Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

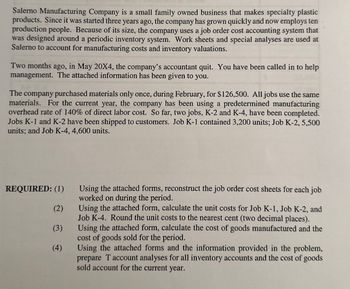

Transcribed Image Text:Salerno Manufacturing Company is a small family owned business that makes specialty plastic

products. Since it was started three years ago, the company has grown quickly and now employs ten

production people. Because of its size, the company uses a job order cost accounting system that

was designed around a periodic inventory system. Work sheets and special analyses are used at

Salerno to account for manufacturing costs and inventory valuations.

Two months ago, in May 20X4, the company's accountant quit. You have been called in to help

management. The attached information has been given to you.

The company purchased materials only once, during February, for $126,500. All jobs use the same

materials. For the current year, the company has been using a predetermined manufacturing

overhead rate of 140% of direct labor cost. So far, two jobs, K-2 and K-4, have been completed.

Jobs K-1 and K-2 have been shipped to customers. Job K-1 contained 3,200 units; Job K-2, 5,500

units; and Job K-4, 4,600 units.

REQUIRED: (1)

(2)

(3)

(4)

Using the attached forms, reconstruct the job order cost sheets for each job

worked on during the period.

Using the attached form, calculate the unit costs for Job K-1, Job K-2, and

Job K-4. Round the unit costs to the nearest cent (two decimal places).

Using the attached form, calculate the cost of goods manufactured and the

cost of goods sold for the period.

Using the attached forms and the information provided in the problem,

prepare T account analyses for all inventory accounts and the cost of goods

sold account for the current year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Mooresville Corporation manufactures reproductions of eighteenth-century, classical-style furniture. It uses a job costing system that applies factory overhead on the basis of direct labor hours. Budgeted factory overhead for the year was $1,359,000, and management budgeted 90,000 direct labor hours. Mooresville had no Materials, Work-in- Process, or Finished Goods Inventory at the beginning of August. These transactions were recorded during August: a. Purchased 5,600 square feet of oak on account at $26 per square foot. b. Purchased 110 gallons of glue on account at $36 per gallon (indirect material). c. Requisitioned 3,920 square feet of oak and 37 gallons of glue for production. d. Incurred and paid payroll costs of $200,500. Of this amount, $52,000 were indirect labor costs; direct labor personnel earned $22 per hour. e. Paid factory utility bill, $16,250 in cash. f. August's insurance cost for the manufacturing property and equipment was $3,800. The premium had been paid in March.…arrow_forward4. Prepare a schedule of Cost of Goods Manufactured and Cost of Goods Sold. 5. Compute the amount of overapplied or underapplied overhead that should be prorated to Work-in-Process, Finished Goods and Cost of Goods Sold. 6. Prepare the income statement for August.arrow_forwardLuzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products based on machine-hours. The predetermined overhead rate was based on a cost formula that estimates $765,000 of total manufacturing overhead for an estimated activity level of 85,000 machine-hours. During the year, a large quantity of furniture on the market caused Luzadis to cut production and build inventories. The company provided the following data for the year: Machine-hours Manufacturing overhead cost Inventories at year-end: Raw materials Work in process (includes overhead applied of $62,100) Finished goods (includes overhead applied of $105,570) Cost of goods sold (includes overhead applied of $453,330) Required: 1. Compute the underapplied or overapplied overhead. 69,000 $ 719,000 $ 14,000 $ 183,000 $ 311,100 $ 1,335,900 2. Assume the company closes underapplied or overapplied overhead to Cost of Goods Sold.…arrow_forward

- Luzadis Company makes furniture using the latest automated technology. The company uses a job - order costing system and applies manufacturing overhead cost to products based on machine - hours. The predetermined overhead rate was based on a cost formula that estimates $1, 520,000 of total manufacturing overhead for an estimated activity level of 76, 000 machine - hours. During the year, a large quantity of furniture on the market caused Luzadis to cut production and build inventories. The company provided the following data for the year: Machine - hours 64, 000 Manufacturing overhead cost $ 1, 471,000 Inventories at year - end: Raw materials S 14,000 Work in process (includes overhead applied of $64, 000) $ 90,500 Finished goods (includes overhead applied of $204, 800) S 289,600 Cost of goods sold (includes overhead applied of $1, 011, 200) $ 1,429, 900 Required: Compute the underapplied or overapplied overhead. Assume the company closes underapplied or overapplied overhead to Cost of…arrow_forwardManor Painting is a commercial Interior and exterior painting contractor specializing in commercial buildings. An Inventory of materials and equipment is on hand at all times, so work can start as quickly as possible. Special equipment is ordered as required. On August 1, the Materials Inventory account had a balance of $54,000. The Work-in-Process Inventory account is maintained to record costs of work not yet complete. There were two such jobs on August 1 with the following costs: Materials and equipment Direct labor (wages payable) Other August Events Materials and equipment Direct labor Overhead (applied) Overhead has been applied at 40 percent of the costs of direct labor using an annual rate. During August, Manor Painting started two new jobs. Additional work was carried out on Jobs 84 and 87. Job 87 was completed and billed to the customer. Details on the costs incurred on jobs during August follow: Job 84 $ 23,100 20,300 8,120 Property taxes Storage area rental Truck and…arrow_forwardLuzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products based on machine-hours. The predetermined overhead rate was based on a cost formula that estimates $900,000 of total manufacturing overhead for an estimated activity level of 75,000 machine-hours. During the year, a large quantity of furniture on the market caused Luzadis to cut production and build inventories. The company provided the following data for the year: Machine-hours Manufacturing overhead cost Inventories at year-end: 60,000 $ 850,000 Raw materials Work in process (includes overhead applied of $36,000) Finished goods (includes overhead applied of $180,000) Cost of goods sold (includes overhead applied of $504,000) Required: 1. Compute the underapplied or overapplied overhead. 2. Assume the company closes underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry. 3.…arrow_forward

- Logistics Solutions maintains warehouses that stock items carried by its dot.com clients. When a client receives an order from a customer, the order is forwarded to Logistics Solutions, which pulls the item from storage, packs it, and ships it to the customer. The company uses a predetermined variable overhead rate based on direct labor- hours. In the most recent month, 155,000 items were shipped to customers using 6,000 direct labor-hours. The company incurred a total of $17,400 in variable overhead costs. According to the company's standards, 0.04 direct labor-hour is required to fulfill an order for one item and the variable overhead rate is $3.00 per direct labor-hour. Required: 1. What is the standard labor-hours allowed (SH) to ship 155,000 items to customers? 2. What is the standard variable overhead cost allowed (SH × SR) to ship 155,000 items to customers? 3. What is the variable overhead spending variance? 4. What are the variable overhead rate variance and the variable…arrow_forwardLogistics Solutions maintains warehouses that stock items carried by its dot.com clients. When a client receives an order from a customer, the order is forwarded to Logistics Solutions, which pulls the item from storage, packs it, and ships it to the customer. The company uses a predetermined variable overhead rate based on direct labor-hours. In the most recent month, 115,000 items were shipped to customers using 3,800 direct labor-hours. The company incurred a total of $10,450 in variable overhead costs. According to the company’s standards, 0.04 direct labor-hours are required to fulfill an order for one item and the variable overhead rate is $2.80 per direct labor-hour. Required: What is the standard labor-hours allowed (SH) to ship 115,000 items to customers? What is the standard variable overhead cost allowed (SH × SR) to ship 115,000 items to customers? What is the variable overhead spending variance? What are the variable overhead rate variance and the variable overhead…arrow_forwardNottaway Flooring produces custom-made floor tiles. The company’s Raw Material Inventory account contains both direct and indirect materials. Until the end of April, the company worked solely on a large job (#4263) for a major client. Near the end of the month, Nottaway began Job #4264. The following information was obtained relating to April production operations. Raw material purchased on account, $408,000. Direct material issued to Job #4263 cost $327,600; indirect material issued for that job cost $24,920. Direct material costing $3,740 was issued to start production of Job #4264. Direct labor hours worked on Job #4263 were 3,600. Direct labor hours for Job #4264 were 120. All direct labor employees were paid $30 per hour. Other actual factory overhead costs incurred for the month totaled $137,400. This overhead consisted of $36,000 of supervisory salaries, $43,000 of depreciation charges, $14,400 of insurance, $25,000 of indirect labor, and $19,000 of utilities. Salaries,…arrow_forward

- Logistics Solutions maintains warehouses that stock items carried by its dot.com clients. When a client receives an order from a customer, the order is forwarded to Logistics Solutions, which pulls the item from storage, packs it, and ships it to the customer. The company uses a predetermined variable overhead rate based on direct labor-hours. In the most recent month, 120,000 items were shipped to customers using 2,300 direct labor-hours. The company incurred a total of $7,360 in variable overhead costs. According to the company's standards, 0.02 direct labor-hour is required to fulfill an order for one item and the variable overhead rate is $3.25 per direct labor-hour. Required: 1. What is the standard labor-hours allowed (SH) to ship 120,000 items to customers? 2. What is the standard variable overhead cost allowed (SH × SR) to ship 120,000 items to customers? 3. What is the variable overhead spending variance? 4. What are the variable overhead rate variance and the variable…arrow_forwardLogistics Solutions maintains warehouses that stock items carried by its dot.com clients. When a client receives an order from a customer, the order is forwarded to Logistics Solutions, which pulls the item from storage, packs it, and ships it to the customer. The company uses a predetermined variable overhead rate based on direct labor-hours. In the most recent month, 145,000 items were shipped to customers using 5,600 direct labor-hours. The company incurred a total of $17,080 in variable overhead costs. According to the company's standards, 0.04 direct labor-hour is required to fulfill an order for one item and the variable overhead rate is $3.10 per direct labor-hour. Required: 1. What is the standard labor-hours allowed (SH) to ship 145,000 items to customers? 2. What is the standard variable overhead cost allowed (SH x SR) to ship 145,000 items to customers? 3. What is the variable overhead spending variance? 4. What are the variable overhead rate variance and the variable…arrow_forwardLogistics Solutions maintains warehouses that stock items carried by its dot.com clients. When a client receives an order from a customer, the order is forwarded to Logistics Solutions, which pulls the item from storage, packs it, and ships it to the customer. The company uses a predetermined variable overhead rate based on direct labor-hours. In the most recent month, 125,000 items were shipped to customers using 4,400 direct labor-hours. The company incurred a total of $12,540 in variable overhead costs. According to the company's standards, 0.04 direct labor-hour is required to fulfill an order for one item and the variable overhead rate is $2.90 per direct labor-hour. Required: 1. What is the standard labor-hours allowed (SH) to ship 125,000 items to customers? 2. What is the standard variable overhead cost allowed (SH x SR) to ship 125,000 items to customers? 3. What is the variable overhead spending variance? 4. What are the variable overhead rate variance and the variable…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning