FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

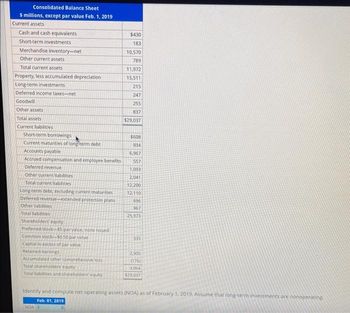

Transcribed Image Text:Consolidated Balance Sheet

$ millions, except par value Feb. 1, 2019

Current assets

Cash and cash equivalents

Short-term investments

Merchandise inventory-net

Other current assets

Total current assets

Property, less accumulated depreciation

Long-term investments

Deferred income taxes-net

Goodwill

Other assets

Total assets

Current liabilities

Short-term borrowings

Current maturities of long-term debt

Accounts payable

Accrued compensation and employee benefits

Deferred revenue

Other current liabilities

Total current liabilities

Long-term debt, excluding current maturities

Deferred revenue-extended protection plans

Other liabilities

Total liabilities

Shareholders equity

Preferred stock-$5 par value, none issued

Common stock-$0.50 par value

Capital in excess of par value

Retained earnings

Accumulated other comprehensive loss

Total shareholders' equity

Total liabilities and shareholders equity

$430

183

10,570

789

11,972

15,511

215

247

255

837

$29,037

NOA S

$608

934

6,967

557

1,093

2,041

12,200

12,110

696

967

25,973

335

2,905

(176)

3,064

$29,037

Identify and compute net operating assets (NOA) as of February 1, 2019. Assume that long-term investments are nonoperating

Feb. 01, 2019

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Given the data in the following table, accounts receivable in 2023 was…arrow_forwardDec. 31, 2020 Dec. 31, 2019 Assets Current assets: Cash and cash equivalents $248,005 $419,465 Accounts receivable 38,283 34,839 Inventory 15.043 15,332 Prepaid expenses and other current assets 39,965 34,795 Income tax receivable 58,152 16,488 Investments 415,199 338,592 Total current assets 814.647 859,511 Property, plant, & equipment, net 1,217.220 1,106,984 Long-term investments 622,939 496.106 Other assets 70,260 64,716 Total assets $2,725,066 $2,527,317 Liabilities and Shareholders' Equity Current liabilities: Accounts payable $85,709 $69,613 Accrued payroll and benefits 64,958 73,894 Accrued liabilities 129,275 102,203 Total current liabilities 279,942 245,710 Deferred liabilities 284.267 240,975 Other liabilities 32.883 28,263 Total liabilities 597,092 514,948 Shareholders' equity: Common stock 358 354 Additional paid-in capital 954,988 861.843 Retained earnings 1,172.628 1,150,172 Total shareholders' equity 2,127,974 2,012.369 Total liabilities and shareholders' equity…arrow_forwardFinanced by: Paid-up: Share Capital Retained Earnings Reserves Long Term Liabilities Current Other payables Trade creditors Liabilities Accrued expense Barakah Company Balance Sheet as at 31st December 2019 100,000 245,500 30,000 Additional Information: i) ii) 600,000 155,500 75,000 830,500 25,000 375,500 1,231,000 Fixed Assets (net after depreciation) $ Land & Buildings Equipment Vehicles Fixtures & Fittings Current Assets Inventory Accounts Receivable Prepayments Cash at Bank Cash in Hand Work-in-Progress is one-sixth of the total Inventory. Prepayments are related to the rental of buildings. Bad debt is 5% for the year. Non-Muslim ownership is at 20%. 350,500 200,500 150,000 50,000 751,000 Required: Determine the zakat base and due for the company using: (a) Net Current Assets method; and (b) Net Invested Fund Method. 125,000 215,000 10,000 110,000 20,000 1,231,000arrow_forward

- 6d photo, thank you.arrow_forwardanswer in text form please (without image)arrow_forwardUse the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Balance Sheets for 2020 & 2021.arrow_forward

- Please calculate the debts to assets ratio for the years 2022 and 2021, also please show your work.arrow_forwardPlease do not provide answer in image format thank youarrow_forwardWildhorse Inc., had the following condensed balance sheet at the end of operations for 2019. Cash Current assets other than cash Equity invesments Plant assets (net) Land 1. During 2020, the following occurred. 2. 3. 4. 5. 6. 7. WILDHORSE INC. BALANCE SHEET DECEMBER 31, 2019 $8,400 28,800 8. 20,000 67,100 40,300 $164,600 Current liabilities Long-term notes payable Bonds payable Common stock Retained earnings A tract of land was purchased for $8,900. Bonds payable in the amount of $15,000 were redeemed at par. An additional $9,900 in common stock was issued at par. Dividends totaling $9,400 were paid to stockholders. Net income was $30,600 after allowing depreciation of $13,300. Land was purchased through the issuance of $22,800 in bonds. $15,200 25,500 25,000 75,000 23,900 $164,600 Wildhorse Inc. sold part of its investment portfolio for $12,900. This transaction resulted in a gain of $1,900 for the company. No unrealized gains or losses were recorded on these investments in 2020. Both…arrow_forward

- Please help mearrow_forwardDetermine the WACC, and determine whether the company generated value or not, and what the amount was for both years ANSWER 2020 2021 WACC EVA ROICarrow_forwardMaples group Comparative Balance Sheet December 31, 2020 and 2019 2020 2019 Increase/(Decrease Assets Cash and cash equivalent 64,990 61,895 ? Accounts receivable 95,100 88,500 ? Inventories 72,500 79,855 ? Fixed Assets, net ? ? ? Total Assets 442,590 395,800 46,790 Liabilities Accounts payable 45,000 58,350 ? Accrued liabilities ? ? ? Long –term notes payable 99,500 128,550 ? Stockholder’ Equity: Common Stock 143,050 105,110 37,940 Retained earnings 43,540 24,290 19,250 Total liabilities and stockholders’ equity 442, 590 395, 800…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education