Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please give me answer general accounting

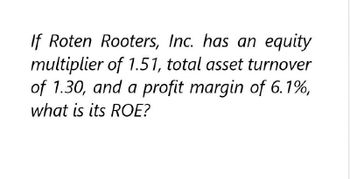

Transcribed Image Text:If Roten Rooters, Inc. has an equity

multiplier of 1.51, total asset turnover

of 1.30, and a profit margin of 6.1%,

what is its ROE?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If Roten Rooters, Inc., has an equity multiplier of 1.27, total asset turnover of 1.20, and a profit margin of 3.5 percent, what is its ROE?arrow_forwardNeed helparrow_forwardRed Fire has an equity multiplier of 1.6, a return on assets of 10.35 percent, and an asset turnover of .9. What is its ROE?arrow_forward

- O'Brien Inc. has the following data: r RF=5.00%; RP M=6.00%; and b=1.10. What is the firm's cost of equity from retained earnings based on the CAPM? A. 11.83% B. 13.22% C. 11.25% D. 8.93% E. 11.60%arrow_forwardGreen Fire has an equity multiplier of 1.35, a return on assets of 15 percent, a total asset turnover of 1.2, and a ROS of 12.5 percent, and a Debt/Equity Ratio of .35. What is its ROE?arrow_forwardNeed answerarrow_forward

- i need the answer quicklyarrow_forwardHelparrow_forwardYour company has a ROE of 18.5 which is very good for your industry. The company has an equity multiplier of 2.3 and a total asset turnover of 1.2. Both of these are higher than the industry average. What does this tell you about your company?arrow_forward

- Assume that you are a consultant to Broske Inc., and you have been provided with the following data: D1 = $0.80; P0 = $32.50; and g = 8.00% (constant). What is the cost of equity from retained earnings based on the DCF approach?arrow_forwardO'Brien Inc. has the following data: rRF = 5.00%; RPM = 6.00%; and b = 1.70. What is the firm's cost of equity from retained earnings based on the CAPM? 15.20% 15.05% 17.33% 13.68% 15.35%arrow_forwardAs the assistant to the CFO of Johnstone Inc., you must estimate its cost of common equity. You have been provided with the following data: D0 = $0.80; P0 = $22.50; and g = 8.00% (constant). Based on the DCF approach, what is the cost of common from retained earnings? Please show formula and answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT