FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

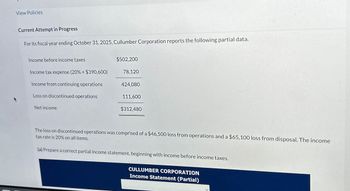

Transcribed Image Text:View Policies

Current Attempt in Progress

For its fiscal year ending October 31, 2025, Cullumber Corporation reports the following partial data.

Income before income taxes

Income tax expense (20% × $390,600)

Income from continuing operations

Loss on discontinued operations

Net income

$502,200

78,120

424,080

111,600

$312,480

The loss on discontinued operations was comprised of a $46,500 loss from operations and a $65,100 loss from disposal. The income

tax rate is 20% on all items.

(a) Prepare a correct partial income statement, beginning with income before income taxes.

CULLUMBER CORPORATION

Income Statement (Partial)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Compute Measures for DuPont Disaggregation Analysis Use the information below for 2018 for 3M Company to answer the requirements ($ millions) 2018 2017 Sales $32,765 Net income, consolidated 5,363 Net income attributable to 3M shareholders 5,349 Assets 36,500 $37,987 Total equity 9,848 11,622 Equity attributable to 3M shareholders 9,796 11,563 d. Compute adjusted ROA (assume a statutory tax rate of 22% and pretax net interest expense of $207).Round answer to two decimal places (ex: 0.12345 = 12.35%)arrow_forwardAssume a company had net income of $61,000. It provided the following excerpts from its balance sheet: This Year Last Year Current assets: Accounts receivable $ 46,000 $ 46,000 Inventory $ 53,000 $ 53,000 Current liabilities: Accounts payable $ 44,000 $ 49,000 Income taxes payable $ 10,000 $ 14,000 If the company did not sell any noncurrent assets during the period and its depreciation charges for the period were $21,000, then based solely on the information provided, the net cash provided by operating activities would be: Multiple Choice $49,000. $31,000. $73,000. $91,000.arrow_forwardForecast an Income StatementSeagate Technology reports the following income statement for fiscal 2019. SEGATE TECHNOLOGY PLC Consolidated Statement of Income For Year Ended June 28, 2019, $ millions Revenue $20,780 Cost of revenue 14,916 Product development 1982 Marketing and administrative 906 Amortization of intangibles 46 Restructuring and other, net (44) Total operating expenses 17,806 Income from operations 2,974 Interest income 168 Interest expense (448) Other, net 50 Other expense, net (230) Income before income taxes 2,744 (Benefit) provision for income taxes (1,280) Net income $4,024 Forecast Seagate’s 2020 income statement assuming the following income statement relations ($ millions). Revenue growth 5% Cost of revenue 71.8% of revenue Product development 9.5% of revenue Marketing and administrative 4.4% of revenue Amortization of intangibles No change Restructuring and other, net $0 Interest income No change…arrow_forward

- For its fiscal year ending October 31, 2022, Blue Corporation reports the following partial income statement data. Income before income taxes Income tax expense (40% × $603,000) Income from continuing operations Gain from discontinued operations Net income $603,000 241,200 361,800 134,000 $495,800 The gain from discontinued operations consists of two parts: a $67,000 loss from operations and a $201.000 gain from the disposal of the operation. The income tax rate is 40% on all items. Prepare a correct income statement, beginning with income before income taxes. BLUE CORPORATION Income Statement (Partial) 6A LA $arrow_forwardsavitaarrow_forwardThe income statement disclosed the following items for the year: Depreciation expense $40,700 Gain on disposal of equipment 23,760 Net income 254,700 The changes in the current asset and liability accounts for the year are as follows: Increase (Decrease) Accounts receivable $6,340 Inventory (3,610) Prepaid insurance (1,350) Accounts payable (4,300) Income taxes payable 1,350 Dividends payable 950 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from (used for) operating activities: Adjustments to reconcile net income to net cash flows from (used for) operating activities: Changes in current operating assets and liabilities: Net cash flows from operating activities b. Why is net cash flows from operating activities different than net income? Cash flows…arrow_forward

- The income statement disclosed the following items for the year: Depreciation expense $57,400 Gain on disposal of equipment 33,510 Net income 494,300 The changes in the current asset and liability accounts for the year are as follows: Increase(Decrease) Accounts receivable $8,950 Inventory (5,090) Prepaid insurance (1,910) Accounts payable (6,070) Income taxes payable 1,910 Dividends payable 1,340 a. Prepare the “Cash flows from operating activities” section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.arrow_forwardIncome Statement, Lower Portion At the beginning of 2019, Cameron Company's retained earnings was $239,400. For 2019, Cameron has calculated its pretax income from continuing operations to be $158,400. During 2019, the following events also occurred: 1. During July, Cameron sold Division M (a component of the company). It has determined that the pretax income from the operations of Division M during 2019 totals $46,800 and that a pretax loss of $47,600 was incurred on the sale of Division M. 2. Cameron had 28,000 shares of common stock outstanding during all of 2019. It declared and paid a $2 per share cash dividend on this stock. Required: Assuming that all the pretax items are subject to a 30% income tax rate: 1. Complete the lower portion of Cameron's 2019 income statement, beginning with "Pretax Income from Continuing Operations." Round earnings per share computations to two decimal places. CAMERON COMPANY Partial Income Statement For Year Ended December 31, 2019 Pretax income from…arrow_forwardIdentify and Compute NOPAT Following is the income statement for Lowe's Companies Inc. LOWE'S COMPANIES INC. Consolidated Statement of Earnings Twelve Months Ended (In millions) Net sales Cost of sales Gross margin Expenses Selling, general and administrative Depreciation and amortization Operating income Interest expense, net Pretax earnings Income tax provision Net earnings Feb. 1, 2019 $114,094 77,442 36,652 27,861 2,363 6,428 998 5,430 1,728 $3,702 Compute its net operating profit after tax (NOPAT) for the 12 months ended February 1, 2019, assuming a 22% total statutory tax rate. Note: Round your answer to the nearest whole dollar (millions). $ 5,014 Xarrow_forward

- Identify and Compute NOPAT Following is the income statement for Lowe’s Companies Inc. LOWE’S COMPANIES INC. Consolidated Statement of Earnings Twelve Months Ended (In millions) Feb. 1, 2019 Net sales $80,579 Cost of sales 54,693 Gross margin 25,886 Expenses Selling, general and administrative 19,677 Depreciation and amortization 1,669 Operating income 4,540 Interest expense, net 705 Pretax earnings 3,835 Income tax provision 1,220 Net earnings $2,615 Compute its net operating profit after tax (NOPAT) for the 12 months ended February 1, 2019, assuming a 22% total statutory tax rate. Feb. 1, 2019 NOPAT Answerarrow_forwardOnly typed solutionarrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education