Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

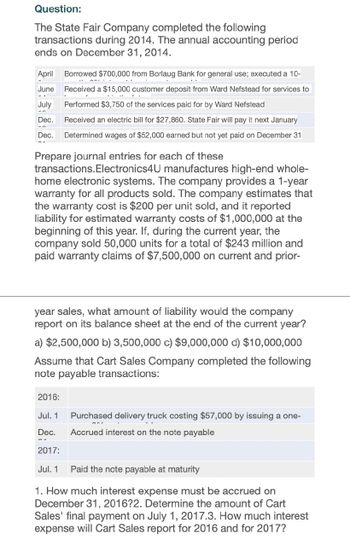

Transcribed Image Text:Question:

The State Fair Company completed the following

transactions during 2014. The annual accounting period

ends on December 31, 2014.

April Borrowed $700,000 from Borlaug Bank for general use; executed a 10-

June

July

Dec.

Received a $15,000 customer deposit from Ward Nefstead for services to

Performed $3,750 of the services paid for by Ward Nefstead

Received an electric bill for $27,860. State Fair will pay it next January

Dec. Determined wages of $52,000 earned but not yet paid on December 31

Prepare journal entries for each of these

transactions.Electronics4U manufactures high-end whole-

home electronic systems. The company provides a 1-year

warranty for all products sold. The company estimates that

the warranty cost is $200 per unit sold, and it reported

liability for estimated warranty costs of $1,000,000 at the

beginning of this year. If, during the current year, the

company sold 50,000 units for a total of $243 million and

paid warranty claims of $7,500,000 on current and prior-

year sales, what amount of liability would the company

report on its balance sheet at the end of the current year?

a) $2,500,000 b) 3,500,000 c) $9,000,000 d) $10,000,000

Assume that Cart Sales Company completed the following

note payable transactions:

2016:

Jul. 1 Purchased delivery truck costing $57,000 by issuing a one-

Dec. Accrued interest on the note payable

2017:

Jul. 1 Paid the note payable at maturity

1. How much interest expense must be accrued on

December 31, 2016?2. Determine the amount of Cart

Sales' final payment on July 1, 2017.3. How much interest

expense will Cart Sales report for 2016 and for 2017?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Company A purchases land on January 1, 2021 for $ 40,000 with a note payable. Other cost includes $ 2500 in delinquent property taxes, Ş in transfer taxes and a $ 1500 survey fee. General Journal Page Date Account Titles and Explanation Debit Creditarrow_forwardVigeland Company completed the following transactions during Year 1. Vigeland’s fiscal year ends on December 31. January 15 Purchased and paid for merchandise. The invoice amount was $15,400; assume a perpetual inventory system. April 1 Borrowed $660,000 from Summit Bank for general use; signed a 10-month, 13% annual interest-bearing note for the money. June 14 Received a $34,000 customer deposit for services to be performed in the future. July 15 Performed $3,950 of the services paid for on June 14. December 12 Received electric bill for $26,260. Vigeland plans to pay the bill in early January. December 31 Determined wages of $18,000 were earned but not yet paid on December 31 (disregard payroll taxes).arrow_forwardOn January 1, 2016, Byner Company purchased a used tractor. Byner paid $5,000 down and signed a noninterestbearing note requiring $25,000 to be paid on December 31, 2018. The fair value of the tractor is not determinable. An interest rate of 10% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. Required: 1. Prepare the journal entry to record the acquisition of the tractor. Round computations to the nearest dollar. 2. How much interest expense will the company include in its 2016 and 2017 income statements for this note? 3. What is the amount of the liability the company will report in its 2016 and 2017 balance sheets for this note?arrow_forward

- Vigeland Company completed the following transactions during Year 1. Vigeland’s fiscal year ends on December 31. January 15 Purchased and paid for merchandise. The invoice amount was $15,200; assume a perpetual inventory system. April 1 Borrowed $774,000 from Summit Bank for general use; signed a 10-month, 9% annual interest-bearing note for the money. June 14 Received a $24,000 customer deposit for services to be performed in the future. July 15 Performed $3,450 of the services paid for on June 14. December 12 Received electric bill for $26,160. Vigeland plans to pay the bill in early January. December 31 Determined wages of $15,000 were earned but not yet paid on December 31 (disregard payroll taxes). Required: Prepare journal entries for each of these transactions. Prepare the adjusting entries required on December 31.arrow_forwardThe following items were selected from among the transactions completed by Aston Mar-tin Inc. during the current year: Apr. 15. Borrowed $225,000 from Audi Company, issuing a 30-day, 6% note for that amount. May 1. Purchased equipment by issuing a $320,000, 180-day note to Spyder Manufacturing Co., which discounted the note at the rate of 6%. 15. Paid Audi Company the interest due on the note of April 15 and renewed the loan by issuing a new 60-day, 8% note for $225,000. (Record both the debit and credit to the notes payable account.) July 14. Paid Audi Company the amount due on the note of May 15. Aug. 16. Purchased merchandise on account from Exige Co., $90,000, terms, n/30. Sept. 15. Issued a 45-day, 6% note for $90,000 to Exige Co., on account. Oct. 28. Paid Spyder Manufacturing Co. the amount due on the note of May 1. 30. Paid Exige Co. the amount owed on the note of September 15. Nov. 16. Purchased store equipment from Gallardo Co. for $450,000, paying $50,000 and issuing a…arrow_forwardPublishing completed the following transactions during 2018 Oct 1: Sold a six-month subscription (starting on November 1), collecting cash of $540, plus sales tax of 8%. (Prepare a single compound entry for this transaction.) Date Accounts and Explanation Debit Credit Oct. 1 Nov. 15: Remitted (paid) the sales tax to the state of Tennessee. Date Accounts and Explanation Debit Credit Nov. 15 Dec. 31: Made the necessary adjustment at year-end to record the amount of subscription revenue earned during the year. Date Accounts and Explanation Debit Credit Dec. 31arrow_forward

- Brooks Inc. issued a $220,000, six-month, 6% note to purchase equipment on August 1, 2022. Brooks Inc's fiscal year end is September 30. The journal entry to record unpaid, accrued interest as of September 30, 2022 is: Interest expense 6,600 Interest payable 6,600 Interest expense 13,200 Interest payable 13,200 Interest expense 2,200 Interest payable 2,200arrow_forwardWhat is the interest expense for December 31 on these accounting question?arrow_forwardOn January 1, 2022, the ledger of Waterway Company contains these liability accounts. Accounts Payable $54,000 Sales Taxes Payable $7,200 Unearned Service Revenue $16,500 During January, these selected transactions occurred. Jan. 5 Sold merchandise for cash totaling $20,520, which includes 8% sales taxes. 12 Performed services for customers who had made advance payments of $11,000. (Credit Service Revenue.) 14 Paid state revenue department for sales taxes collected in December 2021 ($7,200). 20 Sold 900 units of a new product on credit at $50 per unit, plus 8% sales tax. This new product is subject to a 1-year warranty. 21 Borrowed $31,500 from Girard Bank on a 3-month, 8 %, $31.500 note. 25 Sold merchandise for cash totaling $9,936, which includes 8% sales taxes.ranscribed Image (b) Journalize the adjusting entries at January 31 for (1) the outstanding notes payable, and (2) estimated warranty liability, assuming warranty costs are…arrow_forward

- Tom’s Surf Company, whose fiscal year ends December 31, completed the following transactions involving notes payable:2018Nov 30 Purchased inventory display equipment by issuing a 60 day 10 percent note for $35,000.Dec 31 Made the end-of-year adjusting entry to accrue interest expense2019Jan 29 Paid off the balance of the notePrepare the journal entries for the above transactions. Round your answers for interest calculations to the nearest cent. Assume there are 365 days in the year.arrow_forwardOn September 15, Berto Motor Service Center issued a 90-day, 18% note amounting to P10,000for a loan from a friend. The service center uses the fiscal accounting period ending September30.Required: Entries on date of issue and end of Septemberarrow_forwardSpath Company borrows 75,000 by issuing a 4-year, noninterest-bearing note to a customer on January 1, 2019. In addition, Spath agrees to sell inventory to the customer at reduced prices over a 5-year period. Spaths incremental borrowing rate is 12%. The customer agrees to purchase an equal amount of inventory each year over the 5-year period so that a straight-line method of revenue recognition is appropriate. Required: Prepare the journal entries on Spaths books for 2019 and 2020. (Round answers to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College