FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

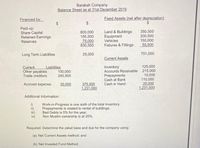

Transcribed Image Text:Barakah Company

Balance Sheet as at 31st December 2019

Financed by:

Fixed Assets (net after depreciation)

2$

$

Paid-up:

Share Capital

Retained Earnings

Reserves

350,500

200,500

150,000

50,000

Land & Buildings

600,000

155,500

75,000

830,500

Equipment

Vehicles

Fixtures & Fittings

Long Term Liabilities

25,000

751,000

Current Assets

125,000

Accounts Receivable 215,000

10,000

110,000

20,000

1,231,000

Inventory

Current

Other payables

Trade creditors

Liabilities

100,000

245,500

Prepayments

Cash at Bank

Cash in Hand

Accrued expense

30.000

375,500

1,231.000

Additional Information:

i)

Work-in-Progress is one sixth of the total Inventory.

Prepayments is related to rental of buildings.

ii)

ii)

Bad Debts is 5% for the year.

iv)

Non Muslim ownership is at 20%.

Required: Determine the zakat base and due for the company using:

(a) Net Current Assets method; and

(b) Net Invested Fund Method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The following account balances were taken from the 2021 adjusted trial balance of the Bowler Corporation: sales revenue, $325,000; cost of goods sold, $168,000; salaries expense, $45,000; rent expense, $20,000; depreciationexpense, $30,000; and miscellaneous expense, $12,000. Prepare an income statement for 2021.arrow_forwardFor which of the following sources of income would the entire amount be required to be included in a business’ gross income and taxed in the current year? a. Prepaid rent received by a cash-method company b. Life insurance proceedsc. State and local bond interest d. None of the abovearrow_forwardThe income statement of Mid-South Logistics includes $12 million for amortized prior service cost. Does MidSouth Logistics prepare its financial statements according to U.S. GAAP or IFRS? Explainarrow_forward

- The balance sheet of Mi-T-M reports total assets of $400,000 and $450,000 at the beginning and end of the year, respectively. The return on assets for the year is 10%. What is Mi-T-M's net income for the year? A. $42,500 B. $85,000 C. $45,000 D. $4,250,000arrow_forwardThe following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Please see the attachment for details: a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place.b. What conclusions can be drawn from these data as to the company’s abilityto meet its currently maturing debts?arrow_forwardAssuming that a business total asset is 1/3 liabilities which includes an account payable of 50,000 how much is the total liabilities if the total equity balance is thrice as much as the accounts payable balance?arrow_forward

- If total liabilities amount to P400,000 which 1⁄3 of the total assets, what is the amount of the residual interest of the business?arrow_forwardXYZ Company reported the following information for the year: Net Sales $1,000,000, Cost of goods sold $500,000, Selling expenses $200,000, General and administrative expenses $100,000, and Interest expense $50,000. Calculate the company's Earnings Before Interest and Taxes (EBIT) and Net Income.arrow_forwardThe financial statements for Castile Products, Incorporated, are given below: Castile Products, Incorporated Balance Sheet December 31 Assets Current assets: Cash Accounts receivable, net Merchandise inventory Prepaid expenses Total current assets Property and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Bonds payable, 10% Total liabilities. Stockholders equity Connon stock, $5 per value. Retained earnings Total stockholders equity Total liabilities and stockholders' equity Castile Products, Incorporated Income Statement For the Year Ended December 31 Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Interest expense Net incone before taxes Income taxes (30%) Net income $24,000 230,000 370,000 9,000 633,000 860,000 $1,493,000 $ 290,000 320,000 610,000 $150,000. 733,000 883,000 $1,493,000 $ 2,290,000 1,220,000 1,070,000 580,000 490,000 32,000 458,000 137,400 $ 320,600arrow_forward

- Clayton Industries has the following account balances: Current assets Noncurrent assets The company wishes to raise $45,000 in cash and is considering two financing options: Clayton can sell $45,000 of bonds payable, or it can issue additional common stock for $45,000. To help in the decision process, Clayton's management wants to determine the effects of each alternative on its current ratio and debt-to-assets ratio. Required a-1. Compute the current ratio for Clayton's management. Note: Round your answers to 2 decimal places. Currently If bonds are issued If stock is issued $ 22,000 Current liabilities 77,880 Noncurrent liabilities stockholders' equity Currently If bonds are issued If stock is issued Current Ratio 2.44 to 1 a-2. Compute the debt-to-assets ratio for Clayton's management. Note: Round your answers to 1 decimal place. Bonds Stock to 1 to 1 Debt to Assets Ratio Additional Retained Earnings $ 9,000 50,000 48,888 % % % b. Assume that after the funds are invested, EBIT…arrow_forwardSouthern Style Realty has total assets of $485,390, net fixed assets of $250,000, current liabilities of $23,456, and long-term liabilities of $148,000. What is the total debt ratio? Can you provide the formula?arrow_forwardThis is the financial position of Hospital AMIH, Inc. regarding the repayment of its debts. These are the most relevant data of its financial statements: Total revenues $ 245,000 Total expenses $ 145,000 Depreciation $ 10,000 Changes in receivable accounts +$ 50,000 Changes in inventory ($ 20,000) Changes in accounts payable ($ 25,000) Total current liabilities $ 30,000 Total long-term debt $ 45,000 cash flow (total margin + depreciation expense) + interest expense/principal payment + interest expense Calculate the operating cash flow.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education