Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

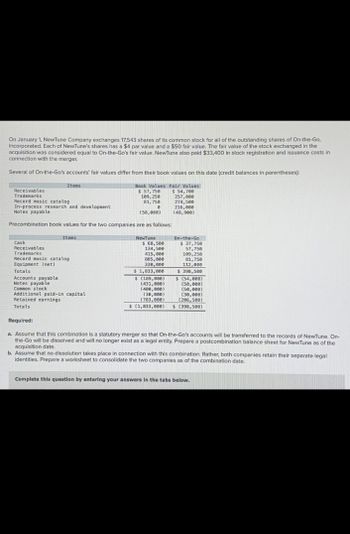

Transcribed Image Text:On January 1, NewTune Company exchanges 17,543 shares of its common stock for all of the outstanding shares of On-the-Go,

Incorporated. Each of NewTune's shares has a $4 par value and a $50 fair value. The fair value of the stock exchanged in the

acquisition was considered equal to On-the-Go's fair value. NewTune also paid $33,400 in stock registration and issuance costs in

connection with the merger.

Several of On-the-Go's accounts' fair values differ from their book values on this date (credit balances in parentheses):

Receivables

Trademarks

Items

Record music catalog

In-process research and development

Notes payable

Book Values

$ 57,750

109,250

Fair Values

$ 54,700

257,000

81,750

274,500

216,000

(58,000)

(48,900)

Precombination book values for the two companies are as follows:

Items

Cash

Receivables

Trademarks

Record music catalog

Equipment (net)

Totals

Accounts payable

Notes payable

Common stock

Additional paid-in capital

Retained earnings

Totals

NewTune)

$ 68,500

134,500

415,000

885,000

330,000

$ 1,833,000

$ (189,000)

(431,000)

(400,000)

(30,000)

(783,000)

$ (1,833,000)

On-the-Go

$ 37,750

57,750

109,250

81,750

112,000

$ 398,500

$ (54,000)

(58,000)

(50,000)

(30,000)

(206,500)

$ (398,500)

Required:

a. Assume that this combination is a statutory merger so that On-the-Go's accounts will be transferred to the records of NewTune. On-

the-Go will be dissolved and will no longer exist as a legal entity. Prepare a postcombination balance sheet for NewTune as of the

acquisition date.

b. Assume that no dissolution takes place in connection with this combination. Rather, both companies retain their separate legal

identities. Prepare a worksheet to consolidate the two companies as of the combination date.

Complete this question by entering your answers in the tabs below.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Juniper Company is authorized to issue 5,000,000 shares of $2 par value common stock. In conjunction with its incorporation process and the IPO, the company has the following transaction: Mar. 1, issued 4,000 shares of stock in exchange for equipment worth $250,000. Journalize the transaction.arrow_forwardVishnu Company is authorized to issue 500,000 shares of $2 par value common stock. In conjunction with its incorporation process and the IPO, the company has the following transaction: Apr. 10, issued 1,000 shares of stock for legal services valued at $15,000. Journalize the transaction.arrow_forwardSilva Company is authorized to issue 5,000,000 shares of $2 par value common stock. In its IPO, the company has the following transaction: Mar. 1, issued 500,000 shares of stock at $15.75 per share for cash to investors. Journalize this transaction.arrow_forward

- St. Marie Company is authorized to issue 1,000,000 shares of $5 par value preferred stock, and 5,000,000 shares of $1 stated value common stock. During the year, the company has the following transactions: Journalize the transactions.arrow_forwardAnslo Fabricating, Inc. is authorized to issue 10,000,000 shares of $5 stated value common stock. During the year, the company has the following transactions: Journalize the transactions.arrow_forwardWingra Corporation was organized in March. It is authorized to issue 500,000 shares of $100 par value 8% preferred stock. It is also authorized to issue 750,000 shares of $1 par value common stock. In its first year, the corporation has the following transactions: Journalize the transactions.arrow_forward

- Effective May 1, the shareholders of Baltimore Corporation approved a 2-for-1 split of the companys common stock and an increase in authorized common shares from 100,000 shares (par value 20 per share) to 200,000 shares (par value 10 per share). Baltimores shareholders equity items immediately before issuance of the stock split shares were as follows: What should be the balances in Baltimores Additional Paid-in Capital and Retained Earnings accounts immediately after the stock split is effected?arrow_forwardBrown Corporation issues 800 shares of its 5 par common stock for 20 per share. Prepare the journal entry to record this transaction.arrow_forwardJames Incorporated is authorized to issue 5,000,000 shares of $1 par value common stock. In its second year of business, the company has the following transactions: Journalize the transactions.arrow_forward

- On July 1, TruData Company issues 10,200 shares of its common stock with a $5 par value and a $50 fair value in exchange for all of Webstat Company's outstanding voting shares. Webstat's precombination book and fair values are shown below along with book values for TruData's accounts. Revenues (1/1 to 7/1) Expenses (1/1 to 7/1) Retained earnings, 1/1 Cash and receivables Inventory Patented technology (net) Land Buildings and equipment (net) Liabilities Common stock Additional paid-in capital Webstat Webstat Book Values Book Values Fair Values $ (309,200) 196,000 (122,000) 162,000 164,000 224,000 398,000 88,000 (500,000) (292,000) (8,800) TruData $ (162,000) 94,000 (154,000) 62,000 162,000 190,000 208,000 90,000 (376,000) (78,000) (36,000) $ 62,000 180,000 204,000 236,000 90,000 (354,000) On its acquisition-date consolidated balance sheet, what amount should TruData report as retained earnings as of July 1?arrow_forwardProblems 15 through 18 are based on the following information: On July 1, TruData Company issues 10,000 shares of its common stock with a $5 par value and a $40 fair value in exchange for all of Webstat Company's outstanding voting shares. Webstat's precombination book and fair values are shown along with book values for TruData's accounts as follows: Revenues (1/1 to 7/1) Expenses (1/1 to 7/1) Retained earnings, 1/1 Cash and receivables TruData Book Values Inventory Patented technology (net) Land Webstat Book Values Webstat Fair Values $(130,000) $(250,000) 170,000 80,000 (130,000) (150,000) 140,000 60,000 190,000 145,000 230,000 180,000 400,000 200,000 Buildings and equipment (net) 100,000 75,000 Liabilities (540,000) (360,000) Common stock (70,000) (300,000) (10,000) Additional paid-in capital (30,000) 16. On its acquisition-date consolidated balance sheet, what amount should TruData report as patented technology (net)? a. $200,000 b. $230,000 c. $410,000 d. $430,000 $ 60,000…arrow_forwardOn February 22, Triangle Corporation acquired 2,700 shares of the 95,000 outstanding common stock of Jupiter Co. at $41.80 plus commission charges of $540. On June 1, a cash dividend of $0.80 per share was received. On November 12, 900 shares were sold at $50 less commission charges of $108. At the end of the accounting period on December 31, the fair value of the remaining 1,800 shares of Jupiter Company's stock was $42.50 per share. In your computations, round per share amounts to two decimal places. When required, round final answers to the nearest dollar. a. Using the cost method, journalize the entry for the purchase of stock. If an amount box does not require an entry, leave it blank. 88 Feb. 22 Investments-Jupiter Co. Stock v Cash Feedback b. Using the cost method, journalize the entry for the receipt of dividends. If an amount box does not require an entry, leave it blank. Cash June 1 Dividend Revenue Feedback c. Using the cost method, journalize the entry for the sale of 900…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning