Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Need Help Please Solve

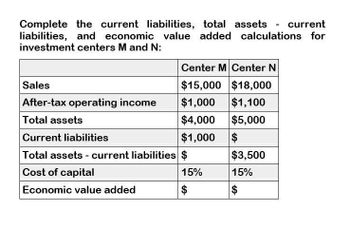

Transcribed Image Text:Complete the current liabilities, total assets - current

liabilities, and economic value added calculations for

investment centers M and N:

Center M Center N

Sales

$15,000 $18,000

After-tax operating income

$1,000

$1,100

Total assets

$4,000

$5,000

Current liabilities

$1,000

$

Total assets - current liabilities $

$3,500

Cost of capital

15%

15%

Economic value added

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Give true calculation for this general accounting questionarrow_forwardGeneral Accounting Question Solutionarrow_forwardThe following are available for divison X and Y Profit before interest and tax X 185 000 Y172 000 Capital employed X 1 540 000 Y 1 650 000 The cost of capital is 10% comment on the performance of the departments based on a. Return on capital employed b.residual incomearrow_forward

- p3-10arrow_forwardPlease help me with show all calculation thankuarrow_forwardMeasures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $82.60 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Υ2 20Υ1 Retained earnings, January 1 $3,704,000 $3,264,000 Net income $ 600,000 $ 550,000 Dividends: On preferred stock (10,000) (10,000) On common stock (100,000) (100,000) Increase in retained earnings $ 490,000 $ 440,000 Retained earnings, December 31 $4,194,000 $3,704,000 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Υ1 Sales $ 10,850,000 $10,000,000 Cost of goods sold (6,000,000) (5,450,000) $ 4,850,000 $ (2,170,000) Gross profit $ 4,550,000 Selling expenses $ (2,000,000) Administrative expenses (1,627,500) (1,500,000) Total operating expenses $(3,797,500) $ (3,500,000) Operating income $ 1,052,500 $ 1,050,000 Other revenue and expense:…arrow_forward

- Please help me with show all calculation thankuarrow_forwardCalculate: Net profit margin Asset utilization Equity multiplierarrow_forwardUse the following information to answer this question. Total assets Total current liabilities Total expenses Total liabilities Total revenues Tax rate $150,000 105,000 70,000 110,000 80,000 40% After -tax cost of capital 12% Invested capital is defined as total assets less total liabilities. (round your answers te one decimal ) Capital turnover equal O A) 53.3% B) 2 OC) 6.7% D) 28.6%arrow_forward

- Sales Operating Income Total Assets (investment) Target Rate of Return (Cost of Capital) $1,520,437 $77,792 $500,251 12% What is return on investment? Input your answer to 1 decimal place. For example if you calculate.1892 enter 18.9.arrow_forwardBased on the following data, what is the amount of working capital? Accounts payable $55040 Accounts receivable 98040 Cash 60200 Intangible assets 86000 Inventory 118680 Long-term investments 137600 Long-term liabilities 172000 Short-term investments 68800 Notes payable (short-term) 48160 Property, plant, and equipment 1152400 1720 Prepaid insurance $280360 $318200 $244240 $285520arrow_forwardSolve in digital format pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning