Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide Answer

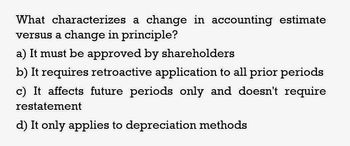

Transcribed Image Text:What characterizes a change in accounting estimate

versus a change in principle?

a) It must be approved by shareholders

b) It requires retroactive application to all prior periods

c) It affects future periods only and doesn't require

restatement

d) It only applies to depreciation methods

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which of the following would NOT be reflected in the income statement? Group of answer choices A.Correction of an error in previously issued financial statements B.Loss on disposal of a segment of a business C.Cumulative effect of a change in depreciation methods D.An extraordinary itemarrow_forwardA change in accounting policy requires what kind of adjustment to thefinancial statements? A. Current period adjustmentB. Prospective adjustmentC. Retrospective adjustmentD. Current and prospective adjustmentarrow_forwardExplain is a change in depreciation method a change in accounting principle, or is it a change in estimate?arrow_forward

- What is the purpose of recognizing depreciation on the financial statements? Is it designed to report PPE at fair value on the balance sheet?arrow_forwardExplain the accounting treatment in the event that an impairment review of a non-current asset which has been previously revalued with a revaluation surplus revealed that the non-current asset has suffered an impairment loss.arrow_forwardwhat happen when different depreciation methods are used in different financial year? Does it have any effect on the financial statements? if yes explain and if no explain in detailsarrow_forward

- A change in accounting estimate is accounted for by Prospective application Retrospective application Retrospective restatement Any of the abovearrow_forwardGenerally accepted methods of accounting for a change in accounting principle include O ncluding the cumulative effect of the change in current period net income. restating prior years' financial statements presented for comparative purposes. O making a prior period adjustment. O prospective changes.arrow_forward10. Changes in amortization method, useful life, and residual value are changes in accounting estimates and are accounted for a. prospectively. b. retrospectively. C. a or b d. not accountedarrow_forward

- If depreciation expense is not recorded how would that affect financial statements and decision-makers?arrow_forwardThe omission of an adjusting entry for the depreciation of equipment will have what effect on the financial statements?arrow_forwardChange in an accounting principle is accounted for O by a prior period adjustment. O by a retrospective application of a new accounting principle. O by constructive application of a new accounting principle.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning