FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

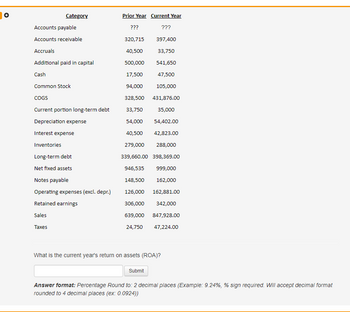

Transcribed Image Text:Category

Accounts payable

Accounts receivable

Accruals

Additional paid in capital

Cash

Common Stock

COGS

Current portion long-term debt

Depreciation expense

Interest expense

Inventories

Long-term debt

Net fixed assets

Notes payable

Operating expenses (excl. depr.)

Retained earnings

Sales

Taxes

Prior Year Current Year

???

???

320,715

397,400

40,500

33,750

500,000

541,650

17,500

47,500

94,000

105,000

328,500

431,876.00

33,750

35,000

54,000

54,402.00

40,500 42,823.00

279,000 288,000

339,660.00 398,369.00

946,535

999,000

148,500

162,000

126,000

162,881.00

306,000 342,000

639,000 847,928.00

24,750

47,224.00

What is the current year's return on assets (ROA)?

Submit

Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format

rounded to 4 decimal places (ex: 0.0924))

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the below information to answer the following question. Sales Cost of goods sold Depreciation Income Statement For the Year Taxable income Taxes Earnings before interest $4,500 and taxes Interest paid Net income Dividends $900 Balance Sheet End-of-Year Cash Accounts receivable Inventory Total current assets Net fixed assets Total assets Accounts payable Long-term debt Common stock ($1 par value) Retained earnings O O O O Total Liab. & Equity 33 percent 40 percent 50 percent $28,400 60 percent 21,200 2,700 67 percent 850 $3,650 1,400 $2,250 $550 2,450 4,700 $7,700 What was the retention ratio? 16,900 $24,600 $ 2,700 9,800 8,000 4,100 $24,600arrow_forwardCurrent position analysis the following data were taken from the balance sheet of Nilo company at the end of the two recent Fisher years; Current assets: Cash Marketable securities Account and note receivable (net) Inventories Prepaid expenses Total Current assets Current liabilities Account and notes payable ( short-term) Accrued liabilities Total Current liabilities Current year $417,000 cash 483,100 Marketable securities 197,700 acct not receivable ( net) 845,500 inventory 435,500 prepaid 2,379,000 Total Current assets Previous year $339,200 cash 381,600 Marketable securities 127,200 access note receivable ( net) 614,300 inventory 392,700 prepaid expenses 1,855,000 Total Current assets Current year Current liabilities Short term $353,800 Accrued liabilities 256,200 Total Current liabilities $610,000 Previous year Short term $371,000 Accrued liabilities 159,000 Total Current liabilities $530,000 A. Determine for each year 1 capital, 2 the current ratio,…arrow_forwardanswer in text form please (without image)arrow_forward

- ! Required information Problem 12-6A (Algo) Use ratios to analyze risk and profitability (LO12-3, 12-4) [The following information applies to the questions displayed below.] Income statements and balance sheets data for Virtual Gaming Systems are provided below. Net sales Cost of goods sold Gross profit Expenses: VIRTUAL GAMING SYSTEMS Income Statements For the Years Ended December 31 2025 $3,495,000 2,477,000 1,018,000 Operating expenses Depreciation expense Loss on sale of land Interest expense Income tax expense Total expenses Net income 952,000 27,000 16,500 7,700 1,003, 200 14,800 2024 $3,021,000 1,947,000 1,074,000 855,000 25,500 7,700 13,500 46,500 948, 200 125,800arrow_forwardWhat's the total asset turnover ratio of this company? Assets: Cash and marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Fixed assets Less: accum. depr. Net fixed assets Total assets Liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term debt Owner's equity (1 million shares of common stock outstanding) Total liabilities and owner's equity Net sales (all credit) Less: Cost of goods sold Selling and administrative expense Depreciation expense Interest expense Earnings before taxes Income taxes Net income 1.41 2.33 O 4.45 1.11 8,000,000 (2,075,000) $600,000 900,000 1,500,000 75,000 $3,075,000 $5,925.000 $9,000,000 $800,000 700,000 50,000 $1,550,000 2,500,000 4,950,000 $9,000,000 $10,000,000 (3,000,000) (2,000,000) (250,000) (200,000) 4,550,000 (1,820,000) $2,730,000arrow_forwardCalculate the dividend payout ratio.arrow_forward

- Assets Cash Accounts Receivable Prepaids Inventory Property, Plant & Equipment Less: Accumulated Depreciation Total Assets Liabilities A wompany Balance Sheet December 31, Year 2 Accounts Payable Accrued Liabilities Notes Payable (Long-Term Debt) Total Liabilities Stockholders Equity Common Stock ($10 par) Paid in Capital In Excess of Part Retained Earnings Treasury Stock Total Stockholders Equity Total Liabilities and Stockholders Equity Year 2 Year 1 Change 40,000 $20,000 140,000 (10,000) $ 60,000 $ 130,000 35,000 43,000 (8,000) 183,000 120,000 63,000 340,000 310,000 30,000 (75,000) (50,000) (25,000) $673,000 $ 603,000 $70,000 $110,600 $ 111,000 $ (400) 34,000 32,000 2,000 50,000 50,000 100,000 $244,600 $ 193,000 $51,600 $ 75,000 $ 75,000 $ 220,000 220,000 143,400 10,000 115,000 28,400 10,000 $428,400 $ 410,000 $18,400 $673,000 $ 603,000 $70,000 28 What is the cash flow from operating activities using the indirect method of the statement of cash flows? O $71,400 O $53,000 O $63,000 O…arrow_forwardAll info for this question is includedarrow_forwardCalculate net debt. Cash and cash equivalents Short term borrowings Long term borrowings Commercial paper (liability) Capital / finance lease Accounts receivable Total liabilities Inventory Select one: 2,108.0 2,103.0 2,025.0 14,132.0 3,176.0 419.0 2,883.0 331.0 1,651.0 83.0 17,308.0 5.0arrow_forward

- Find the below: Cash ratio Inventory turnover EPS Total asset turnover Debt ratio Debt-to-equity ratio Times interest earned ROI Net profit margin ROE Market price/Book value P/E BALANCE SHEET ASSETS LIABILITIES & STOCKHOLDERS EQUITY Cash $ 1,500 Accounts payable $12,500 Marketable securities 2,500 Notes payable 12,500 Accounts receivable 15,000 Total current liabilities $25,000 Inventory 33,000 Long-term debt 22,000 Total current assets…arrow_forwardK. Jackson Corporation Assets Cash Accounts receivable Inventory Net fixed assets Total assets Liabilities and owners' equity. Accounts payable ST Notes payable Long-term debt Owners' Equity Total liabilities and owner's equity Balance Sheet $250,000 450.000 500,000 2.100,000 $3,300.000 $100.000 450.000 1,050,000 1,700.000 $3,300,000 Income Statement Sales (all credit) Cost of goods sold Operating expense Interest expense Income taxes Net income $8,000,000 (4.000.000) (2,900,000) (150,000) (380,000) $570,000 Based on the information for K. Jackson Corporation, the current and acid-test ratios are, respectively. OA2.37 and 1.39. OB2 37 and 1.27 OC2 18 and 1.39 OD.2 18 and 1.27 OE None of the above.arrow_forwardPlease help me fastarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education