FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Damaged clothing from

Help

Save & Exit

Submit

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-group/kEZASSBKEPUGL9bt-TSZRiuPHcKYv3EHOiAm4h0gf44llphi-rtQnDbTLoT33hgp0-8aTTb...

ents | My.NCWU.EX

M Question 1 Chapter 2 Quiz - C X

+

pter 2 Quiz i

1

Skipped

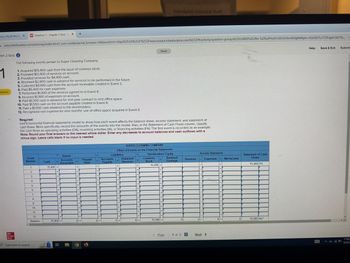

The following events pertain to Super Cleaning Company:

1. Acquired $15,400 cash from the issue of common stock.

2. Provided $13,400 of services on account.

3. Provided services for $4,400 cash.

4. Received $2,800 cash in advance for services to be performed in the future.

5. Collected $9,400 cash from the account receivable created in Event 2.

6. Paid $5,400 for cash expenses.

7. Performed $1,400 of the services agreed to in Event 4.

8. Incurred $1,900 of expenses on account.

9. Paid $1,300 cash in advance for one-year contract to rent office space.

10. Paid $1,550 cash on the account payable created in Event 8.

11. Paid a $1,900 cash dividend to the stockholders.

12. Recognized rent expense for nine months' use of office space acquired in Event 9.

Required:

Saved

Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of

cash flows. More specifically, record the amounts of the events into the model. Also, in the Statement of Cash Flows column, classify

the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA). The first event is recorded as an example.

Note: Round your final answers to the nearest whole dollar. Enter any decreases to account balances and cash outflows with a

minus sign. Leave cells blank if no input is needed.

SUPER CLEANING COMPANY

Event

Number

Cash

+

Assets

Accounts

Receivable

+

+

Prepaid

Rent

==

Accounts

Payable

Unearned

Revenue

5

Effect of Events on the Financial Statements

Liabilities

Stockholders' Equity

Retained

Earnings

Income Statement

Statement of Cash

Common

Stock

+

Revenue

Expenses

Net Income

Flows

1.

15,400 +

+

+

+

15,400 +

15,400 FA

2.

+

+

=

+

+

+

3.

+

+

+

+

4.

+

+

+

+

+

+

Mc

Graw

Hill

5.

+

6.

+

++

7.

8.

9.

+

++

+

+

10.

+

+

11.

+

+

+

III IL

12.

Balance

15,400 +

0+

0

Type here to search

+

+

+

+

+

+

+

+

+

+

+

+

++

+

+

+

+

+

+

+

+

+

+

0+

0+

15,400 +

Prey

1 of 2

Next >

0

15,400 NC*

11:03

9/14/2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- eAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress%3Dfalse e Page | Zora... Welcome, Quente... E Library Genesis Macmillan Launch... (7) YouTube O11- My Conversations... bnc Apparel, Gifts & T... 国 >> a. Complete the materials issuances and balances for the materials subsidiary ledger under FIFO. Received Issued Balance Receiving Materials Unit Report Quantity Requisition Quantity Unit Price Amount Date Quantity Amount Number Number price May 1 400 $9 $3,600 26 280 $11 May 4 103 450 May 10 32 190 13 May 21 116 270 May 27 b. Determine the materials inventory balance at the end of May. C. Journalize the summary entry to transfer materials to work in process. If an amount box does not require an entry, leave it blank. d. Comparing as reported in the materials ledger with predetermined order points would enable management to order materials before a(n) causes idle time. %24 %24arrow_forward- Conne X + mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fmybsc.bryantstratton.edu%252Fwebapps%252Fportal... = T-Connect Assignment 1 Saved Help Save & Exit Subm Check my work Required information [The following information applies to the questions displayed below.] Following are the transactions of a new company called Pose-for-Pics. August 1 M. Harris, the owner, invested $14,500 cash and $62,350 of photography equipment in the company. August 2 The company paid $4,000 cash for an insurance policy covering the next 24 months. August 5 The company purchased supplies for $2,755 cash. August 20 The company received $2,950 cash from taking photos for customers. August 31 The company paid $885 cash for August utilities. k Required: 1. Post the above transactions to the T-accounts. t 2. Use the amounts from the T-accounts in Requirement (1) to prepare an August 31 trial balance for Pose-for-Pics. nces Complete this question by entering your…arrow_forwardect p.mheducation.com/ext/map/index.html?_con3con&external_browser%3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-group/... * D B homework i Saved Help Save & Exit Submit Check my work Required information [The following information applies to the questions displayed below.] Altira Corporation provides the following information related to its merchandise inventory during the month of August 2021: Aug.1 Inventory on hand–2,000 units; cost $5.30 each. 8 Purchased 8,000 units for $5.50 each. 14 Sold 6,000 units for $12.00 each. 18 Purchased 6,000 units for $5.60 each. 25 Sold 7,000 units for $11.00 each. 28 Purchased 4,000 units for $5.80 each. 31 Inventory on hand-7,000 units. Required: 1. Using calculations based on a perpetual inventory system, determine the inventory balance Altira would report in its August 31, 2021, balance sheet and the cost of goods sold it would report in its August 2021 income statement using the FIFO method. Cost of Goods…arrow_forward

- to.mheducation.com/ext/map/index.html?_con3Dcon&external_browser=D0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%25... 5 Assignment Saved Help Save & Exit Submit Check my work Required information Use the following information for the Quick Study below. (Algo) (5-7) [The following information applies to the questions displayed below.] f3 A company reports the following beginning inventory and two purchases for the month of January. On January 26, the company sells. 290 units. Ending inventory at January 31 totals 130 units. Unit Cost $ 2.40 2.60 Units Beginning inventory on January 1 Purchase on January 9 Purchase on January 25 260 60 46:08 100 2.74 pok QS 5-7 (Algo) Perpetual: Inventory costing with weighted average LO P1 nt Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round your per unit costs to 2 decimal places.) int ences Weighted Average -…arrow_forwardDamaged clothing from using a washer or dryer? Please call 1-800-762-3452 and speak with a ustomer service representative. You will need e machine license plate number and date of mage in order to place a refund request CJY Please call to submit a claim with 7 to 10 Saved ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question tion & - Chapter 3 Homew X b Home | bartleby x + apter 3 Homework i 8 5 nts eBook Hint Print Powell Company began the Year 3 accounting period with $48,000 cash, $94,000 Inventory, $68,000 common stock, and $74,000 retained earnings. During Year 3. Powell experienced the following events: 1. Sold merchandise costing $62,000 for $107,500 on account to Prentise Furniture Store. 2. Delivered the goods to Prentise under terms FOB destination. Freight costs were $900 cash. 3. Received returned goods from Prentise. The goods cost Powell $4,800 and were sold to Prentise for…arrow_forwardezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-group/ 3- Homework Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indi Required information [The following information applies to the questions displayed below.] Determine the amount of the late filing and late payment penalties that apply for the following taxpayers. As b. Oscar filed his tax return and paid his $4,400 tax liability seven months late. Saved Answer is complete but not entirely correct. Late filing and late payment penalties $ 1,100 xarrow_forward

- mentum.com/assessments-delivery/ua/la/launch/135147/45280656/aHR0cHM6Ly9mMi5hcHAUZWRIZW50dWOuY29tL2xlYXJuZXItdWkvc2Vjb25kYX.JSL3VzZXHYXNzaWdubwyud izizz O www.coolmathga.. A Mutila te a Doll 2-U. S Achievernernt Senes Mutila te a Doll 2-T T Happy Whees-Un.. T Crush the Castle-T. A Week 5 Bellinger- ext O Post Test: Personal Financial Management O Submit Tet Reader Tools 3\ Select the correct answer. Crystal wants the latest limited edition of Vogue magazine, but she needs to buy food for her family. Crystal prioritizes her needs over her wants. What will she most likely do? O A. Purchase the groceries, because that is her need. O B. Purchase the magazine, because it is a limited edition that she may not see again. Purchase the magazine before it becomes outdatedn OD. Purchase cheaper grocery items so she can still afford the magazine. OE. Purchase neither groceries nor the magazine. Reset Nextarrow_forwardezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconn Assignment i J ok int 8 Print ferences Mc Graw Hill Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $85,460 in assets to launch the business. On December 31, the company's records show the following items and amounts. Cash Accounts receivable office supplies Land Office equipment Accounts payable Owner investments. Exercise 1-18 (Algo) Preparing an income statement LO P2 $ 6,650 Cash withdrawals by owner. 18,650 Consulting revenue 4,640 Rent expense 46,000 Salaries expense 19,560 Telephone expense 9,890 Miscellaneous expenses 85,460 Revenues Using the above information prepare a December income statement for the business. ERNST CONSULTING Income Statement For Month Ended December 31…arrow_forwardPlease help solve stepsarrow_forward

- myncwu - Search X J Home | My.NCWU.Edu mework X M Question 6 - Chapter 3 Homewo X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mhe... A Saved Ho Designs experienced the following events during Year 1, its first year of operation: 1. Started the business when it acquired $66,000 cash from the issue of common stock. 2. Paid $28,000 cash to purchase inventory. Difference in book and actual inventory + Help 00 Save & Exit Check my 3. Sold inventory costing $16,800 for $33,000 cash. 4. Physically counted inventory showing $10,900 inventory was on hand at the end of the accounting period. Required: a. Determine the amount of the difference between book balance and the actual amount of inventory as determined by the physical count.arrow_forwardnework E x ezto.mheducation.com/ext/map/index.html?_con=con&external_browser%3D0&launchUrl=https%253A 52F%252Ffaytechcc.blackboard.co.. - User Management,.. H https://outlook.off.. FES Protection Plan System 7 - North C.. work Exercises Soved Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate ce Purchased merchandise on credit from O'Rourke Fabricators, Invoice 885, $1,600, terms 2/10, n/30; freight of $32 prepaid by O'Rourke Fabricators and added to the invoice (total invoice amount, $1,632). Paid amount due to O'Rourke Fabricators for the purchase of April 1, less the 2 percent discount, Check 457. Purchased merchandise on credit from Kroll Company, Invoice 145, $1,050, terms 2/10, n/30; freight of $55 prepaid by Kroll and added to the invoice. Returned damaged merchandise purchased on April 15 from Kroll Company; received Credit Memorandum 332 for $50. Paid the amount due to Kroll Company for the purchase of…arrow_forwardFill in the missing amounts from the following T accounts.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education