Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

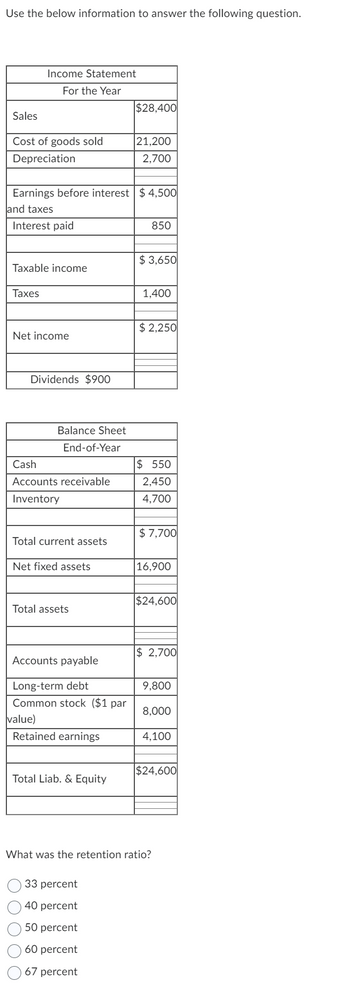

Transcribed Image Text:Use the below information to answer the following question.

Sales

Cost of goods sold

Depreciation

Income Statement

For the Year

Taxable income

Taxes

Earnings before interest $4,500

and taxes

Interest paid

Net income

Dividends $900

Balance Sheet

End-of-Year

Cash

Accounts receivable

Inventory

Total current assets

Net fixed assets

Total assets

Accounts payable

Long-term debt

Common stock ($1 par

value)

Retained earnings

O O O O

Total Liab. & Equity

33 percent

40 percent

50 percent

$28,400

60 percent

21,200

2,700

67 percent

850

$3,650

1,400

$2,250

$550

2,450

4,700

$7,700

What was the retention ratio?

16,900

$24,600

$ 2,700

9,800

8,000

4,100

$24,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Use the following information to answer this question. Windswept, Inc. 2017 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes Net income: Cash Accounts rec. Inventory Total Net fixed assets Total assets Windswept, Inc. 2016 and 2017 Balance Sheets ($ in millions) 2016 2017 $ 280 $ 310 Accounts payable Long-term debt Common stock $3,210 $3,110 Retained earnings 3,570 4,090 $6,780 $7,200 Total liab. & equity 1,130 1,030 1,800 1,770 $10,100 8,000 415 $1,685 102 $ 1,583 554 $ 1,029 What is the cash coverage ratio for 2017? 2016 2017 $1,660 $1,857 1,080 1,393 3,380 3,040 660 910 $6,780 $7,200arrow_forwardCompute the debt ratio from the data shown below: Balance Sheet (Millions of $) Assets Cash and securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total debt Common stock Retained earnings Total common equity Total liabilities and equity Income Statement (Millions of $) Net sales Operating costs except depreciation Depreciation Earnings bef interest and taxes (EBIT) 2007 $1,290 9,890 13,760 $24,940 $18,060 $43.000 $8,170 6,020 4.730 $18,920 $8,815 $27.735 $5,805 2.460 $15.265 $43,000 2007 $51.600 48,246 903 $2,451 Karrow_forwardUse the information provided from Sapphire Ltd calculate and comment on the following ratios:1. Profit margin2. Return on equityarrow_forward

- What are the firm's current ratios for 2018 and 2019? Income Statements ($ in millions) Balance Sheets ($ in millions) 2018 2019 Assets 2018 2019 $1,265 | Cash $780 Short-Term investments Sales Revenue $1,180 $35 $20 $660 $20 $5 Less: Cost of goods sold Less: Operating Expenses Less: Depreciation Earnings before interest and taxes Less: Interest paid $75 $92 | Accounts rec. 190 235 $40 $50 Inventory 250 300 $405 $343 Total Current Assets $495 $560 $170 $150 | Net fixed assets 990 1,105 Taxable Income $235 $193 Less: Taxes (40%) $77 Total assets $116 Liabilities and Owner's Equity $94 $1,485 1,665 Net income $141 Dividends (45%) Additions to Retained Earnings $63 $52 2018 2019 $64 Accounts payable Аccruals $78 $125 $100 $10 $10 Notes payable 35 40 Total Current Liabilities $170 $150 Long-term debt 598 790 Total Liabilities $768 $940 Common stock 554 498 Retained earnings Total Equity Total liab.& equity 163 $227 717 $725 $1,485 $1,665arrow_forwardConsider the following company’s balance sheet and income statement Return on assets. Return on equity.arrow_forwardThe following information applies to the questions displayed below.] Simon Company's yearend balance sheets follow. Current 2 31 Assets Cash Accounts receivable , Merchandise inventory Prepaid expenses ? assets , Total assets Liabilities and Equity Bccounts payable Long-term payable secured by mortgages on plast assets Common stock, $ 10 par value earnings Total Isabilities and equity $ 31,224 89,900 115,000 10,055 277, 807 $523.985 $ 37,266 62,200 50,400 84,000 57,000 4,141 259,433 223,893 $ 451,712 372, 701 $ 131,777$ 77,103 $ 99,494 162,500 130.215 $523.986 104, 5 83,190 162,500 162,500 107.176 77.322 $ , 712 372, 70arrow_forward

- Ratio AnalysisPresented below are summary financial data from Pompeo’s annual report: Amounts in millions Balance Sheet Cash and Cash Equivalents $1,865 Marketable Securities 19,100 Accounts Receivable (net) 9,367 Total Current Assets 39,088 Total Assets 123,078 Current Liabilities 39,255 Long-Term Debt 7,279 Shareholders’ Equity 68,278 Income Statement Interest Expense 375 Net Income Before Taxes 14,007 Calculate the following ratios:(Round to 2 decimal points) a. Times-interest-earned ratio Answer b. Quick ratio Answer c. Current ratio Answer PreviousSave AnswersNextarrow_forwardAssume you are given the following relationships for the Haslam Corporation: Sales/total assets 1.2 Return on assets (ROA) 3% Return on equity (ROE) 5% Calculate Haslam's profit margin and liabilities-to-assets ratio. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: % Liabilities-to-assets ratio: % Suppose half of its liabilities are in the form of debt. Calculate the debt-to-assets ratio. Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardHow to calculate gross profit percentage will be mItanedarrow_forward

- Consider the following company’s balance sheet and income statement. Number of days in inventory. Debt-to-asset ratio. Cash-flow-to-debt ratio.arrow_forwardGiven the data in the following table, the entry for Inventories on the 2023 common-sized balance sheet was %.arrow_forwardLiberty Corporation reported the following financial statements: Which measure expresses Liberty’s times-interest-earned ratio? (amounts rounded) a. 54.7% b. 19 times c, 34.5% d. 32 timesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education