Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial Accounting Question please answer

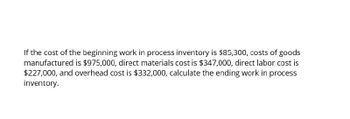

Transcribed Image Text:If the cost of the beginning work in process inventory is $85,300, costs of goods

manufactured is $975,000, direct materials cost is $347,000, direct labor cost is

$227,000, and overhead cost is $332,000, calculate the ending work in process

inventory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A production department within a company received materials of $10,000 and conversion costs of $10,000 from the prior department. It added material of $27,200 and conversion costs of $53,000. The equivalent units are 20,000 for material and 18,000 for conversion. What is the unit cost for materials and conversion?arrow_forwardThe costs per equivalent unit of direct materials and conversion in the Rolling Department of Kraus Steel Company are 750 and 120, respectively. The equivalent units to be assigned costs are as follows: The beginning work in process inventory on October 1 had a cost of 163,800. Determine the cost of completed and transferred-out production, the ending work in process inventory, and the total costs assigned by the Rolling Department.arrow_forwardA company has 100 units in ending work in process that are 40% complete after transferring out 750 Units. If the cost per unit is $5 for materials and $2.50 for conversion, what is the cost of units transferred out and in ending work in process inventory using the weighted-average method?arrow_forward

- The following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardThe cost of direct materials transferred into the Rolling Department of Kraus Company is 3,000,000. The conversion cost for the period in the Rolling Department is 462,600. The total equivalent units for direct materials and conversion are 4,000 tons and 3,855 tons, respectively. Determine the direct materials and conversion costs per equivalent unit.arrow_forwardThere were 2,400 units in ending work in process inventory that were 100% complete with regard to material and 25% complete with regard to conversion costs. Ending work in process inventory had a cost of $9,000 and a per-unit material cost of $2. What was the conversion cost per unit using the weighted-average method?arrow_forward

- Ellerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardThe following data show the units in beginning work in process inventory, the number of units started, the number of units transferred, and the percent completion of the ending work in process for conversion. Given that materials are added 50% at the beginning of the process and 50% at the end of the process, what are the equivalent units for material and conversion costs for each quarter using the weighted-average method? Assume that the quarters are independent.arrow_forwardThe following data show the units in beginning work in process inventory, the number of units started, the number of units transferred, and the percent completion of the ending work in process for conversion. Given that materials are added 50% at the beginning of the process and 50% at the end of the process, what are the equivalent units for material and conversion costs for each quarter using the weighted-average method? Assume that the quarters are independent.arrow_forward

- During the year, a company purchased raw materials of $77,321, and incurred direct labor costs of $125,900. Overhead is applied at the rate of 75% of the direct labor cost. These are the inventory balances: Compute the cost of materials used in production, the cost of goods manufactured, and the cost of goods sold.arrow_forwardThe following product Costs are available for Haworth Company on the production of chairs: direct materials, $15,500; direct labor, $22.000; manufacturing overhead, $16.500; selling expenses, $6,900; and administrative expenses, $15,200. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 7,750 equivalent units are produced, what is the equivalent material cost per unit? If 22,000 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardThe following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning