Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting

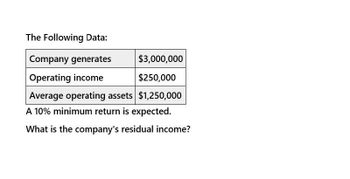

Transcribed Image Text:The Following Data:

Company generates

Operating income

$3,000,000

$250,000

Average operating assets $1,250,000

A 10% minimum return is expected.

What is the company's residual income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume a company had net operating income of $300,000, sales of $1,500,000, residual income of $130,000, and a minimum required rate of return on average operating assets of 14.00%. The company's average operating assets are closest to: Multiple Choice $1,214,286. $1,035,715. $1,157144. $1,200,000. 田arrow_forwardIf net operating income is $80,000, average operating assets are $640,000, and the minimum required rate of return is 11%, what is the residual income? Multiple Choice $89,600 $60,800 $9,600 $70,400arrow_forwardYour Company's residual income was $8,500. Net income was $170,000 and average operating assets were $850,000. What was the expected return percentage? Group of answer choices 17% 21% 19% 18% 20%arrow_forward

- Assume a company had net operating income of $300,000, sales of $1,500,000, average operating assets of $1,000,000, and a minimum required rate of return on average operating assets of 10.00%. The company's residual income is closest to: Multiple Choice $100,000. $200,000. $150,000. $250,000.arrow_forwardWhat is the Residual Income for Stevenson Corporation, given the following info: Invested Assets = $550,000 Sales = $660,000 Income from Operations = $99,000 Desired minimum rate of return = 15.0% O $16,500 O $17,280 O $14,850 O $0arrow_forwardRequired Complete the following table Sales Operating Income Average Operating Assets Return on Investment Minimum Required Rate of return % Residual Income A 400,000 160,000 20% 15% B Company 750,000 45,000 18% 50,000 C 600,000 150,000 12% 6,000arrow_forward

- Assume a company reported the following information: Sales Minimum required rate of return on average operating assets Turnover Return on investment (ROI) The residual income is closest to: Multiple Choice O O O $14,800. $10,800. $16,800. $20,800. $ 900,000 9.2% 1.5 12%arrow_forwardAssume a company had net operating income of $300,000, sales of $1,500,000, average operating assets of $1,000,000, and residual income of $130,000. The company's minimum required rate of return on average operating assets is closest to: Multiple Choice о о O о 15%. 16%. 17%. 18%.arrow_forwardCalculate the residual income with the following data: Controllable margin $202,596 Minimum Rate of Return 11% Average Operating Assets $3,092,235 Round to the nearest whole dollar, no decimal places. Note: Controllable margin is the same as net income for a segment with control over the costs. Minimum rate of return is the same as the cost of capital.arrow_forward

- The following information is available for Sunland Department Stores: Average operating assets Controllable margin Contribution margin Minimum rate of return What is Sunland's residual income? O $59200 O. $160800 O $10800 O $670000 $740000 70000 220000 8%arrow_forwardData Sales Net operating income Average operating assets Minimum required rate of return Enter a formula into each of the cells marked with a ? below Review Problem: Return on Investment (ROI) and Residual Income Compute the ROI Margin Turnover ROI Compute the residual income Average operating assets $25,000,000 $3,000,000 $10,000,000 25% Net operating income Minimum required return Residual income ? ? ? ? ? ? ?arrow_forwardThe following information is for Gable, Inc. and Harlowe, Inc. for the recent year. Harlowe, Inc. $800,000 200,000 600,000 400,000 $200,000 Sales Variable costs. Contribution margin Fixed costs Income from operations Gable, Inc. $800,000 400,000 400,000 200,000 $200,000 What total amount of net income will Harlowe, Inc. earn if it experiences a 10 percent increase in revenue?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning