FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

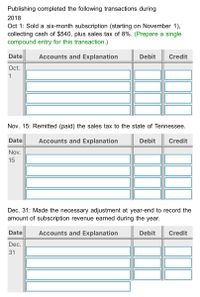

Transcribed Image Text:Publishing completed the following transactions during

2018

Oct 1: Sold a six-month subscription (starting on November 1),

collecting cash of $540, plus sales tax of 8%. (Prepare a single

compound entry for this transaction.)

Date

Accounts and Explanation

Debit

Credit

Oct.

1

Nov. 15: Remitted (paid) the sales tax to the state of Tennessee.

Date

Accounts and Explanation

Debit

Credit

Nov.

15

Dec. 31: Made the necessary adjustment at year-end to record the

amount of subscription revenue earned during the year.

Date

Accounts and Explanation

Debit

Credit

Dec.

31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following transactions are from Ohlm Company. (Use 360 days a year.) Year 1 Dec. 16 Accepted a $10,700, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 Feb. 14 Received Todd’s payment of principal and interest on the note dated December 16. Mar. 2 Accepted a(n) $6,600, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Co. 17 Accepted a(n) $3,300, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. Apr. 16 Privet dishonored her note. May 31 Midnight Co. dishonored its note. Aug. 7 Accepted a(n) $7,900, 90-day, 10% note in granting a time extension on the past-due account receivable of Mulan Co. Sep. 3 Accepted a(n) $3,210, 60-day, 11% note in granting Noah Carson a time extension on his past-due account…arrow_forwardMcNamara Industries completed the following transactions during 2024: (Click the icon to view the transactions.) Journalize the transactions. Explanations are not required. Round to the nearest dollar. (Record debits first, then credits. Exclude explanations from journal entries.) Nov. 1: Made sales of $16,000. McNamara estimates that warranty expense is 5% of sales. (Record only the warranty expense.) Date Accounts Debit Credit Nov. 1 More info Nov. 1 Nov. 20 Dec. 31 Dec. 31 ← Made sales of $16,000. McNamara estimates that warranty expense is 5% of sales. (Record only the warranty expense.) Paid $500 to satisfy warranty claims. Estimated vacation benefits expense to be $3,500. McNamara expected to pay its employees a 4% bonus on net income after deducting the bonus. Net income for the year is $25,000. Prin Done Xarrow_forwardOn December 1, 2021, a company converted an existing account receivable in the amount of $6,000 to a note receivable to allow an extended payment period. The note is due in three months and includes an annual interest rate of 9%. The company prepares year-end financial statements on December 31 and recorded adjusting entries at that time. What entry should the company make on March 1, 2022, when the interest is paid at maturity? Multiple Choice Debit Cash and credit Notes Receivable for $6,135. Debit Cash for $6,135, credit Notes Receivable for $6,000, and credit Interest Revenue for $135. Debit Cash for $135 and credit Interest Revenue for $135. О Debit Cash for $135, credit Interest Receivable for $45, and credit Interest Revenue for $90.arrow_forward

- (Bonus Question 02) Record the sale by Verity Springs, Inc. of $136,000 in accounts receivable on May 1. Verity Springs is charged a 3.00% factoring fee. View transaction list Journal entry worksheet < 1 Record the sale of receivable. Note: Enter debits before credits. Date May 01 General Journal Debit Creditarrow_forwardQuestion. Jamaica Corporation carried out the following transactions involving note payable. During the fiscal year ended December 31, 2020. Aug 6 Borrowed $ 15,200 from Tony Stark, issuing to him a 45 da, 14% note payable. Sept. 16 Purchased office equipment from Ikea Company. The invoice amount was $18,800 and Ikea Company agreed to accept as full payment a 3-month, 15% note for the invoice amount. Sept. 20 Paid Tony Stark note plus accrued interest. Nov.1 Borrowed $ 2,35,000 from Nation Commercial Bank at an interest rate of 12% per annum; signed a 90-days note payable for $ 2,42,256, which included a $7,056 interest charge in the face amount. Dec.1 Purchased merchandise in the amount of $13,000 from Stephens & Co. Gave in settlement a 60-day note nearing interest at 15% (Perpetual inventory system is deployed). Dec. 16 The $18,800 note payable to Ikea Company matured today. Paid the interest accrued and issued new 30-days, 12% note to replace the maturing…arrow_forward4. Prepare journal entries to record (a) issuance of the note, (b) accrual of interest on December 31, and (c) payment of the note at maturity. Complete this question by entering your answers in the tabs below. Req 1 Prepare journal entries to record (a) issuance of the note, (b) accrual of interest on December 31, and (c) payment of the note at maturity. Note: Use 360 days a year. Do not round intermediate calculations. View transaction list 2 Req 2 and 3 3 1 Record the issuance of the note on December 1. Req 4 Record the interest accrued on the note as of December 31, current year. Note : Record payment of the note at maturity, assuming no reversing entries were made on January 1. = = journal entry has been entered Record entry Clear entry X Credit View general journal >arrow_forward

- E4-29 Mattson Loan Company completed these transactions: 2019 Apr. Dec. 2020 Apr. 1 Loaned $20,000 to Charlene Baker on a one-year, 5% note. 31 Accrued interest revenue on the Baker note. 1 Collected the maturity value of the note from Baker (principal plus interest). Show what Mattson would report for these transactions on its 2019 and 2020 balance sheets and income statements. Mattson's accounting year ends on December 31.arrow_forwardHelp me selecting the right answer. Thank youarrow_forwardThe transaction below pertains to Boyer Coe Company, whose fiscal year ends December 31. On November 1, 2019 Coe borrowed $25,000 at 6 percent for 6 months. The entry to record the November 1 borrowing transaction would include a: A. Credit to notes payable for $750 B. Credit to notes payable for $24,250 C. Debit to cash for $24,250 D. Debit to cash for $25,000arrow_forward

- On August 2, Jun Company receives a $7,000, 90-day, 11.5% note from customer Ryan Albany as payment on his $7,000 account receivable. Prepare Jun's journal entry assuming the note is honored by the customer on October 31 of that same year. (Do not round intermediate calculations. Round your answers to nearest whole dollar value. Use 360 days a year.) View transaction list Journal entry worksheet 1 Record cash received on note plus interest. Note: Enter debits before credits. Date October 31 General Journal Debit Creditarrow_forwardDo a journal entry based on this transections, round interest amounts to the nearest dollar,arrow_forwardJournalize the following entries on the books of the borrower and creditor. Label accordingly. (Assume a 360-day year is used for interest calculations.) June 1 James Co. purchased merchandise on account from O’Leary Co., $90,000, terms n/30. The cost of merchandise sold was $54,000. 30 James Co. issued a 60-day, 5% note for $90,000 on account. Aug. 29 James Co. paid the amount due.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education