FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

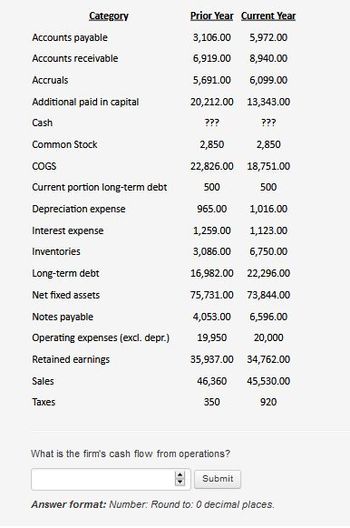

Transcribed Image Text:Category

Accounts payable

Accounts receivable

Accruals

Additional paid in capital

Cash

Common Stock

COGS

Current portion long-term debt

Depreciation expense

Interest expense

Inventories

Long-term debt

Net fixed assets

Notes payable

Operating expenses (excl. depr.)

Retained earnings

Sales

Taxes

Prior Year Current Year

3,106.00

5,972.00

6,919.00

8,940.00

5,691.00

6,099.00

20,212.00

13,343.00

???

???

2,850

18,751.00

500

2,850

22,826.00

500

965.00

1,016.00

1,259.00

1,123.00

3,086.00 6,750.00

16,982.00 22,296.00

75,731.00 73,844.00

4,053.00 6,596.00

19,950 20,000

35,937.00

34,762.00

46,360 45,530.00

350

920

What is the firm's cash flow from operations?

Submit

Answer format: Number: Round to: 0 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial Balance Sheet cash Account Receivable Inventories Investment Depreciable assets Accumulated depreciation Account Payable Capital Stock Retained Earnings Unappropriated Beginning of Year $41,200 65,000 40,000 10,000 198,000 (20,000) 30,000 150,000 154,200 End of Year ? $35,700 53,062 45,000 10,000 208,000 (40,000) 35,000 150,000arrow_forwardThe following data are taken from the records of Grouper Company. Cash Current assets other than cash Long-term debt investments Plant assets Accumulated depreciation Current liabilities Bonds payable Common stock Retained earnings Additional information: 1. 2. 3. 4. 5. December 31, December 31, 2025 2024 $15,100 84,300 10,000 334,300 $443,700 $20,100 39,900 74,800 255,400 53,500 $443,700 $8,000 60,600 52,500 214,900 $336,000 $40,400 21,800 -0- 255,400 18,400 $336,000 Held-to-maturity debt securities carried at a cost of $42,500 on December 31, 2024, were sold in 2025 for $34,300. The loss (not unusual) was incorrectly charged directly to Retained Earnings. Plant assets that cost $50,300 and were 80% depreciated were sold during 2025 for $8,000. The loss was incorrectly charged directly to Retained Earnings. Net income as reported on the income statement for the year was $57,100. Dividends paid amounted to $11,740. Depreciation charged for the year was $19,940.arrow_forwardCurrent position analysis the following data were taken from the balance sheet of Nilo company at the end of the two recent Fisher years; Current assets: Cash Marketable securities Account and note receivable (net) Inventories Prepaid expenses Total Current assets Current liabilities Account and notes payable ( short-term) Accrued liabilities Total Current liabilities Current year $417,000 cash 483,100 Marketable securities 197,700 acct not receivable ( net) 845,500 inventory 435,500 prepaid 2,379,000 Total Current assets Previous year $339,200 cash 381,600 Marketable securities 127,200 access note receivable ( net) 614,300 inventory 392,700 prepaid expenses 1,855,000 Total Current assets Current year Current liabilities Short term $353,800 Accrued liabilities 256,200 Total Current liabilities $610,000 Previous year Short term $371,000 Accrued liabilities 159,000 Total Current liabilities $530,000 A. Determine for each year 1 capital, 2 the current ratio,…arrow_forward

- What's the total asset turnover ratio of this company? Assets: Cash and marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Fixed assets Less: accum. depr. Net fixed assets Total assets Liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term debt Owner's equity (1 million shares of common stock outstanding) Total liabilities and owner's equity Net sales (all credit) Less: Cost of goods sold Selling and administrative expense Depreciation expense Interest expense Earnings before taxes Income taxes Net income 1.41 2.33 O 4.45 1.11 8,000,000 (2,075,000) $600,000 900,000 1,500,000 75,000 $3,075,000 $5,925.000 $9,000,000 $800,000 700,000 50,000 $1,550,000 2,500,000 4,950,000 $9,000,000 $10,000,000 (3,000,000) (2,000,000) (250,000) (200,000) 4,550,000 (1,820,000) $2,730,000arrow_forwardThe following are the Financial Statements of Louise Company: Loulse Company Statement of Financial Position As of December 31, 2015, and 2016 2015 2016 ASSETS Current Assets Cash Accounts Receivables, net Merchandise Inventory Marketable Securities 198,000 30,000 15,000 20,000 10,000 273,000 270,000 40,000 10,000 20,000 8.000 348,000 Prepaid Expenses Total Current Assets Non-Current Assets Land Building, net Machinery, net Fumiture and Fixtures, net Long-term Investments Total Non-Current Assets 500,000 390,000 100,000 50,000 100,000 L140.000 500,000 380,000 90,000 45,000 80,000 1,095,000 TOTAL ASSETS 1413.000 1.443.000arrow_forwardCalculate net debt. Cash and cash equivalents Short term borrowings Long term borrowings Commercial paper (liability) Capital / finance lease Accounts receivable Total liabilities Inventory Select one: 2,108.0 2,103.0 2,025.0 14,132.0 3,176.0 419.0 2,883.0 331.0 1,651.0 83.0 17,308.0 5.0arrow_forward

- 4arrow_forwardBALANCE SHEET INCOME STATEMENT ($ in millions) ($ in millions) ASSETS Cash & Marketable Securities LIABILITIES Revenue Cost Of Goods Sold 28,681. 10 Accounts Payable Salaries Payable 449.90 1,611.20 20,768.80 Accounts Receivable 954.80 225.20 Gross Profit 7.912.30 Inventories 3,645.20 Other Current Liabilities 1,118.80 Operating Expenses: Selling, General & Admin. Depreciation Operating income Other Current Assets Total Current Assets 116.60 5,166.50 Total Current Liabilities 2,955.20 5,980.80 Other Liabilities 693.40 307.30 1,688.90 1,129.70 2,348.40 (575.60) Machinery & Equipment Land 1,624.20 Total Liabilities 3,648.60 Buildings Depreciation Property, Plant & Equip. - Net Other Long Term Assets Total Long-Term Assets Interest SHAREHOLDER'S EQUITY Other Expense (Income) (13.10) 4,591.40 120.90 828.50 5.401.70 1,637.30 618.10 1,019.20 Common Stock Income Before Taxes Retained Earnings Total Shareholder's Equity Income Taxes 4,712.30 6,230.20 Net Income Total Assets 9,878.80 Total…arrow_forwardK. Jackson Corporation Assets Cash Accounts receivable Inventory Net fixed assets Total assets Liabilities and owners' equity. Accounts payable ST Notes payable Long-term debt Owners' Equity Total liabilities and owner's equity Balance Sheet $250,000 450.000 500,000 2.100,000 $3,300.000 $100.000 450.000 1,050,000 1,700.000 $3,300,000 Income Statement Sales (all credit) Cost of goods sold Operating expense Interest expense Income taxes Net income $8,000,000 (4.000.000) (2,900,000) (150,000) (380,000) $570,000 Based on the information for K. Jackson Corporation, the current and acid-test ratios are, respectively. OA2.37 and 1.39. OB2 37 and 1.27 OC2 18 and 1.39 OD.2 18 and 1.27 OE None of the above.arrow_forward

- Revenues Expenses Cost of goods sold Selling expenses General and administrative expenses Interest expense Income tax expense Total expenses Net income Assets Current assets Cash Marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Plant and equipment (net) Intangibles Total assets Liabilities and Stockholders' Equity Liabilities Current liabilities Accounts payable Other Total current liabilities Bonds payable Total liabilities Year 2 $219,100 Total liabilities and stockholders' equity 124, 400 19,700 10,000 1,700 20, 100 175,900 $ 43,200 $ 38,500 15,800 54,300 64,300 118,600 Stockholders' equity Common stock (43,000 shares) Retained earnings Total stockholders' equity 159,000 $277,600 $ 4,800 $ 7,200 2,800 2,800 36,600 31, 100 101,600 94, 100 3,900 2,900 149,700 138, 100 106,400 106,400 21,500 0 $277,600 $244,500 Year 1 $182,800 114,900 44, 100 101, 100 17,700 9,000 1,700 16,900 146,400 $36,400 $ 34,200 16, 200 50,400 65,300 115,700 114,900…arrow_forwardWilmington Corporation's liabilities to equity ratio in Year 7 ? Wilmington Corporation's total debt to equity ratio in Year 7? Wilmington Corporation's times interest earned ratio in Year 7 ? Wilmington Corporation's cash flow from operations to total debt ratio in Year 7?arrow_forwardPrepare a blance sheetarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education