EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Don't use Ai.

Answer with explanation.

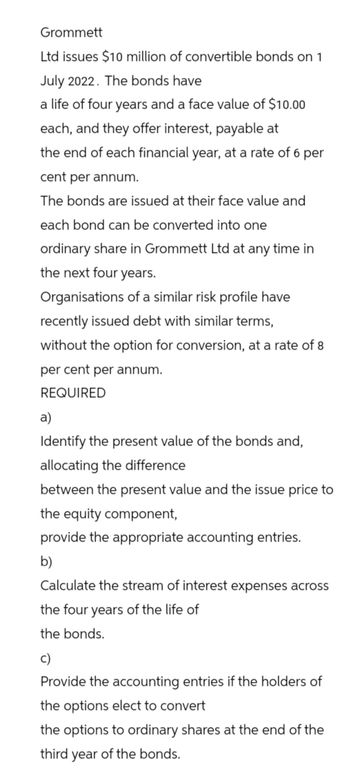

Transcribed Image Text:Grommett

Ltd issues $10 million of convertible bonds on 1

July 2022. The bonds have

a life of four years and a face value of $10.00

each, and they offer interest, payable at

the end of each financial year, at a rate of 6 per

cent per annum.

The bonds are issued at their face value and

each bond can be converted into one

ordinary share in Grommett Ltd at any time in

the next four years.

Organisations of a similar risk profile have

recently issued debt with similar terms,

without the option for conversion, at a rate of 8

per cent per annum.

REQUIRED

a)

Identify the present value of the bonds and,

allocating the difference

between the present value and the issue price to

the equity component,

provide the appropriate accounting entries.

b)

Calculate the stream of interest expenses across

the four years of the life of

the bonds.

c)

Provide the accounting entries if the holders of

the options elect to convert

the options to ordinary shares at the end of the

third year of the bonds.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2018, Wawatosa Inc. issued 5-year bonds with a face value of $200,000 and a stated interest rate of 12% payable semi-annually on July 1 and January 1. The bonds were sold to yield 10%. Assuming the bonds were sold at 107.732, what is the selling price of the bonds? Were they issued at a discount or a premium?arrow_forwardFlysafe Bhd issues 2,000 convertible bonds at 1 January 2019. The bonds have a 3 years term, and are issued at par with a face value of RM1,000 per bond, giving total proceeds of RM2,000,000. Interest is payable annually in arrears at a nominal annual interest rate of 6%. Each bond is convertible at any time up to maturity into 250 ordinary shares. When the bonds were issued, the prevailing market interest rate for similar debt without the conversion option is 9%. When preparing the draft financial statements for the year ended 31 December2020, the directors are proposing to show the convertible bonds within equity in the statement of financial position, as they believe all the bond holders will choose the equity option when the loan note is due for redemption. They further intend to charge a finance cost of RM120,000 (RM2,000,000 x 6%) in the statement of profit or loss for each year up to the date of redemption. Required Critically evaluate the impact of the directors’ proposed…arrow_forwardABC Co. issued 1.000 convertible bonds at the beginning of 2019. The bonds have a four-year term with a stated rate of interest of 6 percent, and are issued at par with a face value of Rp1.000 per bond (the total proceeds received from issuance of the bonds are Rp1.000.000). Interest is payable annually at December 31. Each bond is convertible into 250 ordinary shares with a par value of Rp1. The market rate of interest on similar non-convertible debt is 9 percent. On December 31, 2020, ABC wishes to reduce its annual interest cost. The company agrees to pay the holder of its convertible bonds an additional Rp40.000 if they will convert. Assuming conversion occurs, ABC’s journal entry to record the conversion will include all of the following, except:arrow_forward

- ngela Corporation issues 2,000 convertible bonds at January 1, 2019. The bonds have a 3-year life, and are issued at par with a face value of $1,000 per bond, giving total proceeds of $2,000,000. Interest is payable annually at 6%. Each bond is convertible into 250 ordinary shares (par value of $1). When the bonds are issued, the market rate of interest for similar debt without the conversion option is 8%. Instructions a. Compute the liability and equity component of the convertible bond on January 1, 2019. b. Prepare the journal entry to record the issuance of the convertible bond on January 1, 2019. c. Prepare the journal entry to record the repurchase of the convertible bond for cash at January 1, 2022, its maturity date.arrow_forwardSheridan Corporation issued $5 million of 10-year, 6% callable convertible subordinated debentures on January 2, 2023. The debentures have a face value of $1,000, with interest payable annually. The current conversion ratio is 14:1, and in two years it will increase to 17:1. At the date of issue, the bonds were sold at 100 to yield a 6% effective interest rate. The bond discount is amortized using the effective interest method. Sheridan's effective tax rate was 30%. Net income in 2023 was $7.4 million, and the company had 3 million shares outstanding during the entire year. For simplicity, ignore the requirement to record the debentures' debt and equity components separately. (a) Calculate basic earnings per share. (Round answers to 2 decimal places, e.g. 15.25.) Basic earnings per share $arrow_forwardOn the 1st of may 2023 the Blue Company issued and sold convertible bonds. The bonds have a term of 8 years and their final maturity date is 1st of may 2031. Interest is paid annually on the 1st of may each year, and the first interest payment will be 1st of may 2024. The nominal value of the bonds is 750,000,000. The nominal interest rate of the bonds is 5.5% and they were sold based ona 7.5% yield. The bonds can be converted into shares in the company at a rate of 4. Share price in the Blue Company when the bonds were sold were 3.5. No bonds were converted into equity in 2023. If the bonds were not convertible they would have been sold at a yield of 10.5%. The income tax rate is 21% What entries must be made in the Blue Company books in 2023 because of the bonds?arrow_forward

