Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Business 123 Introduction to Investments

May I please have the solution for the following questions?

Thank you

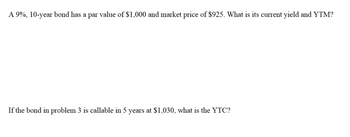

Transcribed Image Text:A 9%, 10-year bond has a par value of $1,000 and market price of $925. What is its current yield and YTM?

If the bond in problem 3 is callable in 5 years at $1,030, what is the YTC?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- A 20 year, 5% annual-pay bond has a par value of $1,000, what would this bond be trading for it it were being priced to yield 12% as annual rate? what is the method to solve this equation and answer ?arrow_forwardWhat is the duration of the following bond:$1,000par value,6%annual coupon, 4 years to maturity, and yield to maturity of6.5%? You will need your answer for the next question. In the prior question, what is the present value of the bond?arrow_forwardBond P is a premium bond with a 10 percent coupon. Bond D is a 6 percent coupon bond currently selling at a discount. Both bonds make annual payments, have a YTM of 8 percent, and have five years to maturity. (Assume par value of K1,000)(i) What is the current yield for Bond P and Bond D?(ii) If interest rates remain unchanged, what is the expected capital gains yield over the next year for Bond P? For Bond D?(iii)Explain your answers and the interrelationship among the various types of yields.arrow_forward

- Consider a 12%, 15 year bond that pays interest semiannually, and its current price is $675. What is the promise yield to maturity?arrow_forwardA bond with no expiration date has a face value of $10,000 and pays a fixed 10% interest. If the market price of the bond rises to $11,000, the annual yield approximately equals: 8%. 9% 10%. 11%. Can you please show your working out and explain the answer?arrow_forwardConsider a 10-year bond with a face value of $1,000 that has a coupon rate of 5.9%, with semiannual payments. a. What is the coupon payment for this bond? b. Draw the cash flows for the bond on a timeline. a. What is the coupon payment for this bond? The coupon payment for this bond is $ (Round to the nearest cent.)arrow_forward

- What is the YTM of a bond with 12 years to maturity, coupon rate of 10% paid annually, par value of $1,000, and a price of $987.25? What is the YTM of a bond with 12 years to maturity, coupon rate of 10% paid SEMIannually, par value of $1,000, and a price of $987.25?arrow_forwardThere is a callable 7% bond in 5 years at 106% of Par value. What is the price assuming it will be called, if similar bonds have a ROR of 8%? If it is not called, what will be its price at year 5?arrow_forwardA 14-year, $1000 par value Fingen bond pays 9 percent interest annually. The market price of the bond is $1100, and the market's required yield to maturity on a comparable-risk bond is 10 percent. (Use microsoft excel) a. Compute the bond's yield to maturity b. Determine the value of the bond to you, given your required rate of return. C. Should you purchase the bond?arrow_forward

- What is the duration of the following bond: $1,000 par value, 6% annual coupon, 4 years to maturity, and yield to maturity of 6.5%? You will need your answer for the next question.arrow_forwardWhat is the present value of a 10-year bond that has 4 years left-to-maturity (N), 7% annual required rate (I/Y) and 8% annual payment (PMT)? (Note: assume future value, FV, is $1000).arrow_forwardWhat is the Macaulay duration of a semi-annual bond with a coupon rate of 7 percent, five years to maturity, and a current price of $959? What is the modified duration? Duration is __. years. Modified duration is __ years.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning