Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN: 9781337619455

Author: Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

not use ai please don't

Transcribed Image Text:lying

of

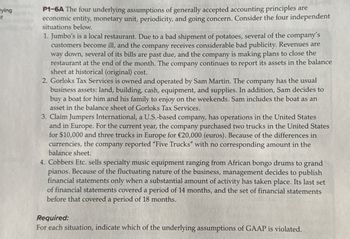

P1-6A The four underlying assumptions of generally accepted accounting principles are

economic entity, monetary unit, periodicity, and going concern. Consider the four independent

situations below.

1. Jumbo's is a local restaurant. Due to a bad shipment of potatoes, several of the company's

customers become ill, and the company receives considerable bad publicity. Revenues are

way down, several of its bills are past due, and the company is making plans to close the

restaurant at the end of the month. The company continues to report its assets in the balance

sheet at historical (original) cost.

2. Gorloks Tax Services is owned and operated by Sam Martin. The company has the usual

business assets: land, building, cash, equipment, and supplies. In addition, Sam decides to

buy a boat for him and his family to enjoy on the weekends. Sam includes the boat as an

asset in the balance sheet of Gorloks Tax Services.

3. Claim Jumpers International, a U.S.-based company, has operations in the United States

and in Europe. For the current year, the company purchased two trucks in the United States

for $10,000 and three trucks in Europe for €20,000 (euros). Because of the differences in

currencies, the company reported "Five Trucks" with no corresponding amount in the

balance sheet.

4. Cobbers Etc. sells specialty music equipment ranging from African bongo drums to grand

pianos. Because of the fluctuating nature of the business, management decides to publish

financial statements only when a substantial amount of activity has taken place. Its last set

of financial statements covered a period of 14 months, and the set of financial statements

before that covered a period of 18 months.

Required:

For each situation, indicate which of the underlying assumptions of GAAP is violated.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 27.A company writes off as uncollectible an account receivable from a bankrupt customer. The company has an adequate amount in its Allowance for Uncollectible Accounts. What would be the effect of this transaction in the company's financial statements? a. Operating expenses for the period will increase. b. Total current assets will decrease. c. Net profit for the period will not be affected. d. Net profit for the period will decrease.arrow_forwardThe four underlying assumptions of generally accepted accounting principles are economic entity, monetary unit, periodicity, and going concern. Consider the following four independent situations. 1. Mound Builders Groceries has over 1,000 grocery stores throughout the Northwest. Approximately 200,000 customers visit its stores each day. Because of the continual nature of grocery sales, the company does not publish an income statement. The company feels that it has an indefinite life and a periodic report would mislead investors. 2. Trolls Shipping provides delivery of packages between the United States and Japan. During the current year, the company delivered 3,000 packages for its U.S. customers totaling $25,000 in revenue. For its Japanese customers, the company delivered 1,000 packages totaling ¥1,000,000 (yen). The company's income statement indicates that total revenue equals 4,000 packages delivered with no corresponding amount in the income statement. 3. Slugs Typewriter has…arrow_forwardThe four underlying assumptions of generally accepted accounting principles are economic entity, monetary unit, periodicity, and going concern. Consider the following four independent situations.1. Mound Builders Groceries has over 1,000 grocery stores throughout the Northwest. Approximately 200,000 customers visit its stores each day. Because of the continual nature of grocery sales, the company does not publish an income statement. The company feels that it has an indefinite life and a periodic report would mislead investors.2. Trolls Shipping provides delivery of packages between the United States and Japan. During the current year, the company delivered 3,000 packages for its U.S. customers totaling $25,000 in revenue. For its Japanese customers, the company delivered 1,000 packages totaling ¥1,000,000 (yen). The company’s income statement indicates that total revenue equals 4,000 packages delivered with no corresponding amount in the income statement.3. Slugs Typewriter has…arrow_forward

- Why is it expected that the initial debit and credit totals of the income statement accounts do not balance on a 10-column worksheet? Select one: a. None of the choices available. b. This is expected because the company should report an asset. c. This is not expected and it shows that there is definitely an error made. d. This is expected because the company should report an income or a loss.arrow_forwardPaying an amount on account reduces Oa. a. stockholders' equity. O b. the amount owed on a liability. O c. net income. O d. an expense. 6 Four companies and their ratio of liabilities to stockholders' equity are as follows: 0.88 Fred Company 0.44 Yabba Company 1.22 Dabba Company 0.66 Doo Company To which company would a supplier be most eager to extend credit? O a. Dabba Company O b. Doo Company O c. Fred Company O d. Yabba Companyarrow_forwardPlease help mearrow_forward

- Which of the following is an example of “cookie jar” accounting? a) A company creates cash reserves in profitable years so the money can be used to offset poor earnings in bad years to give the impression that the company is consistently achieving earnings goals and meeting investor expectations. b)A company intentionally misapplies GAAP and, if caught, argues that the earnings effect is “immaterial” and the error is not worth correcting. c)A company takes a one-time charge against income in order to reduce assets, which results in lower expenses in the future. d) A company recognizes revenues before it is appropriate to do so.arrow_forwardOn December 1, Anson's Drug Store concluded that a customer's $325 account receivable was uncollected and that the account should be written off. What effect will this write-off have on the company's net income and balance sheet totals assuming the direct write-off method is used to account for bad debts? a. decrease in net income; decrease in total assets b. no effect on net income; no effect on total assets c. increase in net income; no effect on total assets d. no effect on net income; decrease in total assetsarrow_forwardOn October 12 of the current year, a company determined that a customer's account receivable was uncollectible and that the account should be written off. Assuming the direct write-off method is used to account for bad debts, what effect will this write-off have on the company's net income and total assets? Mutiple Choice Decrease in net income; no effect on total assets. No effect on net income; no effect on total assets. Decrease in net income; decrease in total assets. Increase in net income; no effect on total assets. No effect on net income; decrease in total assetsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College