- On January 1, 2023, Ayayai Corporation purchased a newly issued $1,550,000 bond. The bond matured on December 31, 2025, and paid interest at 6% every June 30 and December 31. The market interest rate was 8%. Ayayai's fiscal year-end is October 31, and the company had the intention and ability to hold the bond until its maturity date. The bond will be accounted using the amortized costPrepare an amortization schedule for the bond. (Round answers to 2 decimal places, e.g. 52.75.) model. Click here to view Table A. 2 - PRESENT VALUE OF 1 - (PRESENT VALUE OF A SINGLE SUM) Click here to view Table A. 4- PRESENT VALUE OF AN ORDINARY ANNUITY OF 1 (a) Calculate the price paid for the bond using a financial calculator or Excel functions. (Round answers to 2 decimal places, e. g. 52.75.) PV $ Prepare an amortization schedule for the bond. (Round answers to 2 decimal places, e.g. 52.75.) Date Jan. 1, 2023 June 30, 2023 Dec. 31, 2023 June 30, 2024 Dec. 31, 2024 June 30, 2025 Dec. 31, 2025 Totals $…arrow_forwardDebussy Ltd issues 3,000 convertible bonds at the start of 2020. The bonds have a four-year term and are issued at par with a face value of $1,000 per bond, giving total proceeds of $3,000,000. Interest is payable annually in arrears at a nominal annual interest rate of 7%. Each bond is convertible at any time up to maturity into 300 ordinary shares. When the bonds are issued, the prevailing market interest rate for similar debt without conversion options is 10%. Round your answer to the nearest dollar. Required: Determine the amount for the liability and equity components of the convertible notes. Show your workings. The present value factors relevant for the calculation are as followed: 4-year discount factor: Simple Cumulative 7% 0.763 3.387 10% 0.683 3.170 ANSWER HERE:arrow_forwardOn September 30,2024, the Techno Corporation issued 8% stated rate bonds with a face amount of $420 million. The bonds mature on September 30, 2044 (20 years). The market rate of interest for similar bonds was 10% interest is paid semiannually on March 31 and September 30. Determine the price of the bonds on September 30, 2024. n = I = Cash Flow Amount Present Value Interest: Principal:arrow_forward

- On January 1, 2023, Marigold Corporation purchased a newly issued $1,250,000 bond. The bond matured on December 31, 2025, and paid interest at 6% every June 30 and December 31. The market interest rate was 8%. Marigold's fiscal year-end is October 31, and the company had the intention and ability to hold the bond until its maturity date. The bond will be accounted using the amortized cost model. Click here to view Table A.2-PRESENT VALUE OF 1-(PRESENT VALUE OF A SINGLE SUM) Click here to view Table A.4-PRESENT VALUE OF AN ORDINARY ANNUITY OF 1 (a) Calculate the price paid for the bond using a financial calculator or Excel functions. (Round answers to 2 decimal places, eg. 52.75.) PV Sarrow_forwardOn January 1, 2023, Marigold Corporation purchased a newly issued $1,250,000 bond. The bond matured on December 31, 2025, and paid interest at 6% every June 30 and December 31. The market interest rate was 8%. Marigold's fiscal year-end is October 31, and the company had the intention and ability to hold the bond until its maturity date. The bond will be accounted using the amortized cost model. Click here to view Table A.2 - PRESENT VALUE OF 1-(PRESENT VALUE OF A SINGLE SUM) Click here to view Table A.4 - PRESENT VALUE OF AN ORDINARY ANNUITY OF 1 (a) Calculate the price paid for the bond using a financial calculator or Excel functions. (Round answers to 2 decimal places, e.g. 52.75.) PV $arrow_forwardOn February 1, 2024, Strauss-Lombardi issued 9% bonds, dated February 1, with a face amount of $860,000. The bonds sold for $786,220 and mature on January 31, 2044 (20 years). The market yield for bonds of similar risk and maturity was 10%. Interest is paid semiannually on July 31 and January 31. Strauss-Lombardi’s fiscal year ends December 31. Question: 1 to 4. Prepare the journal entries to record their issuance by Strauss-Lombardi on February 1, 2024, interest on July 31, 2024 (at the effective rate), adjusting entry to accrue interest on December 31, 2024 and interest on January 31, 2025. Note: Do not round intermediate calculations and round your final answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning