Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

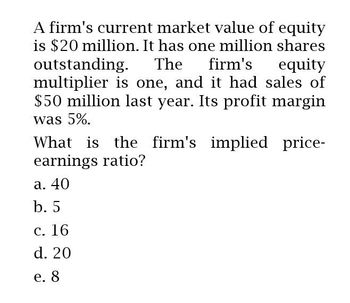

Transcribed Image Text:A firm's current market value of equity

is $20 million. It has one million shares

outstanding. The firm's equity

multiplier is one, and it had sales of

$50 million last year. Its profit margin

was 5%.

What is the firm's implied price-

earnings ratio?

a. 40

b. 5

c. 16

d. 20

e. 8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Need helparrow_forwardA firm's current market value of equity is $100 million. It has one million shares outstanding. The firm's equity multiplier is one, and it had sales of $50 million last year. Its profit margin was 5%. What is the firm's implied price-earnings ratio? O 40 O5 O 16 O 20 0 8arrow_forwardYou are given the following information about a firm: The growth rate equals 8 percent; return on assets (ROA) is 10 percent; the debt ratio is 20 percent; and the stock is selling at $36. What is the return on equity (ROE)?a. 14.0%b. 12.5%c. 15.0%d. 2.5%e. 13.5%arrow_forward

- Financial Accountingarrow_forward2arrow_forwardSuppose that your company is expected to pay a dividend of $1.50 per share next year. The growth in dividend has been steady at 5.1% p.a. and the market expects this growth to continue. If the share is priced at $25 per share, is a 4% cost of equity tenable?arrow_forward

- A firm is expected to pay a dividend of $3.90 one year from now and $4.25 two years from now and $4.30 three years from now. The firm's stock price is expected to be $110.50 in four years. What is the firm's stock value using a 13.78% required return? ○ $75.56 $201.47 $73.36 ○ $65.93arrow_forwardWhat is the cost of equity on these financial accounting question?arrow_forwardYou forecast the company A’s future earning is going to be $5.34 per share. The current market price is $55. What the market forward PE ratio? The estimated growth rate is 10%, what is the PEG ratio based on your estimate of growth rate? The industry average has a P/E ratio of 14 and growth rate of 12%, what does it mean for A’s stock price?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning