FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

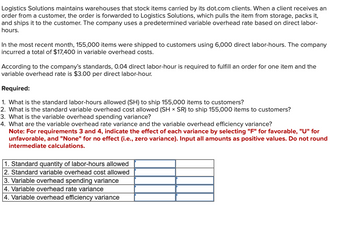

Transcribed Image Text:Logistics Solutions maintains warehouses that stock items carried by its dot.com clients. When a client receives an

order from a customer, the order is forwarded to Logistics Solutions, which pulls the item from storage, packs it,

and ships it to the customer. The company uses a predetermined variable overhead rate based on direct labor-

hours.

In the most recent month, 155,000 items were shipped to customers using 6,000 direct labor-hours. The company

incurred a total of $17,400 in variable overhead costs.

According to the company's standards, 0.04 direct labor-hour is required to fulfill an order for one item and the

variable overhead rate is $3.00 per direct labor-hour.

Required:

1. What is the standard labor-hours allowed (SH) to ship 155,000 items to customers?

2. What is the standard variable overhead cost allowed (SH × SR) to ship 155,000 items to customers?

3. What is the variable overhead spending variance?

4. What are the variable overhead rate variance and the variable overhead efficiency variance?

Note: For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for

unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round

intermediate calculations.

1. Standard quantity of labor-hours allowed

2. Standard variable overhead cost allowed

3. Variable overhead spending variance

4. Variable overhead rate variance

4. Variable overhead efficiency variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Logistics Solutions provides order fulfillment services for dot.com merchants. The company maintains warehouses that stock items carried by its dot.com clients. When a client receives an order from a customer, the order is forwarded to Logistics Solutions, which pulls the item from storage, packs it, and ships it to the customer. The company uses a predetermined variable overhead rate based on direct labor-hours. In the most recent month, 180,000 items were shipped to customers using 7.700 direct labor-hours. The company incurred a total of $26,180 in variable overhead costs. According to the company's standards, 0.03 direct labor-hours are required to fulfill an order for one item and the variable overhead rate is $3.45 per direct labor-hour. Required: 1. What is the standard labor-hours allowed (SH) to ship 180,000 items to customers? 2. What is the standard variable overhead cost allowed (SHSR) to ship 180,000 items to customers? 3. What is the variable overhead spending variance?…arrow_forwardLogistics Solutions maintains warehouses that stock items carried by its dot.com clients. When a client receives an order from a customer, the order is forwarded to Logistics Solutions, which pulls the item from storage, packs it, and ships it to the customer. The company uses a predetermined variable overhead rate based on direct labor-hours. In the most recent month, 125,000 items were shipped to customers using 4,400 direct labor-hours. The company incurred a total of $12,540 in variable overhead costs. According to the company's standards, 0.04 direct labor-hour is required to fulfill an order for one item and the variable overhead rate is $2.90 per direct labor-hour. Required: 1. What is the standard labor-hours allowed (SH) to ship 125,000 items to customers? 2. What is the standard variable overhead cost allowed (SH × SR) to ship 125,000 items to customers? 3. What is the variable overhead spending variance? 4. What are the variable overhead rate variance and the variable…arrow_forward4. Prepare a schedule of Cost of Goods Manufactured and Cost of Goods Sold. 5. Compute the amount of overapplied or underapplied overhead that should be prorated to Work-in-Process, Finished Goods and Cost of Goods Sold. 6. Prepare the income statement for August.arrow_forward

- Mukhiarrow_forwardDelph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 54,000 machine-hours would be required for the period's estimated level of production. It also estimated $1,040,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $5.00 per machine-hour. Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Job D-70 Direct materials cost Direct labor cost Machine-hours Job C-200 Direct materials cost Direct labor cost Machine-hours During the year, the company had no beginning or ending inventories and it…arrow_forwardLuzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine-hours. The predetermined overhead rate was based on a cost formula that estimates $1,368,000 of total manufacturing overhead for an estimated activity level of 72,000 machine-hours. During the year, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the company’s warehouse. The company’s cost records revealed the following actual cost and operating data for the year: Machine-hours 61,000 Manufacturing overhead cost $ 1,324,000 Inventories at year-end: Raw materials $ 16,000 Work in process (includes overhead applied of $115,900) $ 188,000 Finished goods (includes overhead applied of $208,620) $ 338,400 Cost of goods sold (includes overhead applied of $834,480) $ 1,353,600 Required: 1. Compute the underapplied or…arrow_forward

- Luzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine-hours. The predetermined overhead rate was based on a cost formula that estimates $1,368,000 of total manufacturing overhead for an estimated activity level of 72,000 machine-hours. During the year, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the company’s warehouse. The company’s cost records revealed the following actual cost and operating data for the year: Machine-hours 61,000 Manufacturing overhead cost $ 1,324,000 Inventories at year-end: Raw materials $ 16,000 Work in process (includes overhead applied of $115,900) $ 188,000 Finished goods (includes overhead applied of $208,620) $ 338,400 Cost of goods sold (includes overhead applied of $834,480) $ 1,353,600 Required: 1. Compute the underapplied or…arrow_forwardLuzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine-hours. The predetermined overhead rate was based on a cost formula that estimates $1,068,000 of total manufacturing overhead for an estimated activity level of 89,000 machine-hours. During the year, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the company's warehouse. The company's cost records revealed the following actual cost and operating data for the year: Machine-hours Manufacturing overhead cost Inventories at year-end: Raw materials Work in process (includes overhead applied of $44,400) Finished goods (includes overhead applied of $150,960) Cost of goods sold (includes overhead applied of $692,640) Required: 1. Compute the predetermined overhead rate used by the company during the year. 2. Is Manufacturing Overhead…arrow_forwardLogistics Solutions provides order fulfillment services for dot.com merchants. The company maintains warehouses that stock items carried by its dot com clients. When a client receives an order from a customer, the order is forwarded to Logistics Solutions, which pulls the item from storage, packs it, and ships it to the customer. The company uses a predetermined variable overhead rate based on direct labor-hours. In the most recent month, 185,000 items were shipped to customers using 8,000 direct labor-hours. The company incurred a total of $27,600 in variable overhead costs. According to the company's standards, 0.04 direct labor-hours are required to fulfill an order for one item and the variable overhead rate is $3.50 per direct labor-hour. Required: 1. What is the standard labor-hours allowed (SH) to ship 185,000 items to customers? 2. What is the standard variable overhead cost allowed (SH x SR) to ship 185,000 items to customers? 3. What is the variable overhead spending…arrow_forward

- For Reel, Inc. is a manufacturer of fishing rods. The company produces the rods in small batches. At the beginning of the year, For Reel estimated total manufacturing overhead of $24,200, total direct labor hours of 2,000 and total machine hours of 1,000. The company uses a traditional, normal costing system and allocates manufacturing overhead to production using the most appropriate allocation base for its highly automated manufacturing environment. During January, For Reel started and finished Job Allatoona. The job consisted of 10 identical fishing rods sold at a sales price of $500 per rod. A total of $1,500 in direct materials were requisitioned for the job during the month. Direct laborers were paid at a rate of $22 per direct labor hour and were paid $132 in total for work performed on the job. The job required 3.0 hours of machine time. Assuming 4 of the rods were sold during January, what is the total gross profit reported on the job during the month?arrow_forwardKenos Pte Ltd manufactures all types of custom-made furniture. It uses a job-costing system and applies manufacturing overhead on the basis of machine hours. The company's manufacturing overhead budget for the year totalled $2,400,000. It has a maximum capacity of 320,000 machine hours. However, it is budgeted to be able to use 75% of this capacity during this period. On 31 July, Kenos Pte Ltd has the following balances: Work in process inventory -Job 123 -Job 124 Raw materials inventory $13,360 Finished inventory -Job 122 $18,000 $8,620 In August, the following occurred: (i)Raw materials purchased on credit (ii) Raw materials requisitions $23,000 (v) Job number 123 124 125 Indirect labour (vi) -Job number 123 -Job number 124 -Job number 125 -Indirect materials (used in production) (iii)Machine hours, direct labour hours and wages for factory employees (iv)Other overhead incurred: Required: Depreciation (machineries) Depreciation (delivery vans) Machine hours Labour hours 2,400 2,320…arrow_forwardDraper Bank uses activity-based costing to determine the cost of servicing customers. Thereare three activity pools: teller transaction processing, check processing, and ATM transactionprocessing. The activity rates associated with each activity pool are $3.50 per teller transaction,$0.12 per canceled check, and $0.10 per ATM transaction. Corner Cleaners Inc. (a customer ofDraper Bank) had 12 teller transactions, 100 canceled checks, and 20 ATM transactions duringthe month. Determine the total monthly activity-based cost for Corner Cleaners Inc. during themonth.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education