College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

None

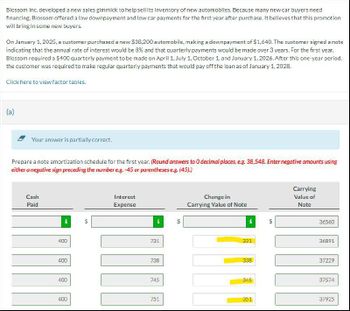

Transcribed Image Text:Blossom Inc. developed a new sales gimmick to help sell its inventory of new automobiles. Because many new car buyers need

financing, Blossom offered a low downpayment and low car payments for the first year after purchase. It believes that this promotion

will bring in some new buyers.

On January 1, 2025, a customer purchased a new $38,200 automobile, making a downpayment of $1,640. The customer signed a note

indicating that the annual rate of interest would be 8% and that quarterly payments would be made over 3 years. For the first year,

Blossom required a $400 quarterly payment to be made on April 1, July 1, October 1, and January 1, 2026. After this one-year period,

the customer was required to make regular quarterly payments that would pay off the loan as of January 1, 2028.

Click here to view factor tables.

(a)

Your answer is partially correct.

Prepare a note amortization schedule for the first year. (Round answers to 0 decimal places, e.g. 38,548. Enter negative amounts using

either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

Cash

Paid

400

Interest

Expense

731

400

738

SA

Change in

Carrying Value of Note

Carrying

Value of

Note

36560

331

36891

338

37229

400

745

345

37574

400

751

351

37925

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Pharoah Inc. developed a new sales gimmick to help sell its inventory of new cars. Because many new car buyers need financing. Pharoah offered a low down payment at the time of purchase and low car payments for the first year after purchase. It believes that this promotion will bring in some new buyers. On January 1, 2023, a customer purchased a new $34,900 automobile, making a down payment of $1,500. The customer signed a note indicating that the annual rate of interest would be 8% and that quarterly payments would be made over 3 years. For the first year, Pharoah required a $490 quarterly payment to be made on April 1, July 1, October 1, and January 1, 2024. After this one-year period. the customer was required to make regular quarterly payments that would pay off the loan as of January 1, 2026. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Prepare a note amortization schedule for the first year. (Round…arrow_forwardGood-Deal Inc. developed a new sales gimmick to help sell its inventory of new automobiles. Because many new car buyers need financing, Good-Deal offered a low downpayment and low car payments for the first year after purchase. It believes that this promotion will bring in some new buyers. On January 1, 2020, a customer purchased a new $33,000 automobile, making a downpayment of $1,000. The customer signed a note indicating that the annual rate of interest would be 8% and that quarterly payments would be made over 3 years. For the first year, Good-Deal required a $400 quarterly payment to be made on April 1, July 1, October 1, and January 1, 2021. After this one-year period, the customer was required to make regular quarterly payments that would pay off the loan as of January 1, 2023. Instructions a. Prepare a note amortization schedule for the first year. b. Indicate the amount the customer owes on the contract at the end of the first year. c. Compute the amount of the new…arrow_forwardCullumber Bakery began selling gift cards in 2025. Based on industry norms, they expect that 40% of the gift cards will not be redeemed. In 2025, the bakery sold gift cards with a value of $1000. During that period, gift cards with a value of $250 were redeemed. The amount of revenue that Cullumber will recognize in 2025 with regard to the gift cards isarrow_forward

- To keep up with sales trends, Sunland Inc., a public company following IFRS, implemented a customer loyalty program that rewards a customer with one loyalty point for every $30 of purchases. Each point is redeemable for a $1 discount on any purchases of Sunland merchandise in the next two years. Following the implementation of the program, during 2023, customers purchased products for $315,000 and earned 10,500 points redeemable for future purchases. (All products are sold to provide a 40% gross profit.) The stand-alone selling price of the purchased products is $315,000. Based on prior experience with incentive programs like this, Sunland expects 9,000 points to be redeemed related to these sales. (a) Measure the separate performance obligations in the Sunland bonus point program. (Round percentage allocations to 2 decimal ploces, e.g. 25.55 and final answers to O decimal places, eg. 25,000.) Products Bonus pointsarrow_forwardBlock Foods, a retail grocery store, has agreed to purchase all of its merchandise from Square Wholesalers. In return. Block receives a special discount on purchases. Over recent months, Square noticed that purchases by Block had been falling off. At first, Square simply thought that business might be down for Block and was hopeful that their purchases would pick up. When business with Block did not return to a normal level, Square requested financial statements from Block. Squares records indicate that Block purchased 300,000 worth of merchandise during 20-1, the most recent year. Selected information taken from Block's financial statements is as follows: REQUIRED Compute net purchases made by Block during 20-1. Does it appear that Block violated the agreement?arrow_forwardThe manager of an automobile dealership is considering a new bonus plan designed to increase sales volume. Currently, the mean sales volume is 14 automobiles per month. The manager wants to conduct a research study to see whether the new bonus plan increases sales volume. To collect data on the plan, a sample of sales personnel will be allowed to sell under the new bonus plan for a one-month period. a. Develop the null and alternative hypotheses most appropriate for this situation. b. Comment on the conclusion when H0 cannot be rejected. c. Comment on the conclusion when H0 can be rejected.arrow_forward

- Check My Work (2 remaining) The manager of an automobile dealership is considering a new bonus plan designed to increase sales volume. Currently, the mean sales volume is 24 automobiles per month. The manager wants to conduct a research study to see whether the new bonus plan increases sales volume. TO collect data on the plan, a sample of sales personnel will be allowed to sell under the new bonus plan for a one-month period. a. Which form of the null and alternative hypotheses most appropriate for this situation? Ho: A is -Select your answer - H.: P is - Select your answer - b. Select the conclusion when Ho cannot be rejected. Select your answer - c. Select the conclusion when Ho can be rejected. -Select Your answer -arrow_forwardnarubhaiarrow_forwardInfinity Designs, an interior design company,has experienced a drop in business due toan increase in interest rates and acorresponding slowdown in remodelingprojects. To smulate business, thecompany is considering exhibing at theHome and Garden Expo. The exhibit willcost the company $12,000 for space. At theshow, Infinity Designs will present a slideshow on a PC, pass out brochures that areprinted previously, (the company printedmore than needed), and show its porolio ofpreviousjobs.The companyesmates thatrevenue will increaseby $36,000 over thenext year as a resultof the exhibit. For theprevious year, profitwas as follows:Revenue $201,000Less:Design supplies (variable cost) $15,000Salary of Samantha Spade (owner) 80,000Salary of Kim Bridesdale (full meemployee)55,000Rent 18,000Ulies 6,000Depreciaon of office equipment 3,600Prinng of adversing materials 700Adversing in Middleton Journal 2,500Travel expenses other than depreciaonof autos (variable cost)$3,000Depreciaon of company cars…arrow_forward

- Aria Perfume, Incorporated, sold 2,430 boxes of white musk soap during January of 2024 at the price of $80 per box. The company offers a full refund to unsatisfied customers for any product returned within 30 days from the date of purchase. Based on historical experience, Aria expects that 3% of sales will be returned. How many performance obligations are there in each sale of a box of soap? How much revenue, sales returns, and net revenue should Aria recognize in January?arrow_forwardSubject - account Please help me. Thankyou.arrow_forwardTo increase sales, Pharoah Inc., a public company following IFRS, implemented a customer loyalty program that rewards a customer with one loyalty point for every $30 of merchandise purchased. Each point is redeemable for a $2.50 discount on any purchases of Pharoah merchandise in the next three years. After the program launched, during 2023, customers bought merchandise for $300,000 (all products are sold to provide a 30% gross profit) and earned 10,000 points redeemable for future purchases. The stand-alone selling price of the merchandise sold is $300,000. Based on prior experience with incentive programs like this, Pharoah expects 8,000 points to be redeemed related to these sales. (b) Prepare the journal entries for cash sales including the issuance of loyalty points for Pharoah in 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning