Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

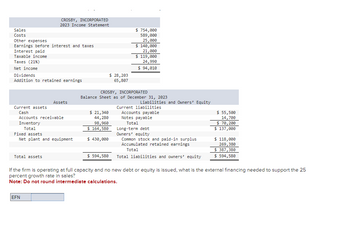

Transcribed Image Text:Sales

Costs

Other expenses

Earnings before interest and taxes

Interest paid

Taxable income

Taxes (21%)

Net income

Dividends

Addition to retained earnings

Current assets

Cash

CROSBY, INCORPORATED

2023 Income Statement

Accounts receivable

Inventory

Total

Total assets

Assets

Fixed assets

Net plant and equipment

EFN

$ 21,340

44,280

98,960

$ 164,580

$ 430,000

$ 28,203

65,807

$ 594,580

$ 754,000

589,000

25,000

$ 140,000

21,000

CROSBY, INCORPORATED

Balance Sheet as of December 31, 2023

$ 119,000

24,990

$ 94,010

Liabilities and Owners' Equity

Current liabilities

Accounts payable

Notes payable

Total

Long-term debt

Owners' equity

Common stock and paid-in surplus

Accumulated retained earnings

Total

Total liabilities and owners' equity

$ 55,500

14,700

$ 70,200

$ 137,000

$ 118,000

269,380

$ 387,380

$ 594,580

If the firm is operating at full capacity and no new debt or equity is issued, what is the external financing needed to support the 25

percent growth rate in sales?

Note: Do not round intermediate calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Use the below information to answer the following question. Sales Cost of goods sold Depreciation Income Statement For the Year Taxable income Taxes Earnings before interest $4,500 and taxes Interest paid Net income Dividends $900 Balance Sheet End-of-Year Cash Accounts receivable Inventory Total current assets Net fixed assets Total assets Accounts payable Long-term debt Common stock ($1 par value) Retained earnings O O O O Total Liab. & Equity 33 percent 40 percent 50 percent $28,400 60 percent 21,200 2,700 67 percent 850 $3,650 1,400 $2,250 $550 2,450 4,700 $7,700 What was the retention ratio? 16,900 $24,600 $ 2,700 9,800 8,000 4,100 $24,600arrow_forwardFinanced by: Paid-up: Share Capital Retained Earnings Reserves Long Term Liabilities Current Other payables Trade creditors Liabilities Accrued expense Barakah Company Balance Sheet as at 31st December 2019 100,000 245,500 30,000 Additional Information: i) ii) 600,000 155,500 75,000 830,500 25,000 375,500 1,231,000 Fixed Assets (net after depreciation) $ Land & Buildings Equipment Vehicles Fixtures & Fittings Current Assets Inventory Accounts Receivable Prepayments Cash at Bank Cash in Hand Work-in-Progress is one-sixth of the total Inventory. Prepayments are related to the rental of buildings. Bad debt is 5% for the year. Non-Muslim ownership is at 20%. 350,500 200,500 150,000 50,000 751,000 Required: Determine the zakat base and due for the company using: (a) Net Current Assets method; and (b) Net Invested Fund Method. 125,000 215,000 10,000 110,000 20,000 1,231,000arrow_forwardSales Revenue Less: Cost of Goods Sold Gross Profits Less: Operating Expenses Operating Profits Less: Interest Expense Net Profits Before Taxes Less: Taxes (40%) Net Profits After Taxes Assets Cash Income Statement Pulp, Paper and Paperboard, Inc. For the Year Ended December 31, 2019 Accounts receivable Inventories Total current assets Gross fixed assets Less: Accumulated depreciation Net fixed assets Total assets Liabilities and stockholders' equity Current liabilities Balance Sheet Pulp, Paper and Paperboard, Inc. December 31, 2019 Accounts payable Notes payable Accruals Total current liabilities Long-term debts Total liabilities Stockholders' equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Calculate the following: NP, GP $2,080,976 1,701,000 $ 379,976 273,846 $ 106,130 19,296 S 86,834 34,810 S 52,024 Current Ratio - Quick Ratio Receivable days - Payable days $ 95,000 237,000 243.000 $ 575,000 500,000 75.000 $ 425,000…arrow_forward

- THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In millions except per share data) Year Ended December 31, Net Operating Revenues Cost of goods sold Gross Profit Selling, general and administrative expenses 2019 2018 2017 37,266 S 34,300 S 36,212 14,619 13,067 13,721 22,647 21,233 22,491 12,103 11,002 12,834 458 1,079 1,902 Other operating charges 10,086 9,152 7,755 Operating Income Interest income 563 689 679 946 950 853 Interest expense Equity income (loss)-net 1,049 1,008 1,072 34 (1,674) (1,763) Other income (loss)- net 10,786 8,225 6,890 Income Before Income Taxes 1,801 1,749 5,607 Income taxes 8,985 6,476 1,283 Consolidated Net Income 42 35 Less: Net income (loss) attributable to noncontrolling interests Net Income Attributable to Shareowners of The Coca-Cola Company 65 8,920 S 6,434 S 1,248 2.09 S 1.51 $ 0.29 Basic Net Income Per Share 2.07 S 1.50 $ 0.29 Diluted Net Income Per Shard 4,276 4,259 4,272 Average Shares Outstanding- Basic 38 40 52 Effect of…arrow_forwardPhilly Corporation Philly Corporation Income Statement Comparative Account Information Relating to Operations For the Year Ended December 31, 2020 For the Year Ended December 31, 2020 2020 2019 Sales Revenue 680,000 Accounts receivable -net 78,000 65,000 Cost of goods sold 355,000 Prepaid insurance 5,000 6,000 Salaries expense 50,000 Equipment 111,100 122,400 Depreciation expense equipment 6,800 Accumulated Depreciation 13,800 14,600 Interest expense 8,000 Land 56,000 36,000 Bad debt expense 2,400 Accounts Payable 59,000 47,000 Loss on sale of equipment 4,800 Interest payable 600 1,500 Miscellaneous…arrow_forwardvas.msst Net sales Operating costs except depreciation Depreciation Earnings before interest and taxes (EBIT) Less interest Earnings before taxes (EBT) Taxes Net income Other data: Shares outstanding (millions) Common dividends (millions of $) Int rate on notes payable & L-T bonds Federal plus state income tax rate Year-end stock price $98,000 91.140 1,960 $4,900 960 $3,940 1,576 $2,364 500.00 $827.40 6% 40% $56.74 Refer to Exhibit 4.1. What is the firm's ROA? Do not round your intermediate calculations,arrow_forward

- Barakah Company Balance Sheet as at 31st December 2019 Financed by: Fixed Assets (net after depreciation) 2$ $ Paid-up: Share Capital Retained Earnings Reserves 350,500 200,500 150,000 50,000 Land & Buildings 600,000 155,500 75,000 830,500 Equipment Vehicles Fixtures & Fittings Long Term Liabilities 25,000 751,000 Current Assets 125,000 Accounts Receivable 215,000 10,000 110,000 20,000 1,231,000 Inventory Current Other payables Trade creditors Liabilities 100,000 245,500 Prepayments Cash at Bank Cash in Hand Accrued expense 30.000 375,500 1,231.000 Additional Information: i) Work-in-Progress is one sixth of the total Inventory. Prepayments is related to rental of buildings. ii) ii) Bad Debts is 5% for the year. iv) Non Muslim ownership is at 20%. Required: Determine the zakat base and due for the company using: (a) Net Current Assets method; and (b) Net Invested Fund Method.arrow_forwardLong-term assets: Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: $104,000 0 34,500 490,000 Notes payable Stockholders' equity: Common stock 590,000 590,000 Retained earnings 1,815,500 1,754,200 Total liabilities and stockholders' equity $3,034,000 $2,948,000 Earnings per share for the year ended December 31, 2024, are $1.25. The closing stock price on December 31, 2 Required: Calculate the following profitability ratios for 2024. (Use 365 days a year. Round your final answers to 1 decima Profitability Ratios 1. Gross profit ratio 2. Return on assets 3. Profit margin 4. Asset turnover 5. Return on equity 6. Price-earnings ratio 38.6% 42.3 % 14.4 % 2.9 times 53.2 % 17.1 1,095,000 (398,000) $3,034,000 1,095,000 (199,000) $2,948,000 $80,000 3,900 29,900 490,000arrow_forwardSales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes. Income tax expense Net income Assets Current assets Long-term investments Plant assets, net Total assets Sin Comparative Income Statements For Years Ended December 31 2021 $ 420,027 252,856 167,171 59,644 37,802 97,446 69,725 12,969 $ 56,756 Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity Assets Current assets Long-term investments Plant assets, net. Total assets Liabilities and Equity Current liabaties Common stock Other paid-in capital Retained earnings Total liabilities and equity 2020 $ 321,775 202,718 KORBIN COMPANY Comparative Balance Sheets December 31 2021 119,057 44,405 28,316 72,721 46,336 9,499 $ 36,837 $ 55,286 0 102,674 $ 157,960 2020 3. Complete the below table to calculate the balance sheet data in trend percents with 2019 as answers to 2 decimal places.) 111.77 % 0.00 $ 37,003 700…arrow_forward

- 4arrow_forwardIncome Statement Sales revenue Cost of goods sold Gross profit Operating expenses (including interest on bonds) Pretax income Income tax Net income Balance Sheet Cash Accounts receivable (net) Merchandise inventory Prepaid expenses Property and equipment (net) Total assets Accounts payable Income taxes payable Bonds payable (interest rate: 10%) Common stock ($10 par value, 10,000 shares outstanding) Retained earnings Total liabilities and stockholders' equity Year 2 $453,000 250,000 203,000 167,000 36,000 10,800 $ 25,200 $ 6,800 42,000 25,000 200 130,000 $204,000 $ 17,000 1,000 70,000 100,000 16,000 $204,000 Year 1 $447,000 241,000 206,000 168,000 38,000 11,400 $ 26,600 $ 3,900 29,000 18,000 100 120,000 $171,000 $ 18,000 1,000 50,000 100,000 2,000 $171,000 Required: Interpret each element of the ratio analysis separately. Ensure accuracy by analyzing each ratio individually!arrow_forwardView Policies Current Attempt in Progress For its fiscal year ending October 31, 2025, Cullumber Corporation reports the following partial data. Income before income taxes Income tax expense (20% × $390,600) Income from continuing operations Loss on discontinued operations Net income $502,200 78,120 424,080 111,600 $312,480 The loss on discontinued operations was comprised of a $46,500 loss from operations and a $65,100 loss from disposal. The income tax rate is 20% on all items. (a) Prepare a correct partial income statement, beginning with income before income taxes. CULLUMBER CORPORATION Income Statement (Partial)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education