Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

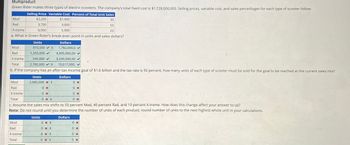

Transcribed Image Text:Multiproduct

Green Rider makes three types of electric scooters. The company's total fixed cost is $1,728,000,000. Selling prices, variable cost, and sales percentages for each type of scooter follow:

Selling Price Variable Cost Percent of Total Unit Sales

Mod

Rad

X-treme

$2,200

3,700

6,000

$1,900

3,000

5,000

30

50

20

a. What is Green Rider's break-even point in units and sales dollars?

Mod

Rad

X-treme

Total

Units

810,000

1,350,000 ✓

540,000 ✓

2,700,000 $

Dollars

$

1,782,000,0✓

4,995,000,00✓

3,240,000,00✓

10,017,000,

b. If the company has an after-tax income goal of $1.6 billion and the tax rate is 50 percent, how many units of each type of scooter must be sold for the goal to be reached at the current sales mix?

Mod

Rad

Units

2,685,000 x $

Dollars

0 %

0%

0x

X-treme

Total

0%

0% $

0 %

0%

c. Assume the sales mix shifts to 50 percent Mod, 40 percent Rad, and 10 percent X-treme. How does this change affect your answer to (a)?

Note: Do not round until you determine the number of units of each product; round number of units to the next highest whole unit in your calculations.

Units

Dollars

Mod

0 * $

0x

Rad

0% $

0%

X-treme

0% $

0 %

Total

0% $

0 %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Multiproduct Green Rider makes three types of electric scooters. The company's total fixed cost is $648,000,000. Selling prices, variable cost, and sales percentages for each type of scooter follow: Mod Selling Price Variable Cost Percent of Total Unit Sales Rad $2,200 3,700 6,000 $1,900 3,000 5,000 30 50 20 X-treme a. What is Green Rider's break-even point in units and sales dollars? Mod Rad Units Dollars X-treme Total b. If the company has an after-tax income goal of $1 billion and the tax rate is 50 percent, how many units of each type of scooter must be sold for the goal to be reached at the current sales mix? Mod Units Dollars $ Rad X-treme Total c. Assume the sales mix shifts to 50 percent Mod, 40 percent Rad, and 10 percent X-treme.arrow_forwardVista Company manufactures electronic equipment. It currently purchases the special switches used in each of its products from an outside supplier. The supplier charges Vista $1.45 per switch. Vista’s CEO is considering purchasing either machine A or machine B so the company can manufacture its own switches. The projected data are as follows: Machine A Machine B Annual fixed costs $ 108,900 $ 145,000 Variable cost per switch 0.46 0.20 Required: 1. For each machine, what is the minimum number of switches that Vista must make annually for total costs to equal outside purchase cost? 2. What volume level would produce the same total costs regardless of the machine purchased? 3. What is the most profitable alternative for producing 150,000 switches per year and what is the total cost of that alternative?arrow_forwardVista Company manufactures electronic equipment. It currently purchases the special switches used in each of its products from an outside supplier. The supplier charges Vista $5.20 per switch. Vista 's CEO is considering purchasing either machine A or machine B so the company can manufacture its own switches. The projected data are as follows: Machine A Machine B Annual fixed costs $ 582, 450 $ 792, 100 Variable cost per switch 1.67 0.75 Required: 1. For each machine, what is the minimum number of switches that Vista must make annually for total costs to equal outside purchase cost? 2. What volume level would produce the same total costs regardless of the machine purchased? 3. What is the most profitable alternative for producing 230,000 switches per year and what is the total cost of that alternative?arrow_forward

- Cox Electric makes electronic components and has estimated the following for a new design of one of Its products. Fixed Cost = $15,000 Material Cost per Unit = $0.19 Labor Cost per Unit = $0.14 MY NOTES ASK YOUR TEACHI Revenue per Unit = $0.69 Note that fixed cost is incurred regardless of the amount produced. Per-unit material and labor cost together make up the variable cost per unit. Assuming that Cox Electric sells all that it produce profit is calculated by subtracting the fixed cost and total variable cost from total revenue. If Cox Electric makes 43,100 units of the new product, what is the resulting profit (In whole dollars)? $arrow_forwardManatoah Manufacturing produces 3 models of window air conditioners: model 101, model 201, and model 301. The sales price and variable costs for these three models are as follows: Product Sales Priceper Unit Variable Costper Unit Model 101 $280 $180 Model 201 345 220 Model 301 395 250 The current product mix is 4:3:2. The three models share total fixed costs of $532,500. A. Calculate the sales price per composite unit. Sales price ? per composite unit B. What is the contribution margin per composite unit? Contribution margin ? per composite unit C. Calculate Manatoah’s break-even point in both dollars and units. Break-even point in dollars ? Break-even point in units ? unit D. Using an income statement format, prove that this is the break-even point. If an amount is zero, enter "0". Income Statement Sales Model 101 Model 201 Model 301 Total Sales Variable Costs Model 101 Model 201 Model 301…arrow_forwardPierson Pet Products produces two models of dog beds: Basic and Custom. Price, cost and expected sales volume data for the two models are as follows: Selling price per bed Variable cost per bed Expected sales (beds) The total fixed costs for the company are $403,200. Basic $24.00 $ 17.00 66,000 Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the expected product mix applies regardless of total sales, compute the break-even volume. c. If the product sales mix were to change to three Basic beds for each Custom bed, what would be the new break-even volume? Required A Required B Complete this question by entering your answers in the tabs below. Custom $ 59.00 $38.00 44,000 Basic beds Custom beds Required C Assuming that the expected product mix applies regardless of total sales, compute the break-even volume. Note: In your computations, round up the total units to break-even to the nearest whole number and round other intermediate…arrow_forward

- Please help mearrow_forwardanswer the following questions, which is the number 1 to 5. Show your complete solution/computationarrow_forwardCompany XYZ is an electric car manufacturer . The company produces and sells two models : Standard and Turbo . The Standard model has a selling price per unit and variable cost per unit of $8,000 and $3,000 respectively . The Turbo model has a selling price per unit and variable cost per unit of $12,000 and $5,000 respectively . The company currently has a sales mix of 2 units of Standard and 4 units of Turbo . Assuming tota fixed costs of $475,000 , how many units of Standard should be sold to achieve breakeven ? a . 30 b. 25 c. None of the given answers d. 50 e. 60arrow_forward

- Pierson Pet Products produces two models of dog beds: Basic and Custom. Price, cost and expected sales volume data for the two models are as follows: Basic $ 19.00 $ 12.00 36,000 Custom $ 54.00 $ 33.00 24,000 Selling price per bed Variable cost per bed Expected sales (beds) The total fixed costs for the company are $396,900. Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the expected product mix applies regardless of total sales, compute the break-even volume. Note: Do not round Intermediate calculations. c. If the product sales mix were to change to three Basic beds for each Custom bed, what would be the new break-even volume? Note: Do not round intermediate calculations.arrow_forwardVdarrow_forwardEx.3.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning