Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Not use

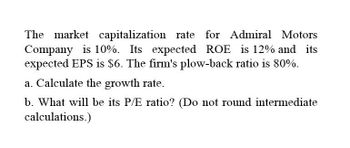

Transcribed Image Text:The market capitalization rate for Admiral Motors

Company is 10%. Its expected ROE is 12% and its

expected EPS is $6. The firm's plow-back ratio is 80%.

a. Calculate the growth rate.

b. What will be its P/E ratio? (Do not round intermediate

calculations.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Can you answer this accounting question without use ai?arrow_forwardThe market capitalization rate for Admiral Motors Company is 7%. Its expected ROE is 12% and its expected EPS is $6. The firm's plowback ratio is 50%. Required: a. Calculate the growth rate. (Input your answer as a nearest whole percent.) b. What will be its P/E ratio? (Do not round intermediate calculations.)arrow_forwardThe market capitalization rate for Admiral Motors Company is 6%. Its expected ROE is 10% and its expected EPS is $5. The firm's plowback ratio is 50%. Required: a. Calculate the growth rate. (Input your answer as a nearest whole percent.) Growth rate % b. What will be its P/E ratio? (Do not round intermediate calculations.) P/E ratioarrow_forward

- es The market capitalization rate for Admiral Motors Company is 8%. Its expected ROE is 10% and its expected EPS is $5. The firm's plowback ratio is 60%. Required: a. Calculate the growth rate. (Input your answer as a nearest whole percent.) Growth rate 6% b. What will be its P/E ratio? (Do not round intermediate calculations.) P/E ratioarrow_forwardA. CALCULATE the cost of equity capital of H Ltd., whose risk-free rate of return equals 10%. The firm's beta equals 1.75 and the return on the market portfolio equals to 15%. B. The current ratio of H Ltd is 5:1 and standard current ratio given by accounting bodies is 2:1? Do you think that H Ltd should try to reduce its current ratio?arrow_forwardThe market capitalization rate for Admiral Motors Company is 12%. Its expected ROE is 9%. If the firm's plowback ratio is 50%, what will be its P/E ratio? Round your answer to one decimal place.arrow_forward

- The Farmer Co. has a payout ratio of 65% and a return on equity (ROE) of 16% (assume that this is expected ROE for the upcoming year). What will be the appropriate price-to-book value (PBV) based on return differential if the expected growth rate in dividends is 5.6% and the required rate of return is 13% ?arrow_forwardA firm has decided that its optimal capital structure is 100% equity-financed. It perceives its optimal dividend policy to be a 60% payout ratio. Asset turnover is sales/assets = 0.6, the profit margin is 10%, and the firm has a target growth rate of 3%. a-1. Calculate the sustainable growth rate. (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.) a-2. Is the firm’s target growth rate consistent with its other goals? b. If the firm’s target growth rate is not consistent with its other goals, what would asset turnover need to be to achieve its goals? (Do not round intermediate calculations. Round your answer to 3 decimal places.) c. If the firm’s target growth rate is not consistent with its other goals, how high would the profit margin need to be to achieve its goals? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.)arrow_forwardCastle-in-Sand generates a rate of return of 20% on its investments and maintains a plowback ratio of 0.30. Its earnings this year will be $4 per share. Investors expect a 12% rate of return on the stock. Required: (a.) Find the price and P/E ratio of the firm. (b.) What happens to the P/E ratio if the plowback ratio is reduced to 0.20? Why? (c.) Show that if plowback equals zero, the earnings-price ratio, E/P, falls to the expected rate of return on the stock.arrow_forward

- You forecast the company A’s future earning is going to be $5.34 per share. The current market price is $55. What the market forward PE ratio? The estimated growth rate is 10%, what is the PEG ratio based on your estimate of growth rate? The industry average has a P/E ratio of 14 and growth rate of 12%, what does it mean for A’s stock price?arrow_forwardCastles in the Sand generates a rate of return of 20% on its investments and maintains a plowback ratio of 0.20. Its earnings this year will be $2 per share. Investors expect a rate of return of 10% on the stock. a. Find the price and P/E ratio of the firm. b. Find the price and P/E ratio of the firm if the plowback ratio is reduced to 0.10.arrow_forwardACME Inc. has the following ratios: A0/S0- 1.3; LO/SO-0.40; profit margin-0.14; and the dividend payout ratio- .32, or 32%. Sales last year were $85 million. Assuming that these ratios will remain constant, use the AFN equation to determine the firm's self-supporting growth rate-in other words, the maximum growth rate ACME can achieve without having to employ non-spontaneous external funds. (Equation 9-2, which is 9-1, solving for g)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you