets 12/31/20 1025 2330 Total assets 12/31/21 1260 3000 Total assets 12/31/22 1150 4080 What is Bramble's return on assets for 2022? (Round answer to 1 decimal place, e.g. 15.2.) 11.5% 13.8% 10.2% 11.7%arrow_forwardThe following information is provided for Cullumber Company and Bramble Corporation. (in $ millions) Cullumber Company Bramble Corporation Net income 2022 $125 $370 Net sales 2022 1310 4520 Total assets 12/31/20 1070 2040 Total assets 12/31/21 1055 3150 Total assets 12/31/22 1170 4100 What is Cullumber's asset turnover for 2022?arrow_forwardNeed helparrow_forward

- The following information is provided for Oceanic Ventures and Pinnacle Holdings: (in $ millions) Oceanic Ventures Pinnacle Holdings Net income 2021 $280 $640 Net sales 2021 3,500 7,200 Total assets 12/31/19 2,400 4,600 Total assets 12/31/20 2,700 5,000 Total assets 12/31/21 3,000 5,500 Capital expenditures $150 $300 What is Pinnacle Holdings' return on assets (rounded) for 2021?arrow_forwardComparative data from the statement of financial position of Munchies Ltd. are shown below. Current assets Property, plant, and equipment Goodwill Total assets Current assets Property, plant, and equipment Total assets 2021 $1,519,000 2021 3,114.000 $4.730,000 % %6 97,000 2020 $1,164.000 2,827,000 107,000 $4,098,000 Using horizontal analysis, calculate the percentage of the base-year amount, using 2019 as the base year. (Round answers to 1 decimal place, e.g. 52.7%) 2020 2019 % $1,227,000 2.871,000 -0- $4,098,000 2019arrow_forwardThe following information is provided for Company A and Company B. (in $ millions) Net income 2028 Net sales 2028 Total assets 12/31/26 Total assets 12/31/27 Total assets 12/31/28 What is Company B's return on assets for 2028? OA) 14.0% OB) 10.5% OC) 12.0% Company A $165 1,650 1,000 1,050 1,150 OD) 15.6% Company B $ 420 4,900 2,400 3,000 4,000arrow_forward

- The following information is provided for Oceanic Ventures and Pinnacle Holdings: Oceanic Ventures Pinnacle Holdings (in $ millions) Net income 2021 $280 $640 Net sales 2021 3,500 7,200 Total assets 12/31/19 2,400 4,600 Total assets 12/31/202,700 5,000 Total assets 12/31/21 3,000 5,500 Capital expenditures $150 $300 What is Pinnacle Holdings' return on assets (rounded) for 2021?arrow_forwardNeed help with this question solution general accountingarrow_forwardmework i 0 ences Mc Graw Hill INCOME STATEMENT OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) Net sales Costs Depreciation Earnings before interest and taxes (EBIT) Interest expense Pretax income Federal taxes (@ 21%) Net income Assets Current assets Cash and marketable securities Receivables Inventories Other current assets Total current assets Fixed assets Property, plant, and equipment Intangible assets (goodwill) Other long-term assets Total assets a. Free cash flow b. Additional tax c. Free cash flow million million million $ 27,571 17,573 1,406 $ 8,592 521 2022 8,071 1,695 $ 6,376 BALANCE SHEET OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) 2021 $ 2,340 1,379 126 1,093 $ 4,938 $ 24,681 2,808 2,987 $ 35,414 $ 2,340 1,339 121 620 $ 4,420 Saved $ 22,839 2,657 3,103 Liabilities and Shareholders' Equity Current liabilities Debt due for repayment Long-term debt Other long-term liabilities Total liabilities Total shareholders' equity $ 33,019 Total liabilities and…arrow_forward

- The following information is provided for Sandhill Company and Indigo Corporation. (in $ millions) Sandhill Company Indigo Corporation Net income 2022 $125 $375 Net sales 2022 1540 4500 Total assets 12/31/20 1045 2010 Total assets 12/31/21 1220 3150 Total assets 12/31/22 1175 4070 What is Indigo's return on assets for 2022?arrow_forwardThe following information is provided for oriole company solve this questionarrow_forwardI want to correct answer general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education