Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

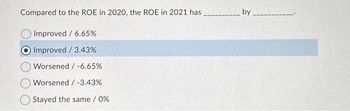

Transcribed Image Text:Compared to the ROE in 2020, the ROE in 2021 has

Improved / 6.65%

Improved / 3.43%

Worsened / -6.65%

Worsened / -3.43%

Stayed the same / 0%

by

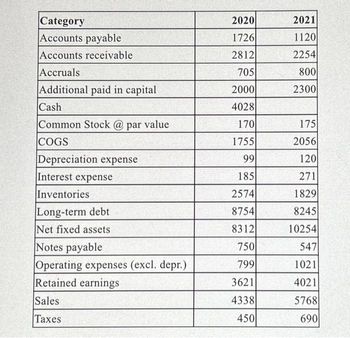

Transcribed Image Text:Category

Accounts payable

Accounts receivable

Accruals

Additional paid in capital

Cash

Common Stock @ par value

COGS

Depreciation expense

Interest expense

Inventories

Long-term debt

Net fixed assets

Notes payable

Operating expenses (excl. depr.)

Retained earnings

Sales

Taxes

2020

1726

2812

705

2000

4028

170

1755

99

185

2574

8754

8312

750

799

3621

4338

450

2021

1120

2254

800

2300

175

2056

120

271

1829

8245

10254

547

1021

4021

5768

690

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- critically analyze the balance sheet of XYZ corporation.arrow_forwardFind BEP.arrow_forwardII. The following is a comparative balance sheet of ABC Co. for December 31, 2022 and 2021: Cash and cash equivalents Accounts receivable Inventories Investment in bonds at amortized cost Equipment Accumulated depreciation Total Assets Accounts payable Bonds payable, due 2025 Ordinary stock, P20 par Share premium Retained earnings Total Liabilities and Equity Additional information: . 2022 250,000 327,600 822,000 0 . 2,400,000 (700,000) 3,099,600 359,000 0 1,800,000 280,000 660,600 3,099,600 2021 220,000 356,000 780,000 200,000 2,040,000 (760,000) 2,836,000 • Net income for 2022, P545,600. Depreciation reported on income statement, P140,000. Fully depreciated equipment, no salvage value, was scrapped. Equipment was purchased for P560,000. Bonds of P400,000 were retired at their face value. 281,000 400,000 1,600,000 200,000 355,000 2,836,000 10,000 shares of ordinary stock were issued for cash of P28 per share. Cash dividends declared and paid, P240,000 Investment in bonds with carrying…arrow_forward

- Current assets Cash RUNNER INC. Statement of Financial Position (partial) December 31 (in thousands) 2021 Trading investments Accounts receivable, net Inventory Prepaid expenses Total current assets Total current liabilities $ 30 56 675 627 41 $ 1,429 $ 867 $ 2020 92 $ 60 589 522 52 $ 1,315 $ 819 2019 60 40 492 575 29 $ 1,196 $ 755arrow_forwardHow to calculate gross profit percentage will be mItanedarrow_forwardplease Complete all requirement and Do not give solution in image format Otherwise down votearrow_forward

- Current assets: Cash Short-term investments Accounts receivable Inventories Other current assets Total current assets Long-term investments Property, plant, and equipment, net Other noncurrent assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable Accrued expenses Unearned revenue Short-term debt Total current liabilities Long-term debt Other noncurrent liabilities Total liabilities Stockholders' equity: Common stock ($0.00001 par value) Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and shareholders' equity $ 48,844 51,713 22,926 4,106 35,230 162,819 105,341 37,378 32,978 $ 338,516 $ 46,236 43,700 5,522 10,260 105,718 91,807 50,503 248,028 1 45,173 45,314 90,488 $ 338,516arrow_forwardplease answer within 30 minutes..arrow_forwardAssets: Cash Accounts receivable Inventories Total current assets Net fixed assets Total assets Liabilities and equity: Accounts payable Notes payable Total current liabilities Long-term debt Common stock Retained earnings Total common equity Total liabilities and equity $ $ $ $ $ $ $ 2015 200,000 864,000 2,000,000 3,064,000 6,000,000 9,064,000 1,400,000 1,600,000 3,000,000 2,400,000 3,000,000 664,000 3,664,000 9,064,000 2014 170,000 700,000 1,400,000 $2,270,000 5,600,000 $7,870,000 $ $1,090,000 1,800,000 $2,890,000 2,400,000 2,000,000 580,00 $2,580,000 $7,870,000 If a firm has EBIT = 1,350,000 and 40% Tax rate, calculate Free Cash Flow.arrow_forward

- Monty Corp.’s comparative balance sheets are as follows. Monty Corp.Comparative Balance SheetsDecember 31 2022 2021 Cash $ 16,700 $ 17,500 Accounts receivable 25,100 22,300 Investments 19,850 15,850 Equipment 60,050 69,950 Accumulated depreciation—equipment (14,150 ) (10,100 ) Total $107,550 $115,500 Accounts payable $ 14,750 $ 11,150 Bonds payable 11,000 30,000 Common stock 49,900 45,300 Retained earnings 31,900 29,050 Total $107,550 $115,500 Additional information: 1. Net income was $18,250. Dividends declared and paid were $15,400. 2. Equipment which cost $9,900 and had accumulated depreciation of $2,000 was sold for $3,400. 3. No noncash investing and financing activities occurred during 2022. Prepare a statement of cash flows for…arrow_forwardWhich of the following is TRUE? O An American call option on a stock should never be exercised early O An American call option on a stock should be exercised early when dividends are expected O It can sometimes be optimal to exercise early an American call option on a stock even when no dividends are expected and there is no liquidity or portfolio rebalancing need. O An American call option on a stock should never be exercised early when no dividends are expected << Previous Next ▸arrow_forward6arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education