FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Solve this question given option accounting

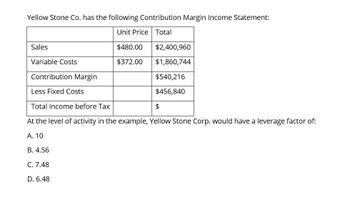

Transcribed Image Text:Yellow Stone Co. has the following Contribution Margin Income Statement:

Unit Price Total

Sales

$480.00

$2,400,960

Variable Costs

$372.00

$1,860,744

Contribution Margin

$540,216

Less Fixed Costs

$456,840

$

Total Income before Tax

At the level of activity in the example, Yellow Stone Corp. would have a leverage factor of:

A. 10

B. 4.56

C. 7.48

D. 6.48

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Zachia Ltd provides the following data regarding its four product lines: Product Sales mix Weighted average contribution margin per unit (WACMU) Fixed costs Desired profit after tax w Y 60 20 15 $13.7 $71,000 $33,950 The corporate tax rate is 30% Required Calculate the number of units of Product X that must be sold in order to achieve the desired after-tax profit?arrow_forward1. The following CVP income statements are available for ABC Company and XYZ Company. Sales Variable costs Contribution margin Fixed costs Operating income ABC Company CVP I/S for 2020 $500,000 300,000 200,000 180,000 $ 20,000 XYZ Company CVP I/S for 2020 $500,000 180,000 320,000 300,000 $ 20,000 med m (a) Compute the break-even point in dollars and the margin of safety ratio for each w ww w w w w h m w m ww m company. (b) Compute the degree of operating leverage for each company. (c) Assuming that sales revenue decreases by 20%, each a CVP income statement for w w w w ww w www w w m wm company. (d) Assuming that sales revenue increases by 20%, calculate the operating incomes of the two companies without w w w w ww med m www S WInoul preparing income statement. (Use DOL) nea ww warrow_forward1. The function of a company's product to produce output at the level of input use is Q = -1/3x3 + 9x3 + 70. If the input price x used is IDR. 800, - per unit, while the output price is IDR. 10, - per unit, specify: a. The amount of input that must be used by the company in orderto produce the amount of output that provides maximum finance! How much is the output? b. What is the average size of the company?arrow_forward

- What is the operating leverage?arrow_forwardHow much is Alibaba Auto’s residual income?arrow_forwardAssume company ABC’s only product is priced at K20 per unit and its variable costs amount to K15 per unit while fixed costs are K3,600.a. Compute the quantity required to achieve a profit of K2 per unit b. Define the term: Degree of Operating Leverage and how it can be computed c. What is the degree of operating leverage for this company at the level of output earning a profit of K3 per unit?arrow_forward

- 1. The following CVP income statements are available for ABC Company and XYZ Company. АВС Companу Sales Variable costs Contribution margin Fixed costs Operating income CVP I/S for 2020 $500,000 300,000 200,000 180,000 $ 20,000 XYZ Company CVP I/S for 2020 $500,000 180,000 320,000 300,000 $ 20,000 (a) Compute the break-even point in dollars and the margin of safety ratio for each company. (b) Compute the degree of operating leverage for each company. (c) Assuming that sales revenue decreases by 20%, prepare a CVP income statement for each company- (d) Assuming that sales revenue increases by 20%, calculate the operating incomes of the two companies without preparing income statement. (Use DOL) www www ww wwwarrow_forwardConsider the following cost and pricing data of ABC Corp. on its Product X:Price: P120.00.per unitProfit Contribution: P90.00Proposed additional Cost: P3 per unit (for quality improvement)Current Profits: P2.4 millionSales: 100,000 units. A. Assuming that average variable costs are constant at all output levels, findABC Corp.’s total cost function before the proposed change.B. Calculate the total cost function if the quality improvement is implemented. UNANSWERED SUB-PARTSC. Calculate ABC Corp.’s break-even output before and after the change, assuming it cannot increase its price.D. Calculate the increase in sales that would be necessary with the quality improvement to increase profits to P2.7 millionarrow_forward11. George Corporation has the following information for the current year: Selling price per unit Variable costs per unit 10.00 $ 6.00 $1,000.00 Fixed costs Required: Prepare a cost-volume-profit graph identifying the following items: Total fixed costs line Total variable costs line Total costs line Total revenues line Breakeven point in sales dollars Breakeven point in units Profit area Loss area А. В. С. D. E. F. G. Н. 6,000 5,000 4,000 3,000 2,000 1,000 100 200 300 400 500 Qty (# Units) 3 Dollars ($)arrow_forward

- 2. A company provided the following information: Sales Variable costs Fixed costs P500,000 P100,000 P200,000 | Required: A. What is the contribution margin ratio? 500,000 – 100,000 = 400,000 "Contribution Margin" 400,000/500,000 = 0.8 What is the level of sales in amount necessary to generate a profit of P40,000? C. What is the contribution margin ratio if the sales price is increased by 10%? Using the information in part C, what level of sales in amount is necessary to generate a profit of P40,000? D. B.arrow_forwardTom Company reports the following data: Sales Variable costs Fixed costs Determine Tom Company's operating leverage. Round your answer to one decimal place. $156,332 81,532 30,800arrow_forwarda. Given the following graphs, calculate the total fixed costs, variable costs per unit, andsales price for Firm A. Firm B’s fixed costs are $120,000, its variable costs per unit are$4, and its sales price is $8 per unit.b. Which firm has the higher operating leverage at any given level of sales? Explain.c. At what sales level, in units, do both firms earn the same operating profit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education