FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

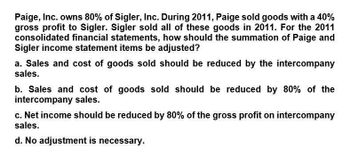

Transcribed Image Text:Paige, Inc. owns 80% of Sigler, Inc. During 2011, Paige sold goods with a 40%

gross profit to Sigler. Sigler sold all of these goods in 2011. For the 2011

consolidated financial statements, how should the summation of Paige and

Sigler income statement items be adjusted?

a. Sales and cost of goods sold should be reduced by the intercompany

sales.

b. Sales and cost of goods sold should be reduced by 80% of the

intercompany sales.

c. Net income should be reduced by 80% of the gross profit on intercompany

sales.

d. No adjustment is necessary.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For 2021, Hamilton Company had Sales of $5,700,000 and Cost of Goods Sold of $3,600,000. For 2020, Hamilton Company had Sales of $4,800,000 and Cost of Goods Sold of $2,900,000. a. What was the Cost of Goods Sold as a percent of Sales for 2021? b. What was the Cost of Goods Sold as a percent of Sales for 2020? c. Did Hamilton show improvement from 2020 to 2021? d. Is this an example of horizontal or vertical analysis?arrow_forwardSmith Corporation had Sales of $2,350,000 in 2021 and $2,125,000 in 2020. Cost of Good Sold were $1,400,000 in 2021 and $1,325,000 in 2020. a. What was the percentage change in Sales year to year? b. What was the percentage change in Cost of Goods Sold year to year? c. Relative to the percentage in Sales, would you say the percentage change on Cost of Goods Sold was favorable or unfavorable? d. Is this an example of horizontal or vertical analysis?arrow_forwardMbi inc. had sales of $900 million for fiscal 2019. Solve this questionarrow_forward

- The following comparative information is available for Larkspur, Inc. for 2022. LIFO FIFO Sales revenue $91,000 $91,000 Cost of goods sold 40,000 31,600 Operating expenses (including depreciation) 27,000 27,000 Depreciation 10,000 10,000 Cash paid for inventory purchases 18,920 18,920 Determine net income under each approach. Assume a 30% tax rate. Net income $ LIFO FIFO Determine net cash provided by operating activities under each approach. Assume that all sales were on a cash basis and that income taxes and operating expenses, other than depreciation, were on a cash basis. Net cash provided by operating activities LIFO FIFO $ Calculate the quality of earnings ratio under each approach. (Round answers to 2 decimal places, e.g. 5.15.) LIFO Quality of earnings ratio FIFOarrow_forwardA condensed income statement for Weber Associates and a partially completed vertical analysis follow. Required: 1. Complete the vertical analysis by computing each missing line item as a percentage of net revenues. TIP: In the prior year, Cost of Goods Sold was 31 percent of Net Revenues, computed as ($1,397 ÷ $4,571). 2. Does Cost of Goods Sold, as a percentage of Net Revenues, represent better or worse performance in 2019 as compared to 2018? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the vertical analysis by computing each missing line item as a percentage of net revenues. TIP: In the prior year, Cost of Goods Sold was 31 percent of Net Revenues, computed as ($1,397 ÷ $4,571). (Decreases should be indicated by a minus sign. Round your answers to the nearest whole percent.) Net Revenues Cost of Goods Sold Research and Development Expense Sales and Marketing Expense General and Administrative Expense Income from Operations Other…arrow_forwardThe following comparative information is available for Blossom Company for 2025. Sales revenue Cost of goods sold Operating expenses (including depreciation) Depreciation Cash paid for inventory purchases Net income $ LIFO eTextbook and Media Net cash provided by operating activities $ LIFO $81,000 38,000 30,000 Quality of earnings ratio 9,100 LIFO 38,000 Determine net income under each approach. Assume a 30 % tax rate. FIFO $ $81,000 31,000 30,000 9,100 Determine net cash provided by operating activities under each approach. Assume that all sales were on a cash basis and that income taxes and operating expenses, other than depreciation, were on a cash basis. 38,000 FIFO LIFO Calculate the quality of earnings ratio under each approach. (Round answers to 2 decimal places, eg. 5.15.) FIFO FIFOarrow_forward

- The following comparative information is available for Blossom Company for 2025. LIFO FIFO Sales revenue $89,000 $89,000 Cost of goods sold 37,000 29,000 Operating expenses (including depreciation) 27,000 27,000 Depreciation 10,000 10,000 Cash paid for inventory purchases 20,750 20,750 (a) Determine net income under each approach. Assume a 30% tax rate. LIFO Net income $ FIFOarrow_forward1. Using the Comparative Income Statement from Kimball Corporation, sent with this assignment, do the vertical analysis of Cost of goods sold. The analysis is for 2 years. a. Year 2014 B. Year 2012 2. Using the Comparative Income Statement from Kimball Corporation, sent with this assignment, do the vertical analysis of Income tax expense. The analysis is for 2 years. a. Year 2014 b. Year 2013 3. Using the Comparative Income Statement from Kimball Corporation, sent with this assignment, do the vertical analysis of Interest expense. The analysis is for 2 years. a. Year 2014 b. Year 2013 4. Using the Comparative Income Statement from Kimball Corporation, sent with this assignment, do the vertical analysis of Net Income. The analysis is for 2 years. to. Year 2014 b. Year 2013 Net sales Expenses: 3 Interest expense Income tax expense Other expense (income) Total expenses Net income C KIMBALL CORPORATION Comparative Income Statement Years Ended December 31, 2014 and 2013 Cost of goods sold…arrow_forward(Current Purchasing Power Accounting, A Normative Accounting Theory) Financial statements in historical cost of Steven Ltd are shown as follows: Statement of financial performance for year ended 31 December 2022 Sales 1,650,000 Less Cost of goods sold 1,285,000 Gross profit 365,000 Less Operating expenses 156,000 201,600 45,600 163,400 Statement of financial position at the end of financial year 31-Dec 31-Dec 2021 2022 150,000 175,000 165,000 870,000 1,360,000 170,000 450,000 740,000 1,360,000 Depreciation Net profit Assets Current assets Cash Accounts receivable Inventory Non-current assets Equipment (net depreciation) Total assets Liabilities Current liabilities Accounts payable Shareholders' equity Share capital Retained profit Total liabilities and equity of + 317,000 350,000 210,000 824,400 + 1,701,400 348,000 450,000 903,400 1,701,400 Karrow_forward

- Concord Ltd. had the following 2023 income statement data: Sales revenue Cost of goods sold Gross profit Operating expenses (includes depreciation of $22,900) Income before income taxes Income taxes Net income $207,500 (a) 119,000 88,500 48,000 40,500 16,000 $24,500 The following accounts increased during 2023 by the amounts shown: Accounts Receivable, $15,900; Inventory, $10,800; Accounts Payable (relating to inventory), $13,900; Taxes Payable, $2,200; and Mortgage Payable, $40,500. Prepare the cash flows from operating activities section of Concord's 2023 statement of cash flows using the indirect method and following IFRS. (Show amounts that decrease cash flow with either a negative sign e.g.-15,000 or in parenthesis e.g. (15,000).) Concord Corporation Statement of Cash Flows Indirect Mothed)arrow_forwardBramble Corp. reported the following in its 2025 and 2024 income statements. Net sales Cost of goods sold Operating expenses Income tax expense Net income Gross profit rate 2025 $154,000 86,240 27,720 21,560 $18,480 (a1) Determine the company's gross profit rate and profit margin for both years. (Round answers to 1 decimal place, eg. 52.7%) Profit margin 2024 $124,000 69,440 16,120 13,640 $24,800 2025 2024 %arrow_forwardVikrambahiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education