Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

need proper answer to this all questions

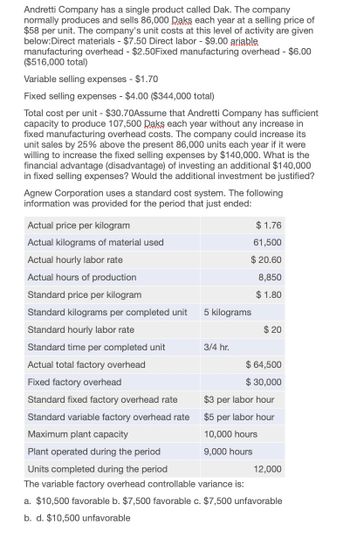

Transcribed Image Text:Andretti Company has a single product called Dak. The company

normally produces and sells 86,000 Daks each year at a selling price of

$58 per unit. The company's unit costs at this level of activity are given

below:Direct materials - $7.50 Direct labor - $9.00 ariable

manufacturing overhead - $2.50Fixed manufacturing overhead - $6.00

($516,000 total)

Variable selling expenses - $1.70

Fixed selling expenses - $4.00 ($344,000 total)

Total cost per unit - $30.70Assume that Andretti Company has sufficient

capacity to produce 107,500 Daks each year without any increase in

fixed manufacturing overhead costs. The company could increase its

unit sales by 25% above the present 86,000 units each year if it were

willing to increase the fixed selling expenses by $140,000. What is the

financial advantage (disadvantage) of investing an additional $140,000

in fixed selling expenses? Would the additional investment be justified?

Agnew Corporation uses a standard cost system. The following

information was provided for the period that just ended:

Actual price per kilogram

Actual kilograms of material used

$ 1.76

61,500

$ 20.60

8,850

Actual hourly labor rate

Actual hours of production

Standard price per kilogram

$ 1.80

Standard kilograms per completed unit

5 kilograms

Standard hourly labor rate

$ 20

Standard time per completed unit

3/4 hr.

Actual total factory overhead

$ 64,500

Fixed factory overhead

$ 30,000

Standard fixed factory overhead rate

Standard variable factory overhead rate

Maximum plant capacity

Plant operated during the period

Units completed during the period

$3 per labor hour

$5 per labor hour

10,000 hours

9,000 hours

The variable factory overhead controllable variance is:

12,000

a. $10,500 favorable b. $7,500 favorable c. $7,500 unfavorable

b. d. $10,500 unfavorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Gent Designs requires three units of part A for every unit of Al that it produces. Currently, part A is made by Gent, with these per-unit costs in a month when 4.000 units were produced: Variable manufacturing overhead is applied at $1.00 per unit. The other $0.30 of overhead consists of allocated fixed costs. Gent will need 6,000 units of part A for the next years production. Cory Corporation has offered to supply 6,000 units of part A at a price of $7.00 per unit. It Gent accepts the offer, all of the variable costs and $1,200 of the fixed costs will be avoided. Should Gent Designs accept the offer from Cory Corporation?arrow_forwardRemarkable Enterprises requires four units of part A for every unit of Al that it produces. Currently, part A is made by Remarkable, with these per-unit costs in a month when 4,000 units were produced: Variable manufacturing overhead is applied at $1.60 per unit. The other $0.50 of overhead consists of allocated fixed costs. Remarkable will need 8,000 units of part A for the next years production. Altoona Corporation has offered to supply 8,000 units of part A at a price of $8.00 per unit. If Remarkable accepts the offer, all of the variable costs and $2,000 of the fixed costs will be avoided. Should Remarkable accept the offer from Altoona Corporation?arrow_forwardRoper Furniture manufactures office furniture and tracks cost data across their process. The following are some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period costs. Wood used to produce desks ($125,00 per desk) Production labor used to produce desks ($15 per hour) Production supervisor salary ($45,000 per year) Depreciation on factory equipment ($60,000 per year) Selling and administrative expenses ($45,000 per year) Rent on corporate office ($44,000 per year) Nails, glue, and other materials required to produce desks (varies per desk) Utilities expenses for production facility Sales staff commission (5% of gross sales)arrow_forward

- Colonels uses a traditional cost system and estimates next years overhead will be $480,000, with the estimated cost driver of 240,000 direct labor hours. It manufactures three products and estimates these costs: If the labor rate is $25 per hour, what is the per-unit cost of each product?arrow_forwardCadre, Inc., sells a single product with a selling price of $120 and variable costs per unit of $90. The companys monthly fixed expenses are $180,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of October when they will sell 10,000 units. How many units will Cadre need to sell in order to realize a target profit of $300,000? What dollar sales will Cadre need to generate in order to realize a target profit of $300,000? Construct a contribution margin income statement for the month of August that reflects $2,400,000 in sales revenue for Cadre, Inc.arrow_forwardMarkson and Sons leases a copy machine with terms that include a fixed fee each month plus acharge for each copy made. Markson made 9,000 copies and paid a total of $480 in January. In April, they paid $320 for 5,000 copies. What is the variable cost per copy if Markson uses the high-low method to analyze costs?arrow_forward

- Box Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $25 per unit and $40 s used in direct labor, while the direct material for the double is $40 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 9,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardHatch Manufacturing produces multiple machine parts. The theoretical cycle time for one of its products is 65 minutes per unit. The budgeted conversion costs for the manufacturing cell dedicated to the product are 12,960,000 per year. The total labor minutes available are 1,440,000. During the year, the cell was able to produce 0.6 units of the product per hour. Suppose also that production incentives exist to minimize unit product costs. Required: 1. Compute the theoretical conversion cost per unit. 2. Compute the applied conversion cost per minute (the amount of conversion cost actually assigned to the product). 3. Discuss how this approach to assigning conversion cost can improve delivery time performance. Explain how conversion cost acts as a performance driver for on-time deliveries.arrow_forwardThe following product Costs are available for Haworth Company on the production of chairs: direct materials, $15,500; direct labor, $22.000; manufacturing overhead, $16.500; selling expenses, $6,900; and administrative expenses, $15,200. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 7,750 equivalent units are produced, what is the equivalent material cost per unit? If 22,000 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forward

- The following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardBox Springs. Inc., makes two sizes of box springs: queen and king. The direct material for the queen is $35 per unit and $55 is used in direct labor, while the direct material for the king is $55 per unit, and the labor cost is $70 per unit. Box Springs estimates it will make 4,300 queens and 3,000 kings in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardPatz Company produces two types of machine parts: Part A and Part B, with unit contribution margins of 300 and 600, respectively. Assume initially that Patz can sell all that is produced of either component. Part A requires two hours of assembly, and B requires five hours of assembly. The firm has 300 assembly hours per week. Required: 1. Express the objective of maximizing the total contribution margin subject to the assembly-hour constraint. 2. Identify the optimal amount that should be produced of each machine part and the total contribution margin associated with this mix. 3. What if market conditions are such that Patz can sell at most 75 units of Part A and 60 units of Part B? Express the objective function with its associated constraints for this case and identify the optimal mix and its associated total contribution margin.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning